How to Make a Budget in 5 Easy Steps!

Are you Struggling to Save Money?

I went from feeling ashamed of having to yet again transfer from my savings to checking account for the third time within 2 months to confidently purchasing a new car (okay it was used) within my budget and without any guilt by following this tried and true method. Are your ready to:

Create a realistic budget that allows you to enjoy life

Save money for emergencies, and then some

Payoff debt

This is your sign to take a deep breath in, and out, and to carve out the 20 minutes you’ll need to take the necessary steps to achieve your money goals!

This post may contain affiliate links. I would never recommend a product that I do not truly love. The price does not increase for you. Thanks for supporting Sunflower Child Designs. See my disclosure for more info.

5 Simple Steps to Creating your Budget and Sticking to it!

Creating your budget isn’t the hardest part, it is fairly easy actually. The hard part is STICKING to your budget. It is the most essential part in success.

Step 1: Determine your Net Income

Your net income is your take home pay after any deductions. Common deductions are for taxes, health insurance and retirement plans. Calculate your net income for the month or bi-weekly. Most people budget monthly but many budget bi-weekly. If you get paid bi-weekly than that might be the best choice for you. Take your average take home pay and write it down. Don’t forget to include all income streams if you have more than one.

Step 2: Track your Expenses

The best way to track your finances is by listing it as “need” or “want”. A need expense is something that cannot really be changed such as a mortgage or car payment. A want cost is a non essential purchase such as new clothes, restaurants, entertainment subscriptions, etc. A want cost is what we have the most control over. Look at your last month’s expenses to create your budget. You can use a scrap piece of paper to write them down or grab the complete finance planner.

Step 3: Create Financial Goals

It is a lot easier to cut back spending in certain areas if you have the bigger picture in mind. Do you want to save for a vacation, an emergency fund, to pay off debt, for a retirement plan, etc.? Set aside money for those specific things each month. Treat it as a bill. These are very important things you need to save for if you desire.

Step 4: Make a Plan

Having a plan is essential. Set realistic and specific spending limits for each category. Science has proven that you are 70% more successful when you physically write things down. If use multiple cards you may want to use an app like Mint to easily see all your transactions at once but don’t forget to hand write your budgets in your finance planner.

If you currently go to Starbucks every morning and try to quit cold turkey you may be unsuccessful. It is important to still live your life in the present as well as the future. Think about your future goals but if a trip to Starbucks makes you very happy try to cut down but not completely out of your budget.

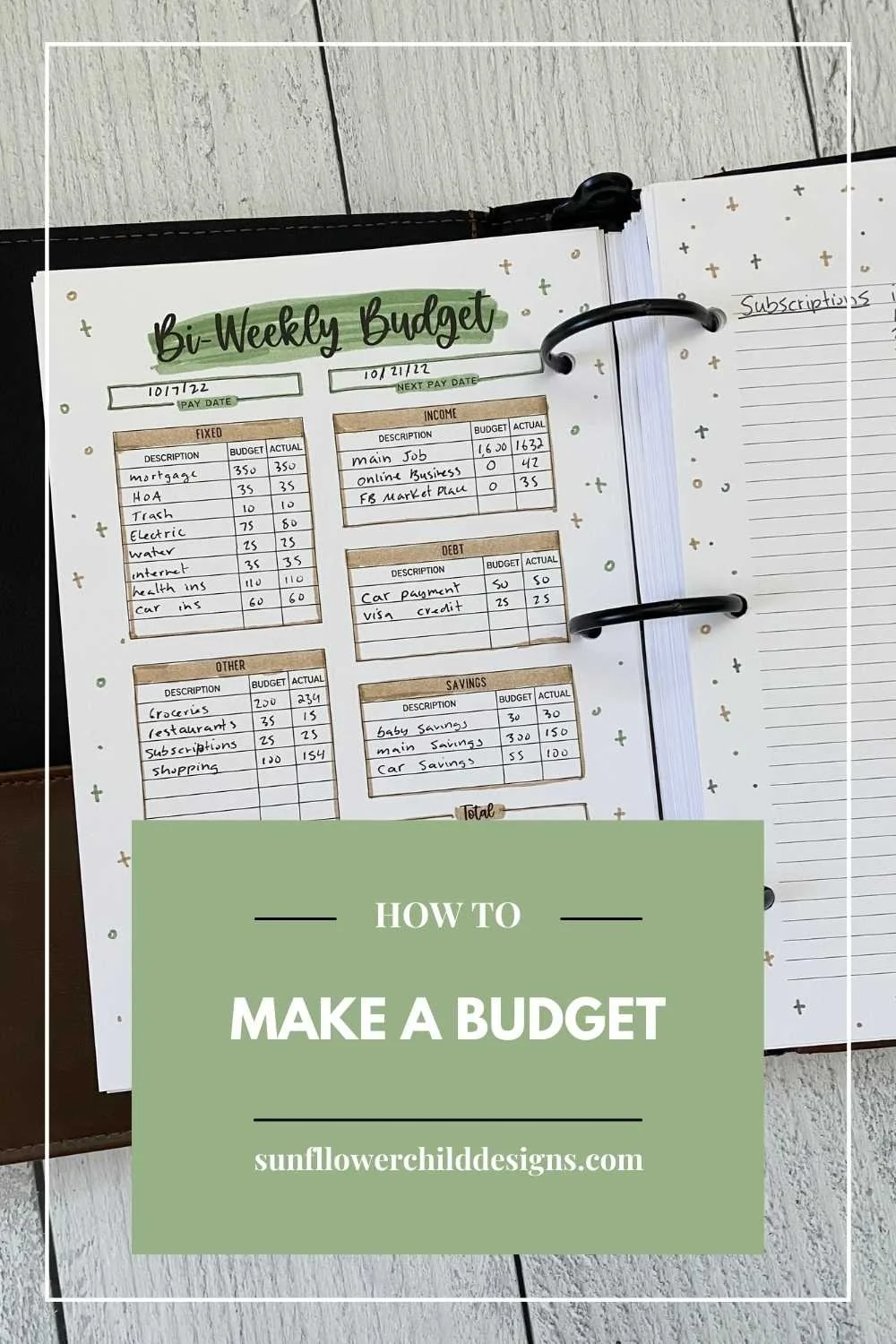

Some people plan a bi-weekly budget and some plan a monthly budget. Decide what is best for you, examples are below.

Step 5: Regularly Review your Budget

You will often need to readjust your budget especially in the beginning. Life is busy for most people to remember but setting an alarm reminder or scheduling it on your calendar every month or pay period will keep you on track.

