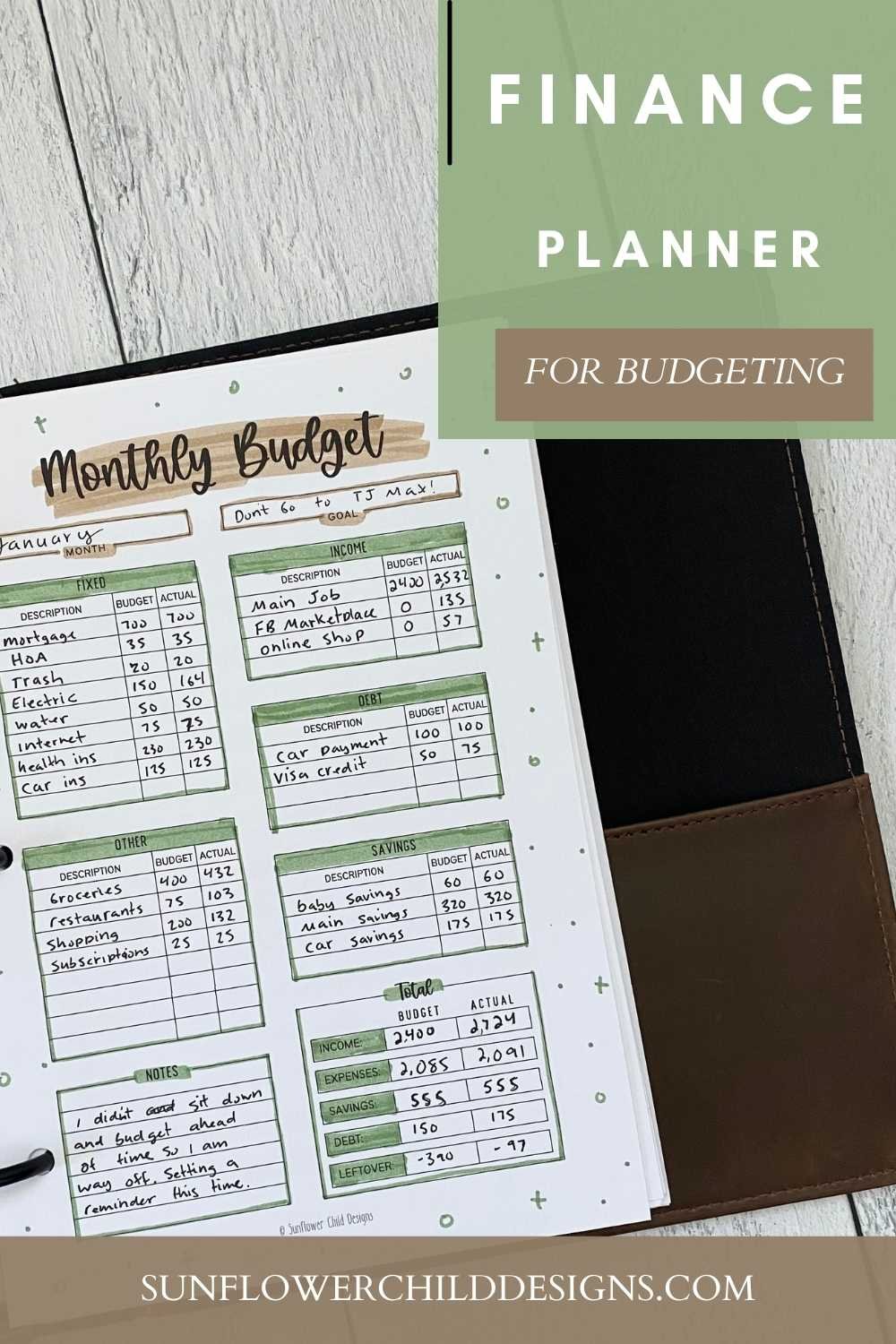

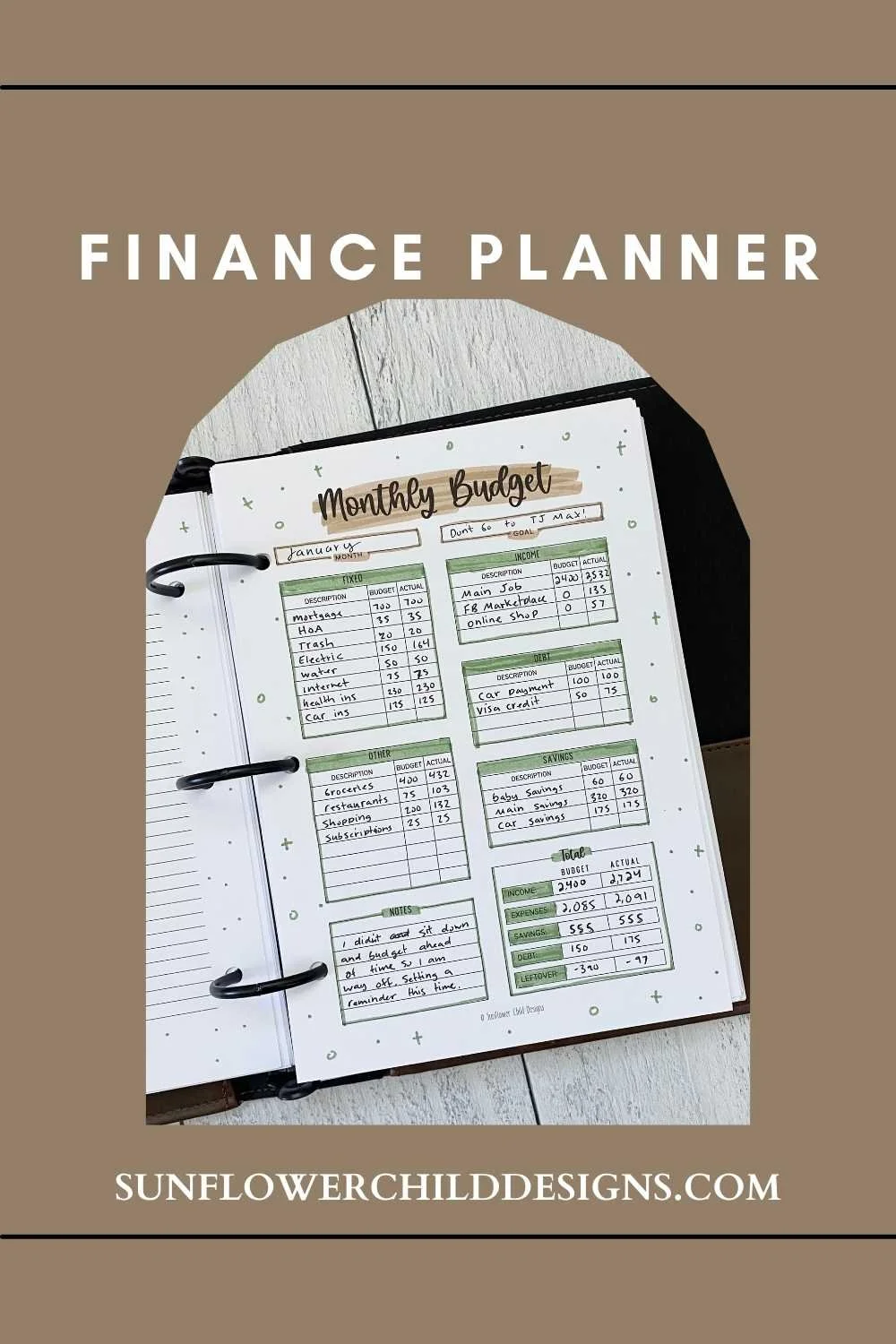

Finance Planner for Budgeting, Saving and Paying off Debt

Are you looking for a Financial Planner?

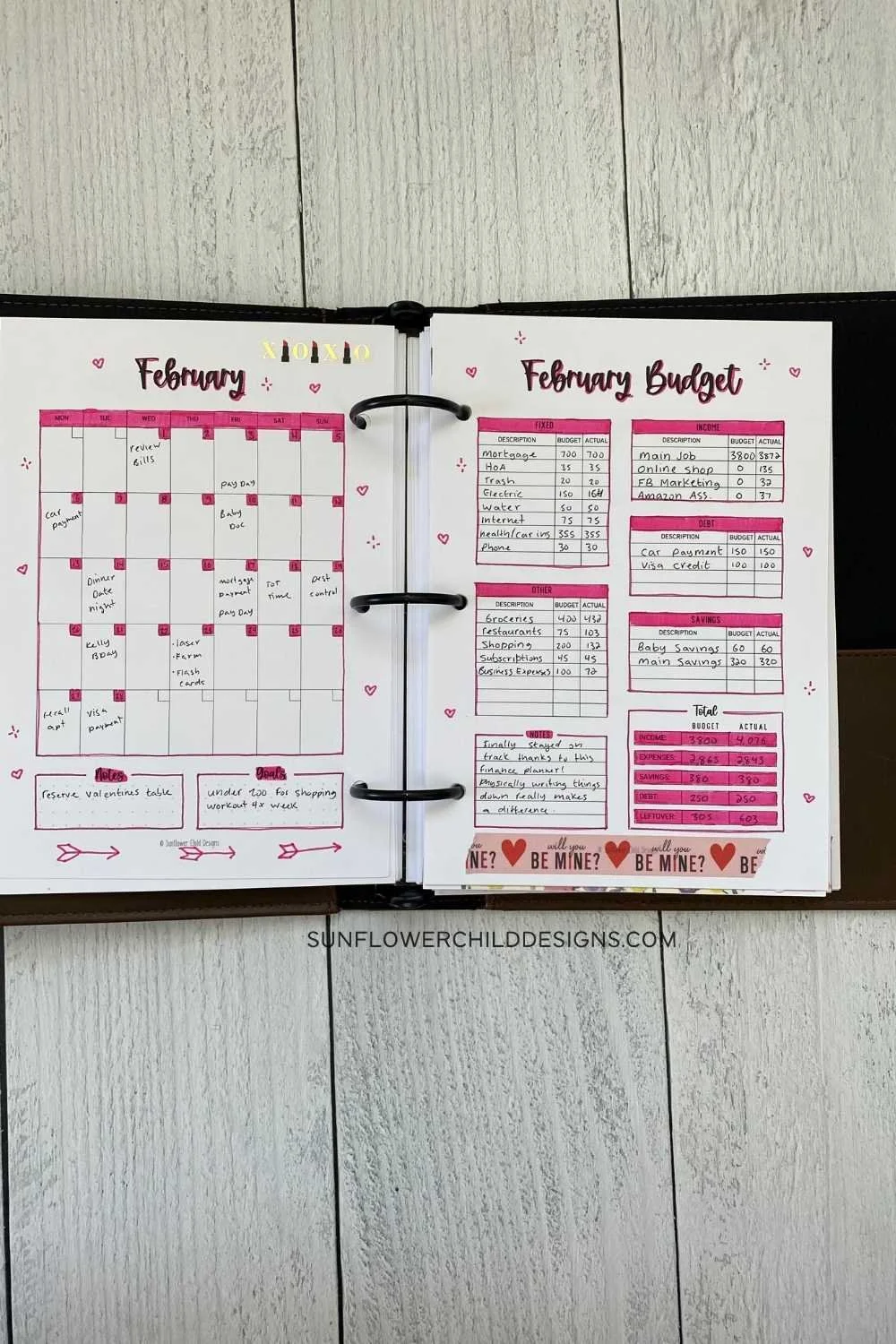

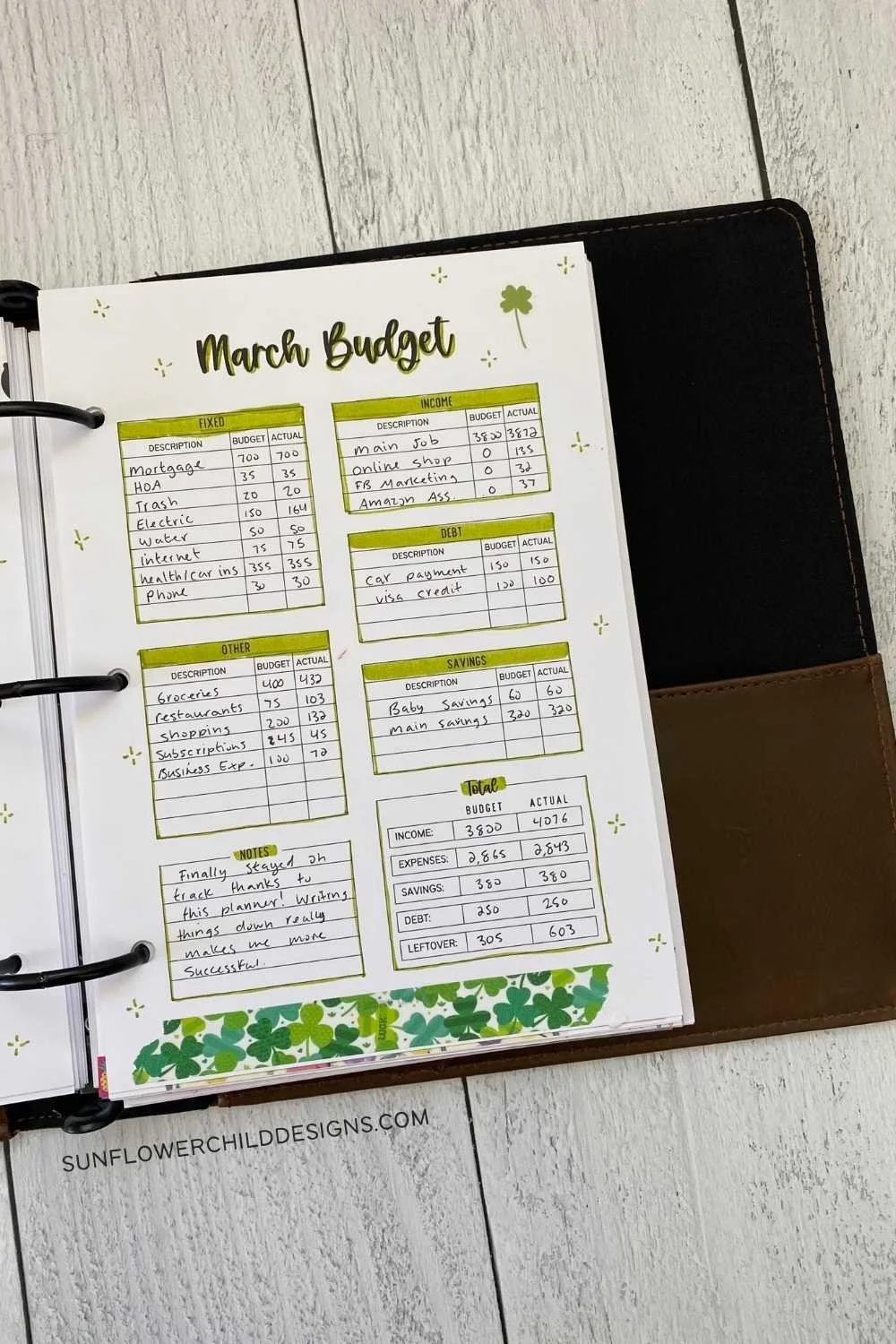

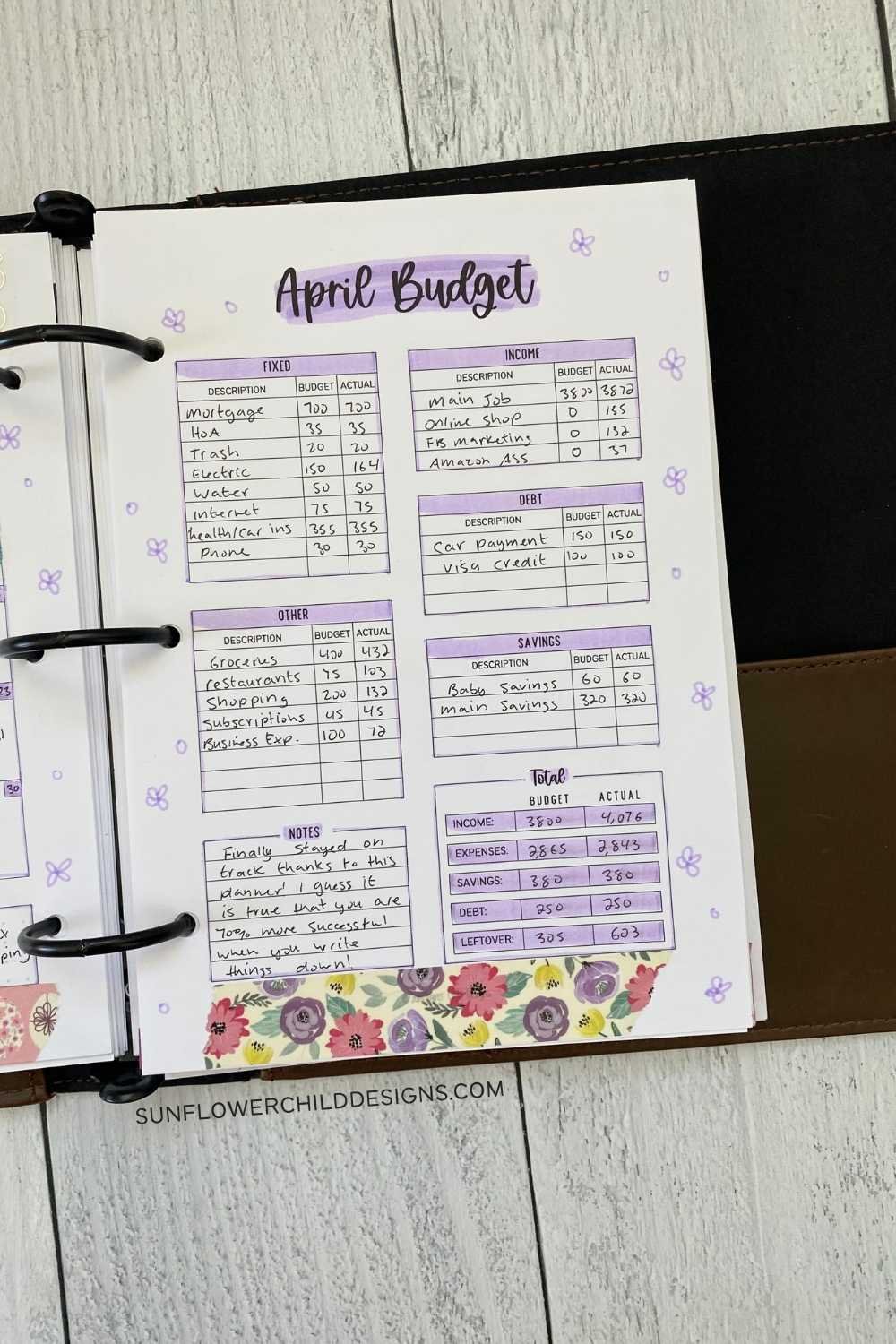

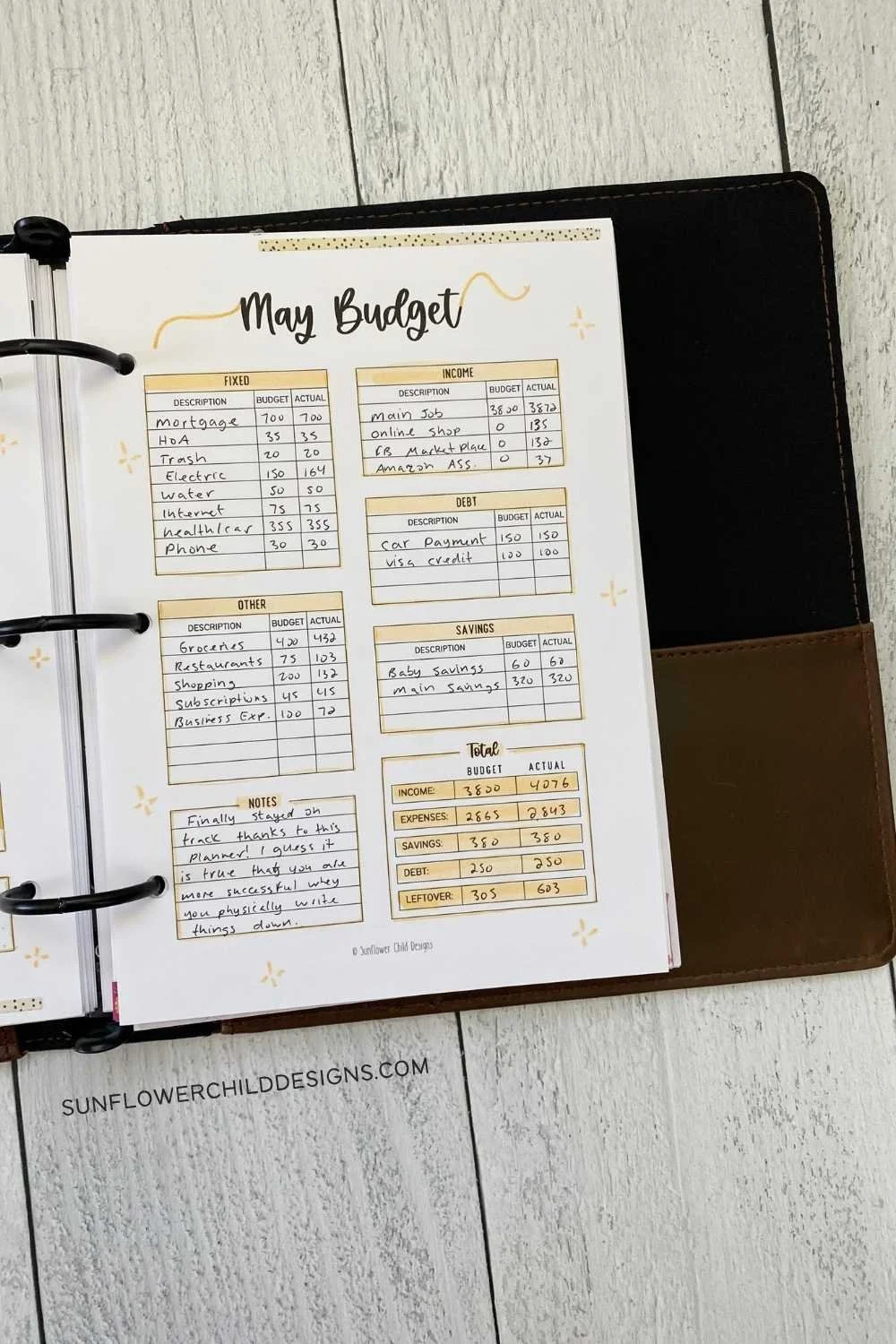

After struggling for years to stick to my budget I finally found the perfect Financial Planner to create a plan that holds me accountable and puts my financial stress at ease. I no longer feel guilty for purchasing things that I desire but do not necessarily need to survive, (cough cough Amazon finds). It is important to create a realistic budget that allows you to live the life you want to live. To create a budget I followed this method, How to create a budget in 5 easy steps.