Tips for Success

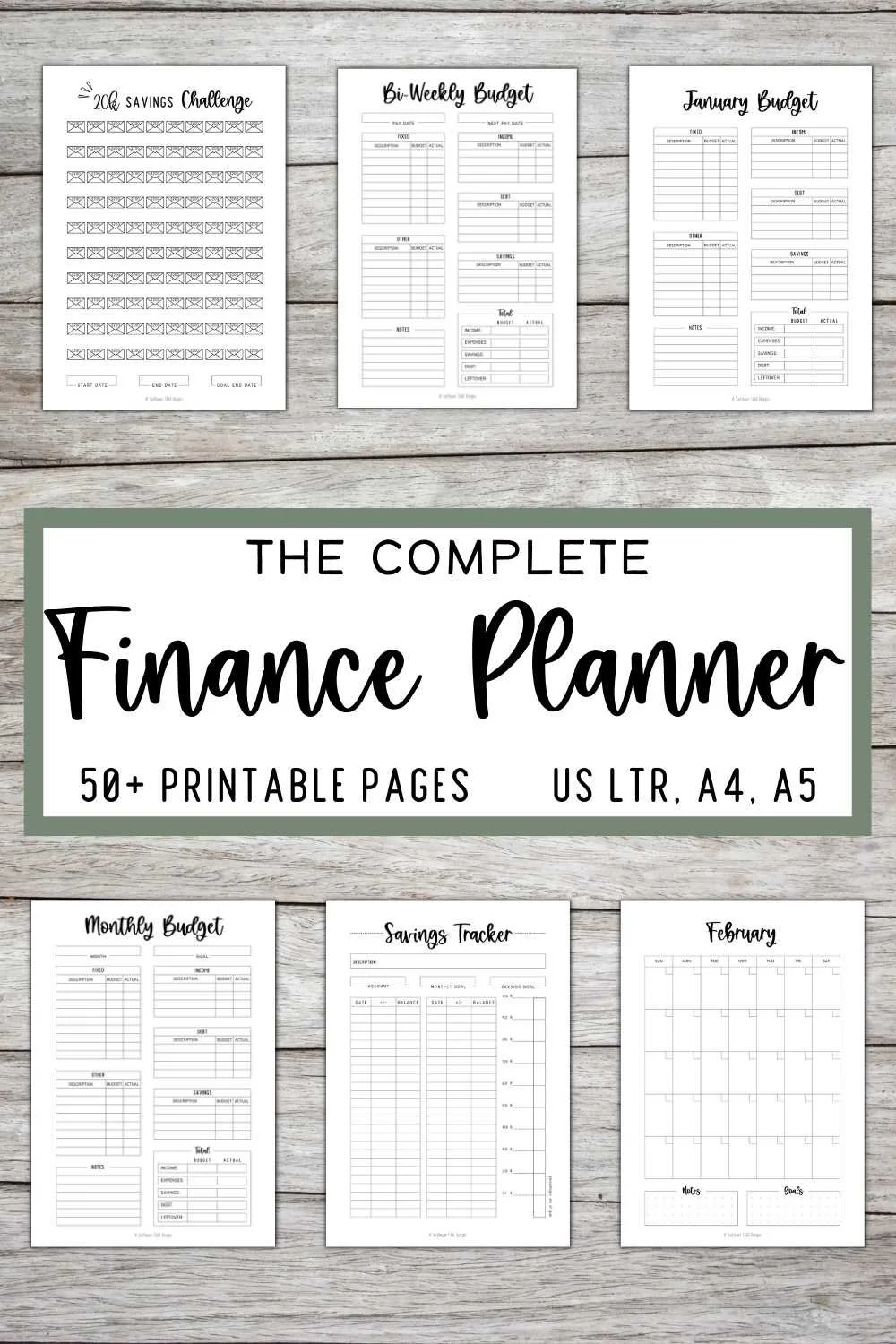

Make it fun. Use a Finance Planner that brings you joy. It makes it much more easier to follow a plan when most of the work is already done for you.

Autopay to savings. Set a certain amount each week or month to automatically move from your checking to savings account.

Have discipline. We all know by now that motivation is never there when you need it. When you have to go to work but don’t want to you do it anyways right? This is one of those things. Put it on your calendar and go over your finances each week or month. You are 70% more successful when you physically write things down.

Use a credit card and pay it off each month. If you pay off your credit card each month you actually EARN money. Most credit cards have 1% on any spending and 2-3% on groceries or gas depending on the card. This EASILY adds up to $500 or more a year that you can apply towards your bill. Get a card that does not have an annual fee, there are plenty.

If you have bad habits with credit cards cut them up and do not use them. This contradicts the previous point but everyone is different. If you have a bad track record with credit cards it is probably best that you do not use them.

Be mindful. Before any purchase you may ask yourself basic questions. Do I already have something like this? Is this a need or want? How often and for how long will I use this for? Is it helping me reach my goals?

Avoid triggers. If you often get hungry in the car and stop by fast food to hold you over keep a healthy snack such as almonds. Those fast food trips really add up.

How to Save Money

Many people do not even have a $1,000 emergency fund. There are many ways to build up your savings account. You can take small actions such as cancelling subscriptions or bigger ones like refinancing your mortgage.

Compare phone plans and insurance policies yearly to get the best rate.

Turn off notifications from business that send a lot of sales emails

Cut down your entertainment expenses. Do you really need more than one streaming service?

Shop “great value” brands instead of name brands, compare prices. The great value 32oz broccoli is $2.24 compared to the Birds Eye 10.8oz for $2.22 and this one really does taste the same!

Take advantage of free local events. Facebook Events is a great way to find them. Stay away from strolling at your local mall.

Autopay to savings. Set a certain amount each week or month to automatically move from your checking to savings account.

Do a no spend challenge. This is included in the finance planner.

Make coffee at home. Bring lunch to work. Avoid restaurants or uber eats.

Delete your Amazon app or other shopping app that you are addicted to. Make it harder for your to spend money.

What Should I Save for First?

Having an accessible emergency fund is essential first. What if your car breaks down, etc.? If you are saving to a 401k or Roth IRA first and have an emergency, that money is not as easily accessible.

How to Payoff Debt

Do the debt snowball or avalanche method.

In a nutshell the snowball method is when you payoff the smallest debt first (regardless of interest) while still making minimum payments on the rest of your debts. This is the most popular because if your smallest debt is $2,000 and you pay it off it motivates you to keep going.

The avalanche method focuses on paying off your highest interest rate debt first while still making the minimum payments on the rest.

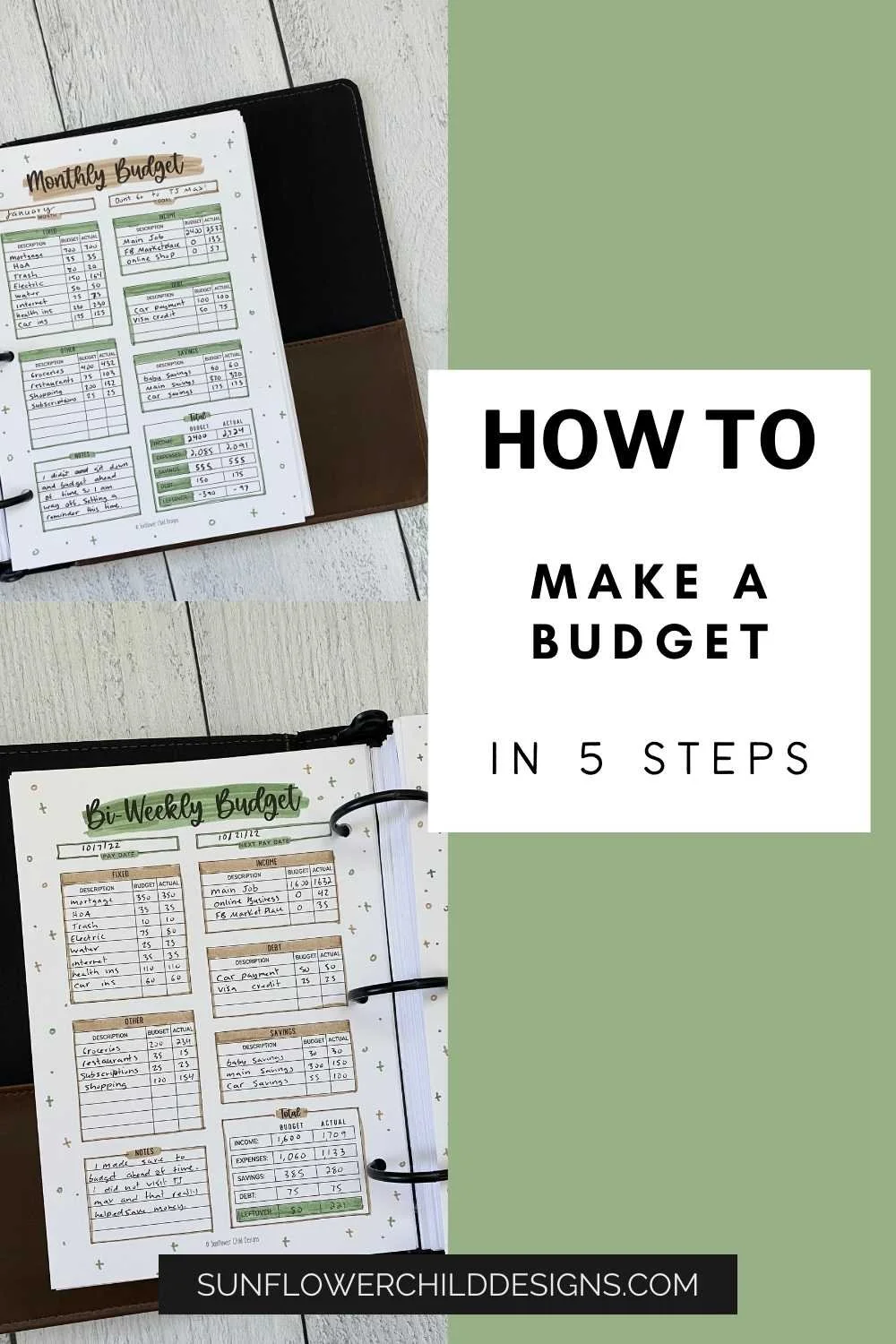

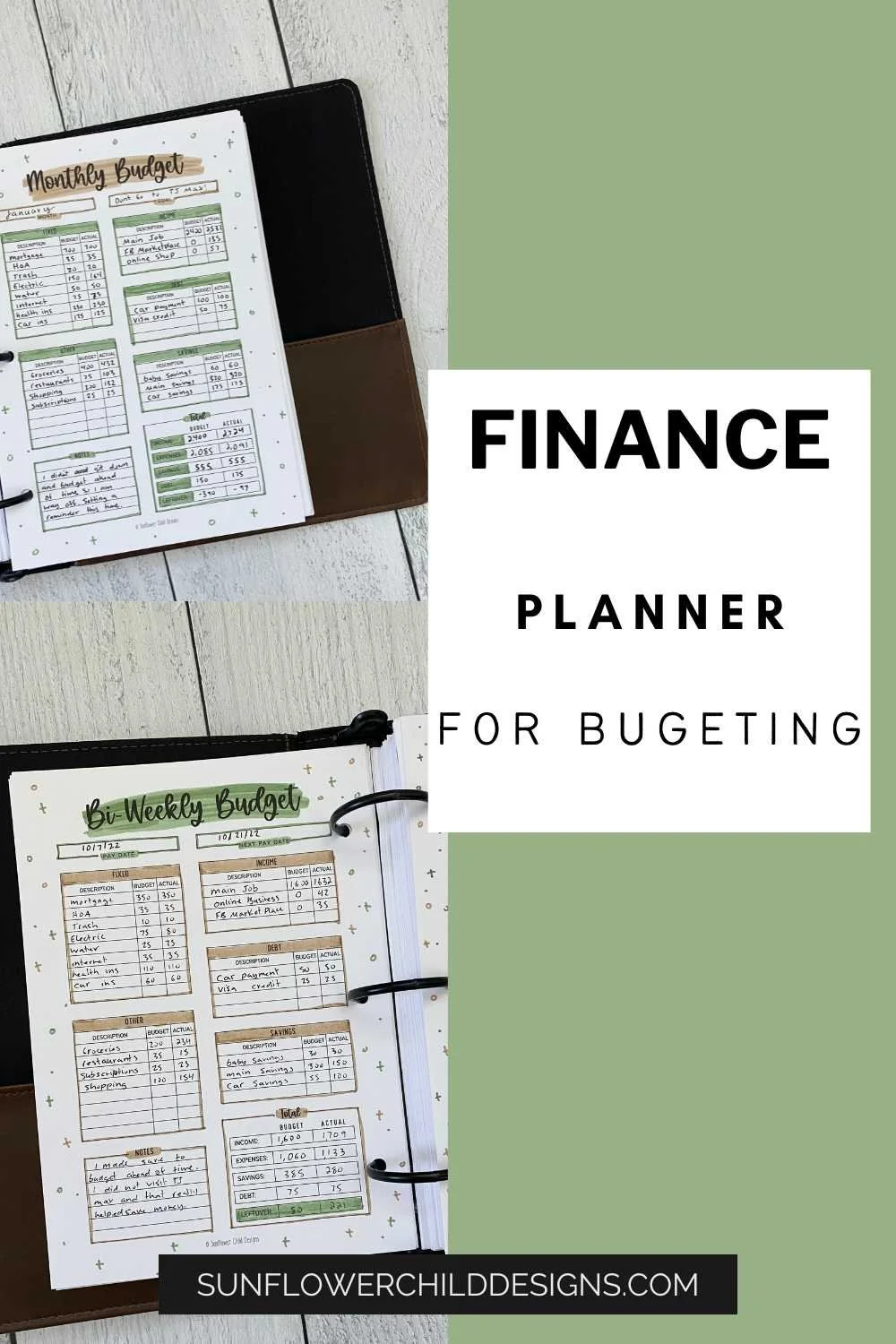

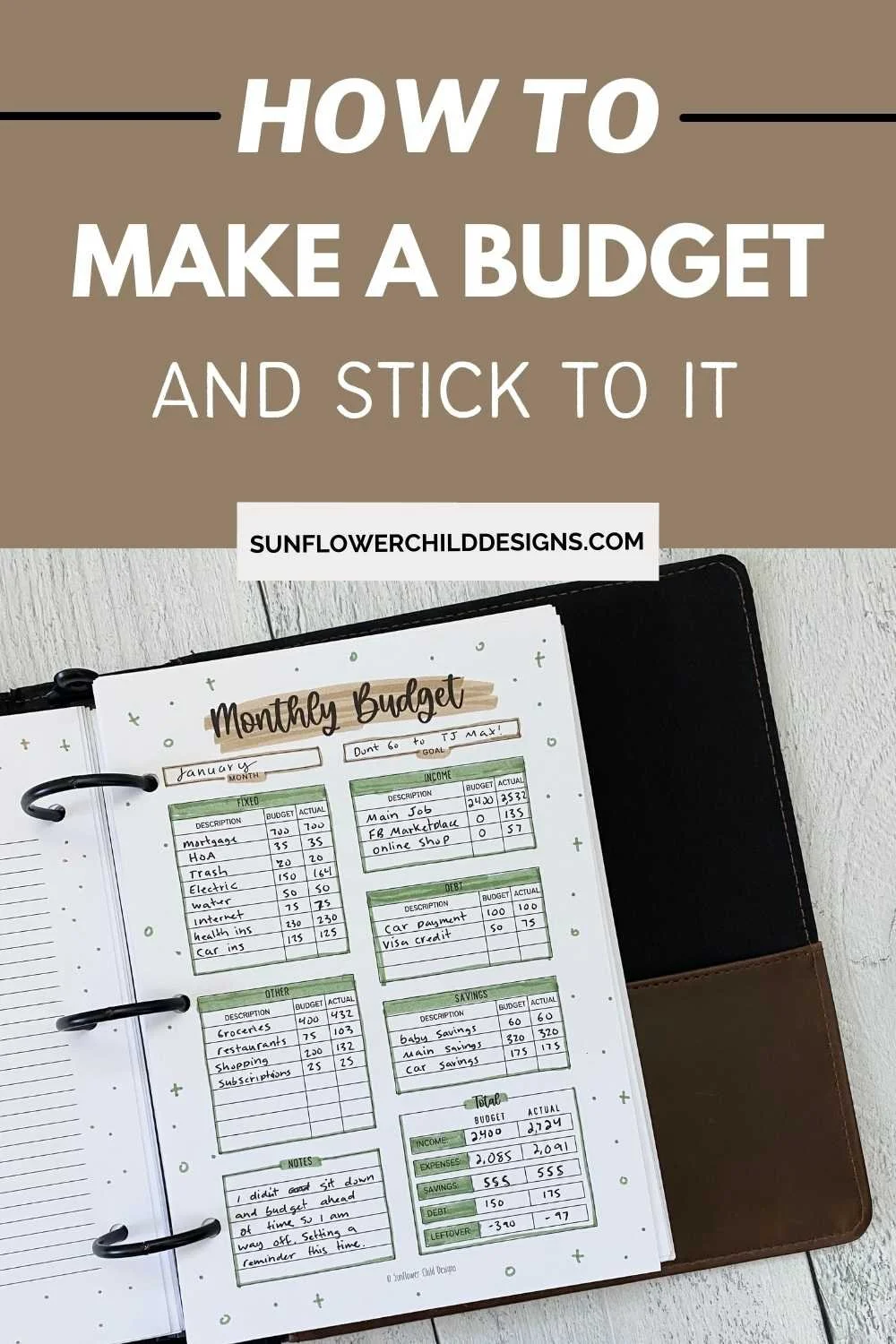

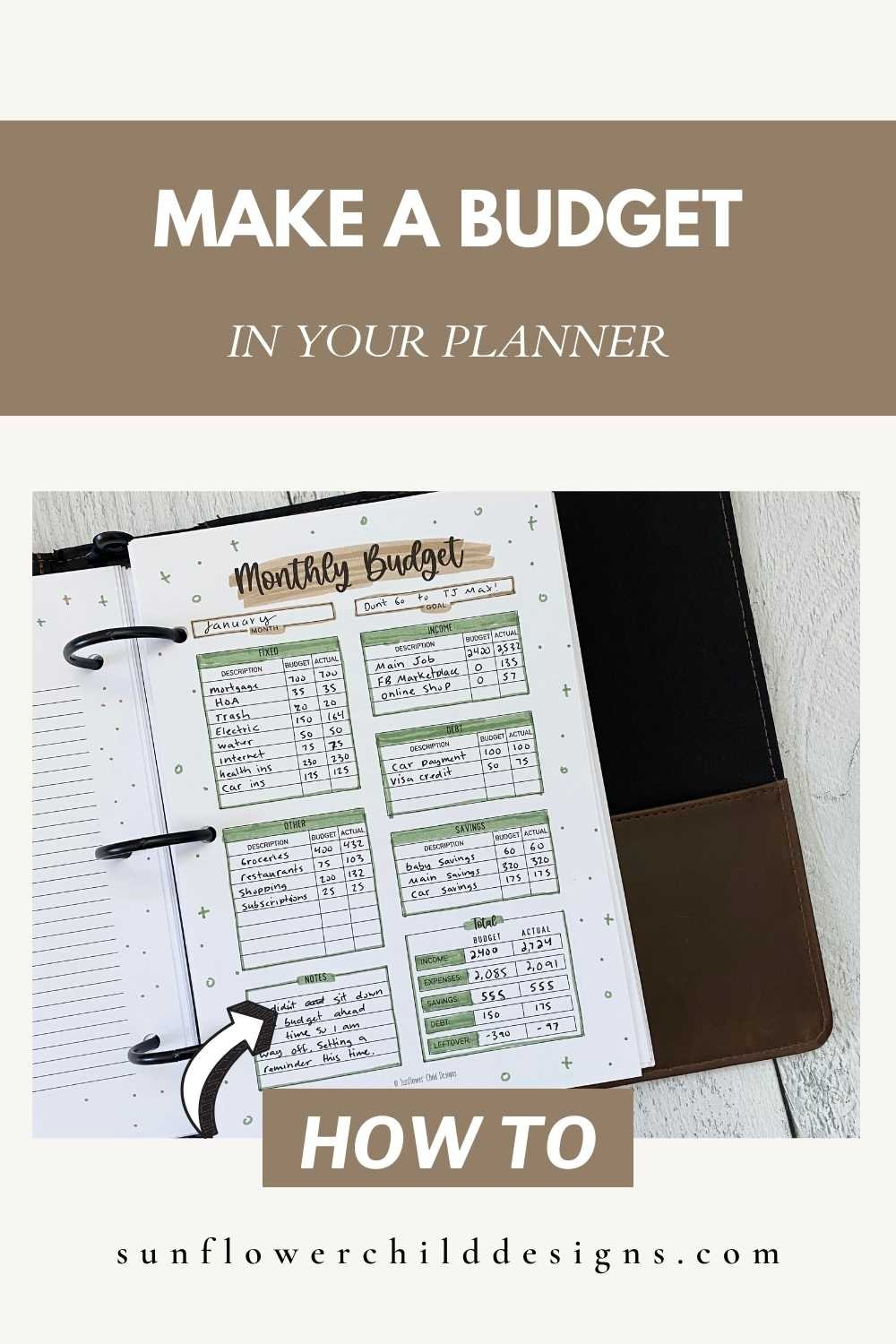

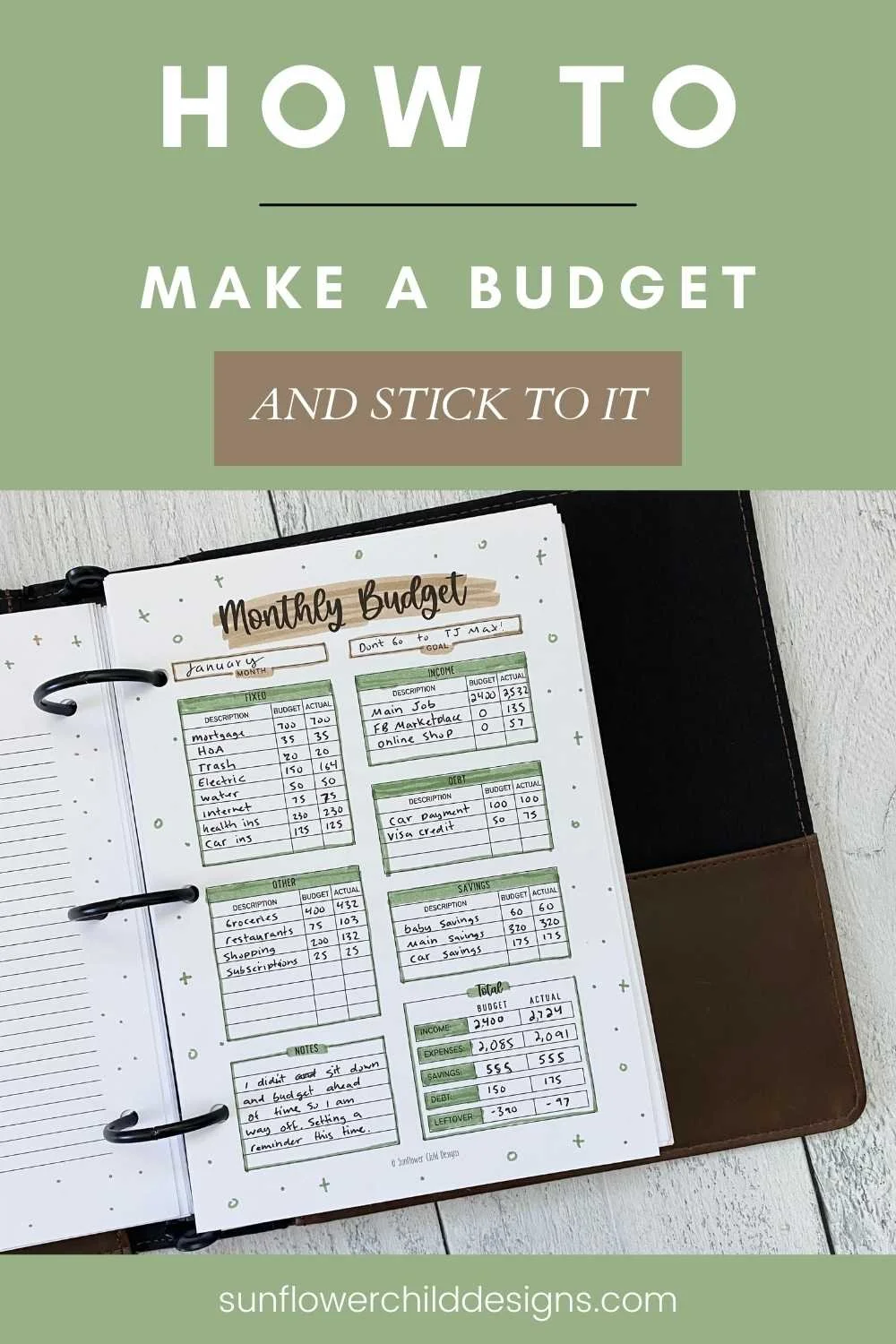