Common Questions

-

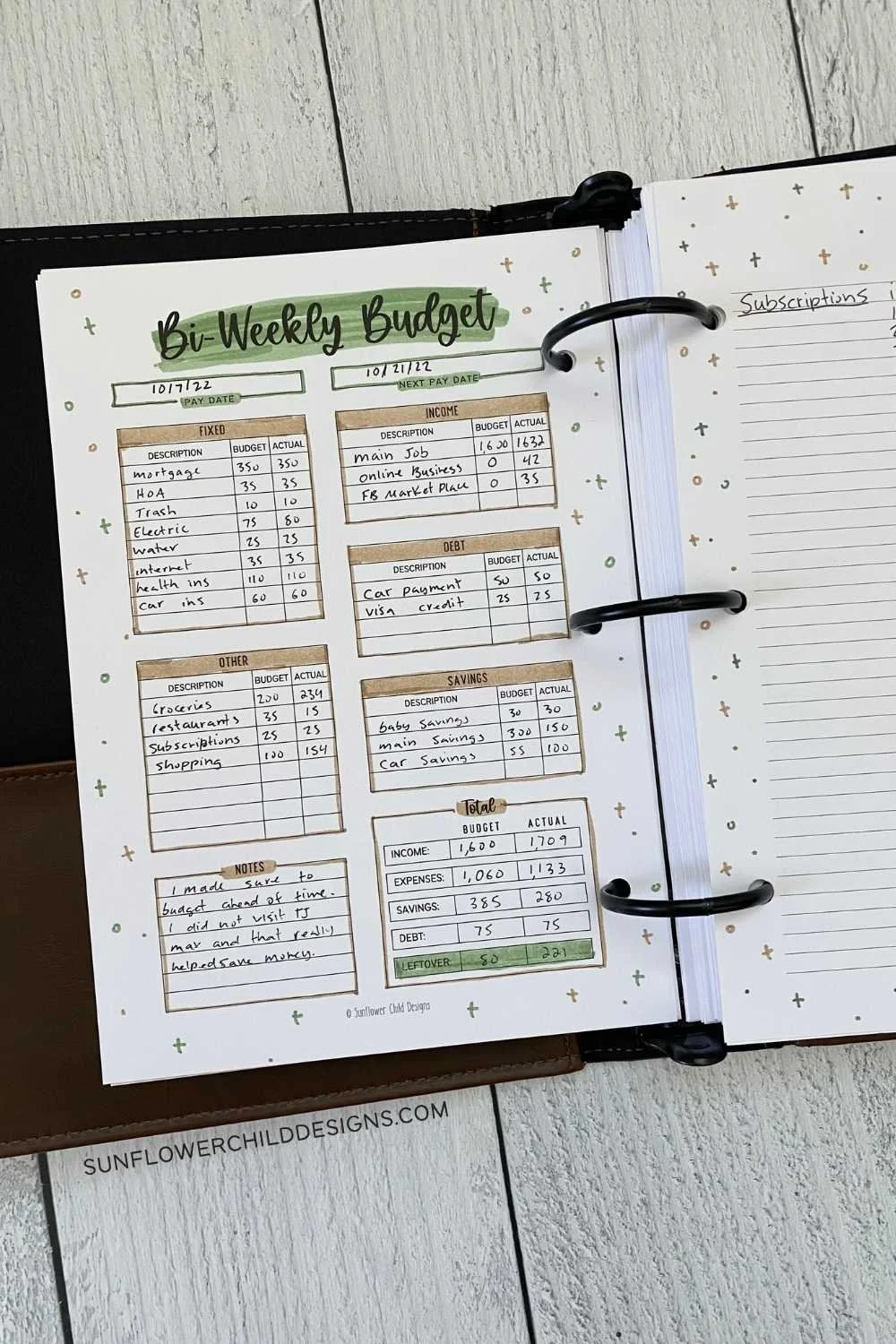