How to Make A Monthly Budget

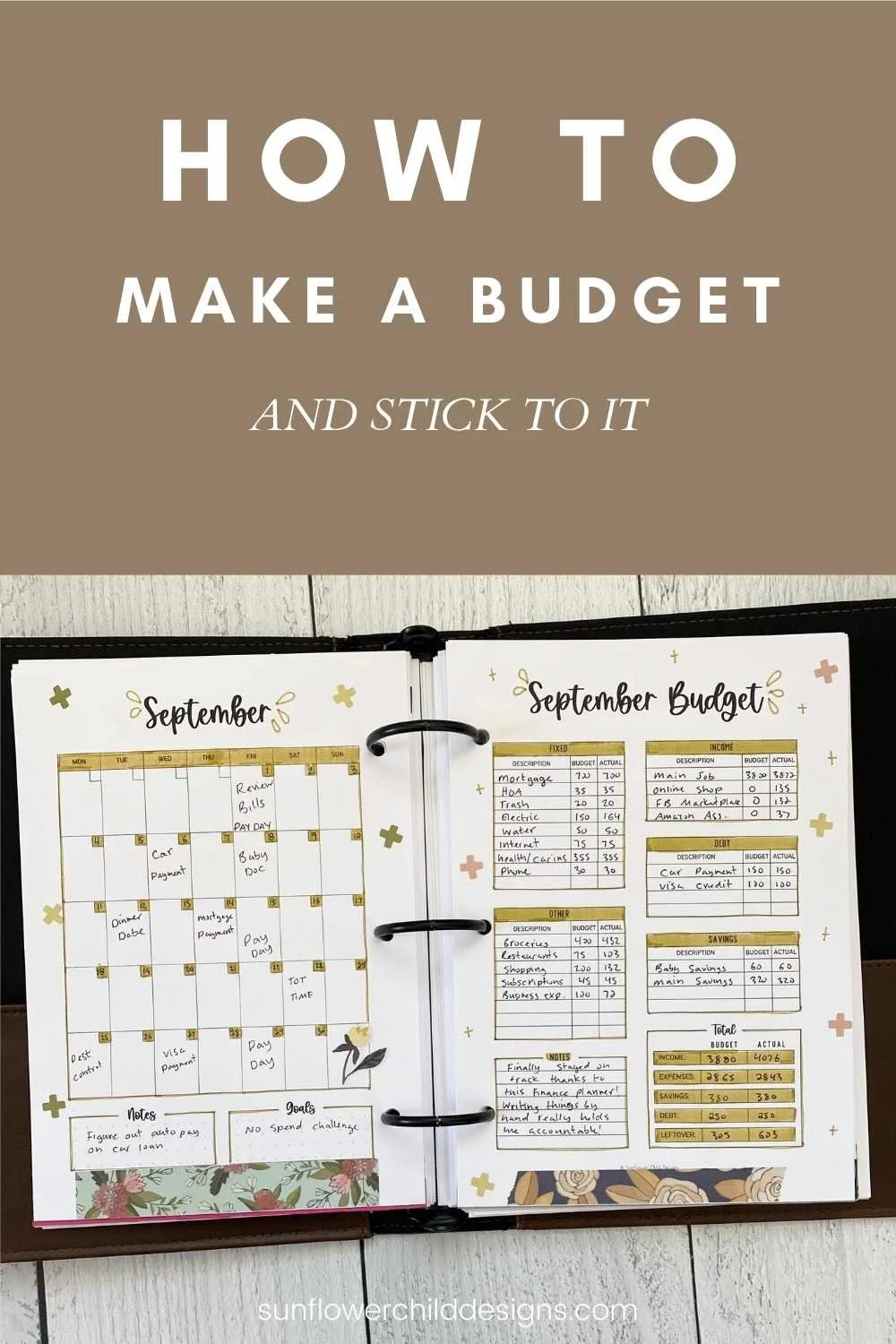

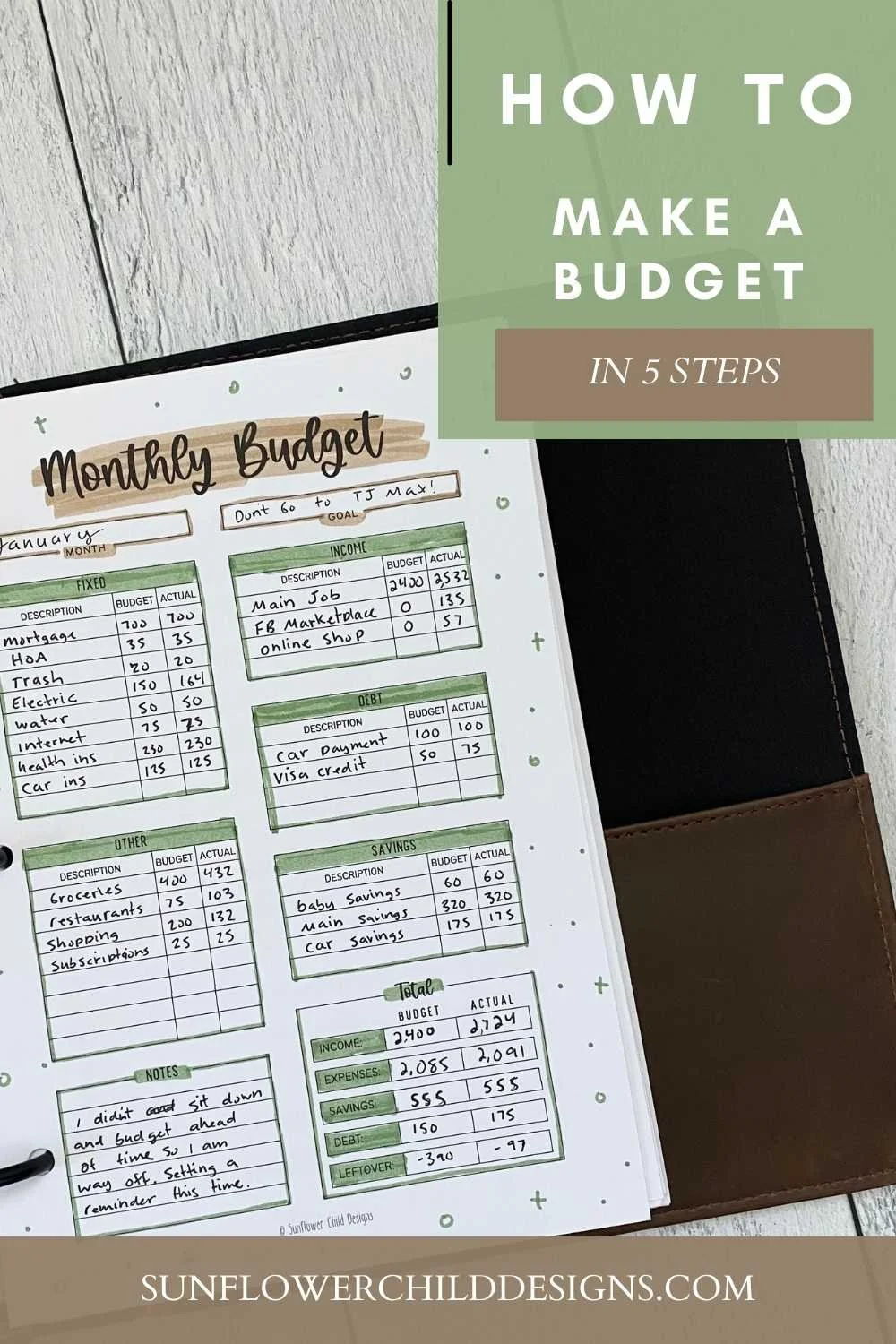

As you can see this is an example of someone who planned their monthly budget in advance in the “budget” column. Then at the end of the month the “actual” number were entered. All of the fixed budgets are on the top left. The electric and water are the only bills that can change but the budgeter had a pretty good idea of what the bills would be.

The “other” column are all the bills that could be potentially lowered. She could most likely completely eliminate the $103 restaurant charge. Most people already have food in their home to cover their restaurant spending.

She made money from her main job, side hustle, and selling old stuff on Facebook Marketplace.

Keeping Track of your debt and savings will encourage you to pay off that debt and add money to your savings.

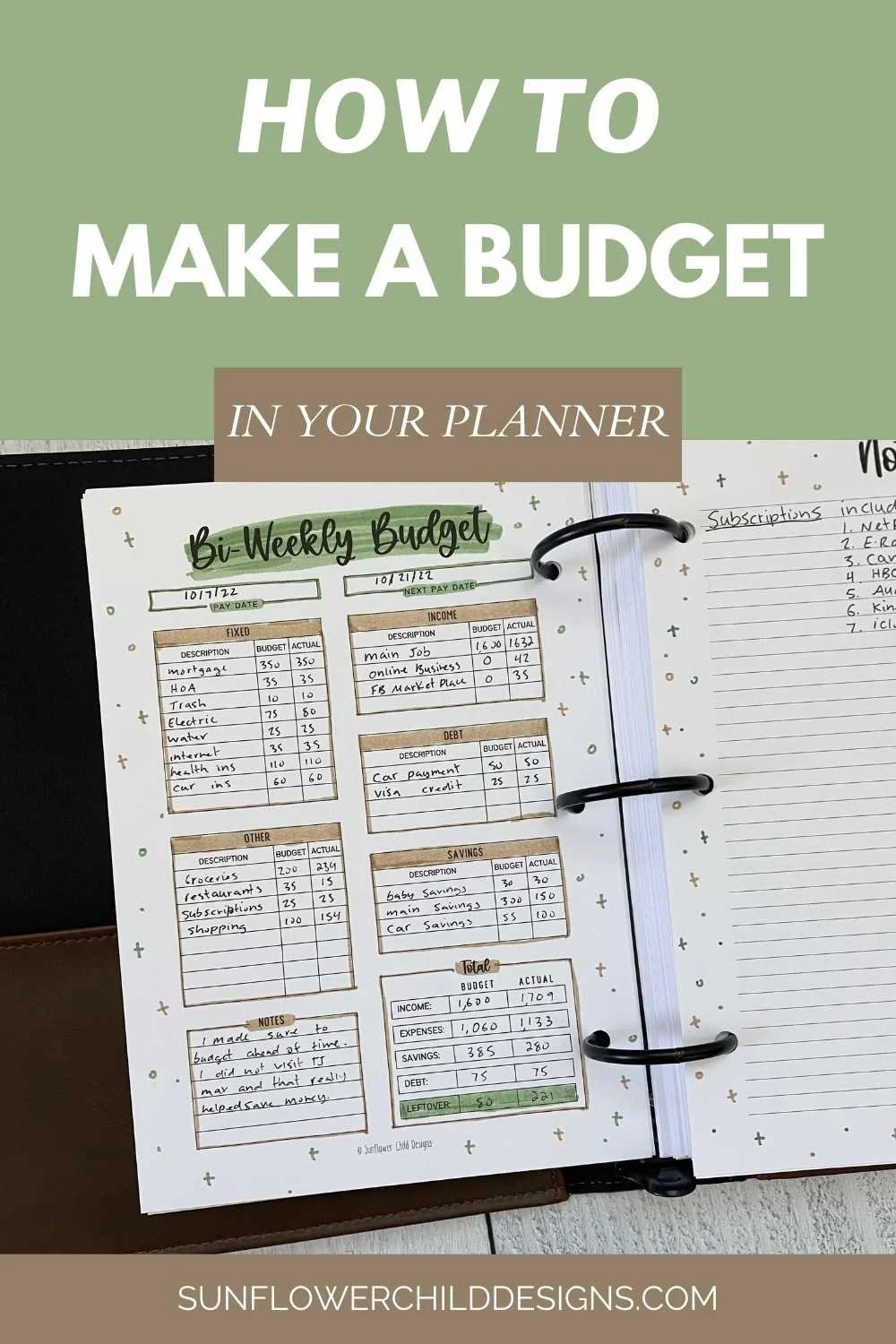

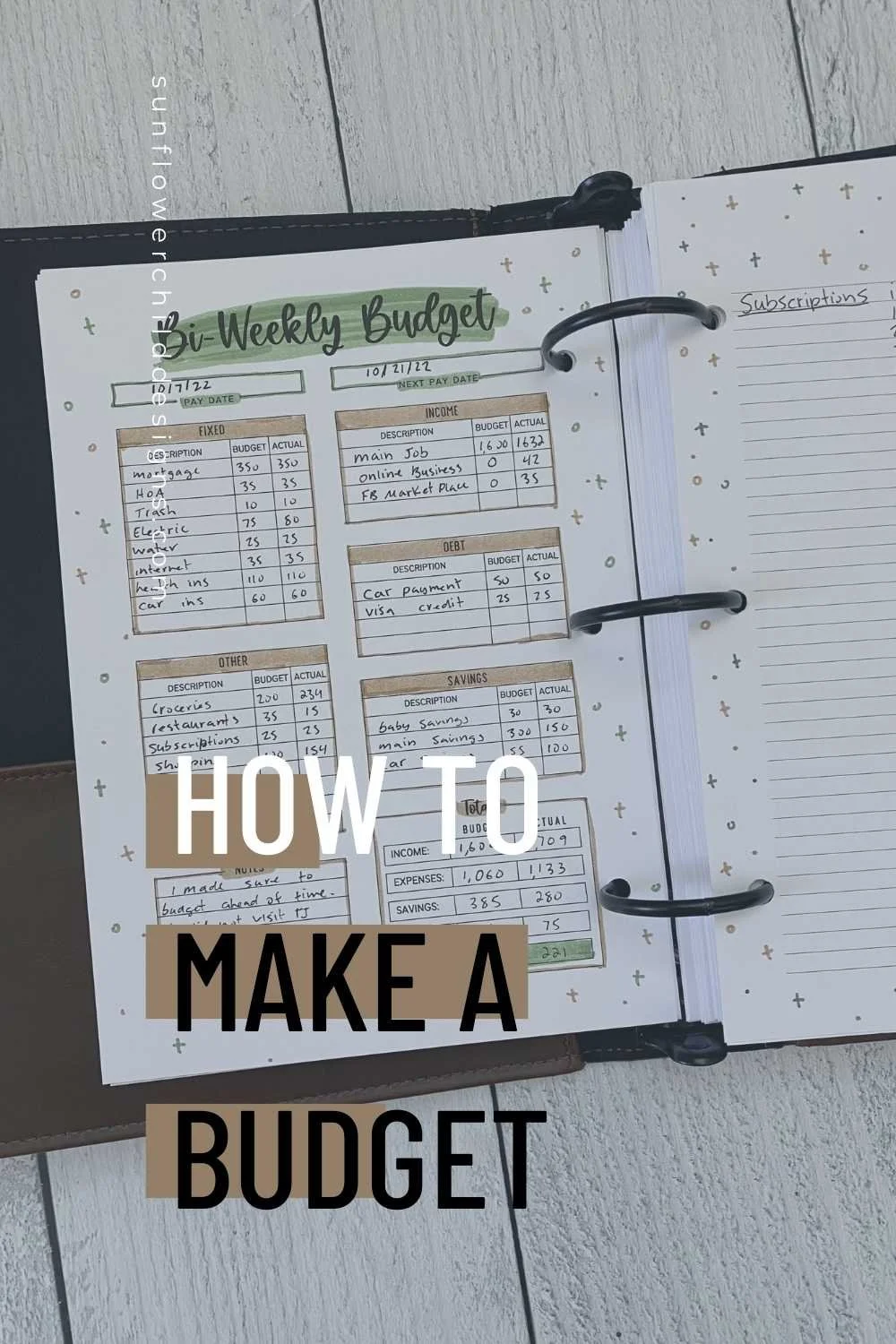

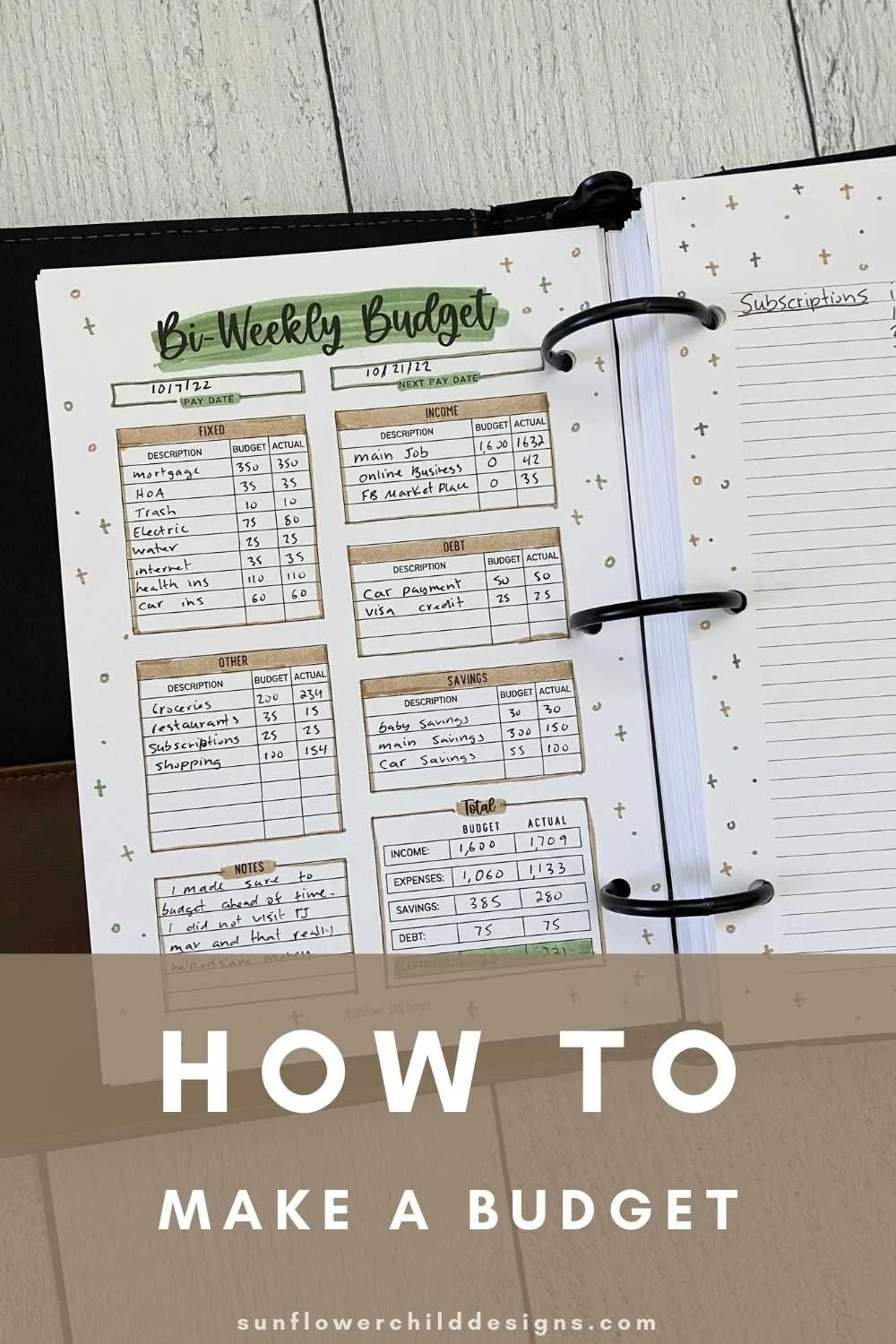

How to Make a Bi-Weekly Budget

Some people get confused when making a bi-weekly budget. What do you do when the mortgage payment is monthly but you get paid bi-weekly? Most people will budget half of their expenses for the 1st paycheck of the month and the rest for the 2nd paycheck. If you often overspend you may want to budget all of the mortgage payment from your 1st paycheck if it is possible.

100 Envelope Challenge

$1,000 savings challenge, $5,000 savings challenge, $10,000 savings challenge, $20,000 savings challenge etc., having a challenge can keep you motivated to keep saving money. The envelopes can be a symbol of the money you put it your bank account or you can have physical envelopes with your saved money. The templates for envelope challenges are included in the finance planner. If you want to do it by hand you can draw 100 envelopes with an amount in each one.

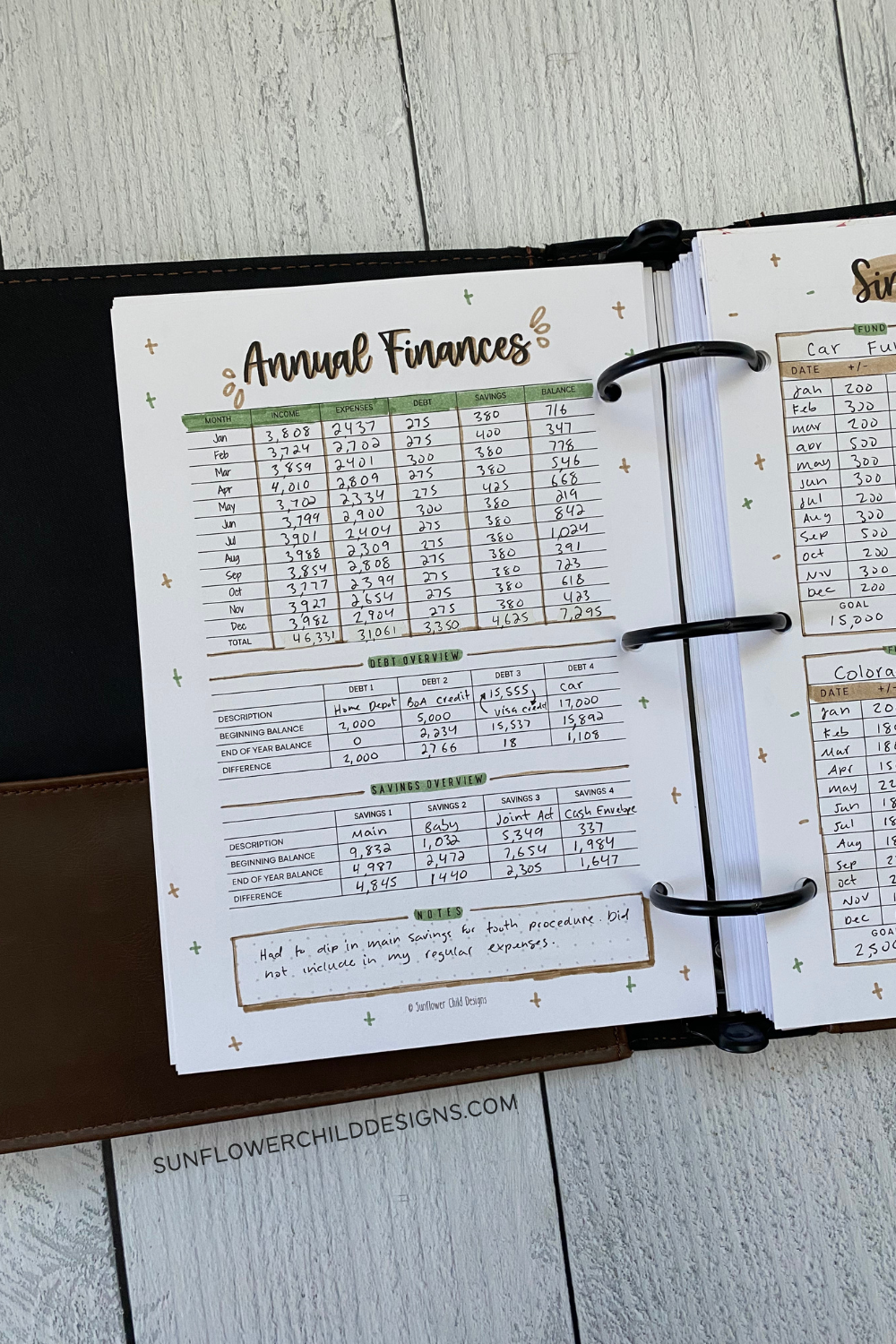

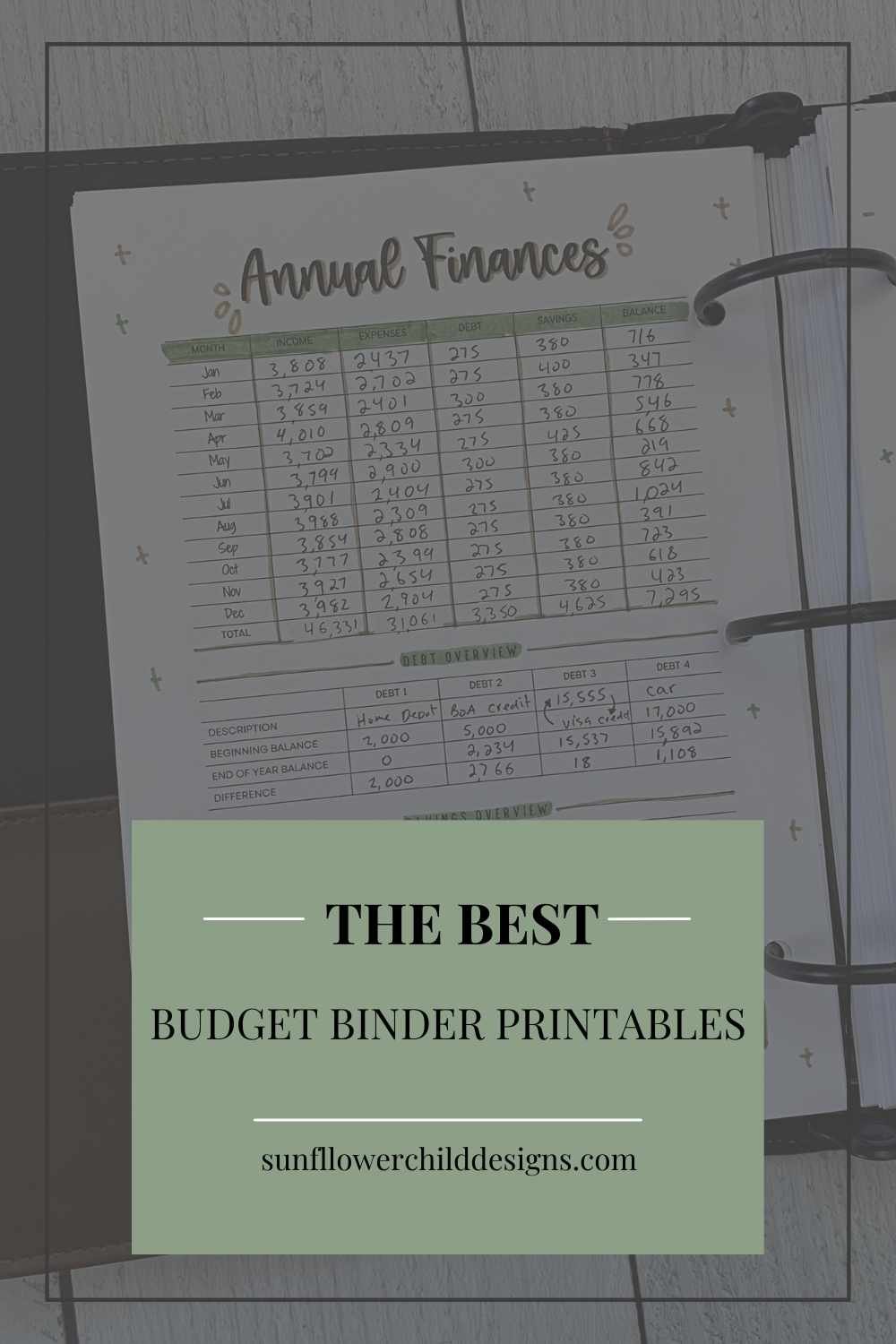

Annual Budget Tracker

Having the full year at a glance with your income, expenses, savings and debt will have you reviewing the entire year on one page. This page will be eye opening on your expenses for the entire year. Grab the the finance planner to easily make your budget and stick to it!

Expense Tracker

The easiest way to track your expenses is automatically through an app such as Mint BUT it is essential to write them down physically, you are 70% more successful when you physically write things down. The plus side of mint is that if you use multiple cards you can see ALL your transactions in one place. When you use mint some things do get confusing so writing them down does clear up confusion. It counts transfers as an expense and it is not accurate when you know you split bills with a partner but pay the bill upfront yourself. A lot of people avoid these types of apps altogether to keep their privacy and I do not blame them.

Expense Tracker with two columns

There is a ton a room to write down all your expenses.

Income Tracker

Tracking your income can encourage you to try to earn some extra money. Sell some old stuff on Facebook Marketplace, start a side hustle, etc. Research ways on how to earn an extra income if you need some extra cash. Make sure you are not paying anything to start making money, those are usually scams.

No Spend Challenge

A fun way to try to save money is completing a no spend challenge. Basically you can spend money on necessities but nothing on anything that is a want. That means no restaurants, clothes, fast food, most of your amazon purchases, etc.

TAKE $5 OFF THE FINANCE PLANNER

Use code FINANCE for $5 off the Finance Planner. It is undated so you can use it every year for a lifetime, saving you tons of money!

DISCLAIMER

Sunflower Child Designs is not a financial expert. Please see a financial expert for professional advice.

Finance Planner Flip Through

Blog Archive

- A - Guides

- April bullet journal ideas

- Bullet Journal

- December Bullet Journal Ideas

- Productivity systems

- Todoist tips

- august bullet journal ideas

- best pens for journaling

- brush pen calligraphy

- budgeting

- bullet journal setup FULL YEAR

- elf kit

- february bullet journal ideas

- fitness

- fluff prompts

- free printables

- habit tracking

- hard cover planners

- how to bullet journal for beginners

- january bullet journal ideas

- july bullet journal ideas

- june bullet journal ideas

- manifestation journaling

- march bullet journal ideas

- may bullet journal ideas

- modern calligraphy alphabet

- november bullet journal ideas

- october bullet journal ideas

- planner binder

- pregnancy

- printable holiday planner

- printable planner pages

- printable stickers

- september bullet journal ideas

- setup from scratch

- setup using printables

- setup using stickers

- stranger things

- tarot

- witchy

Leave me a “tip”, go ahead and pin one!