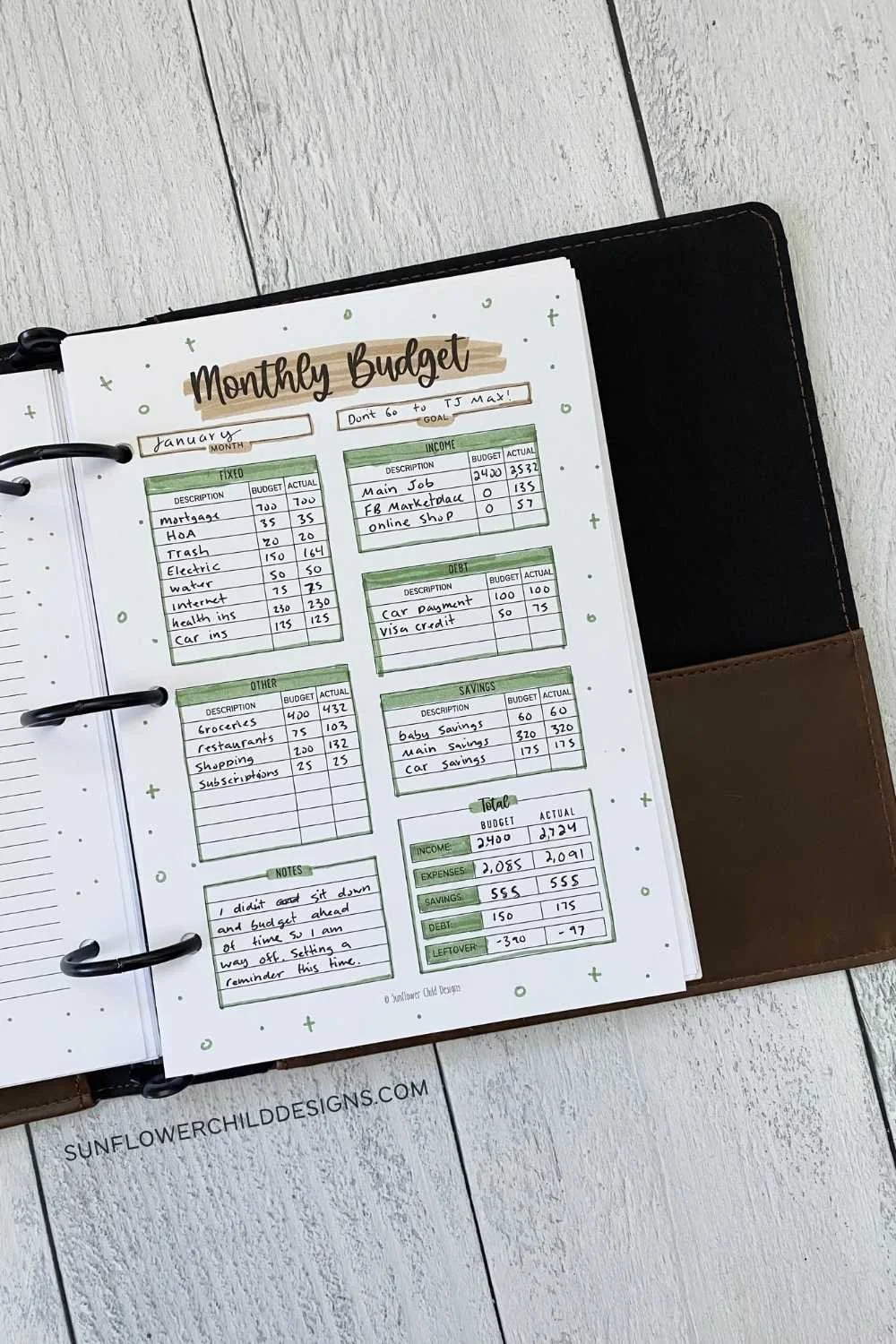

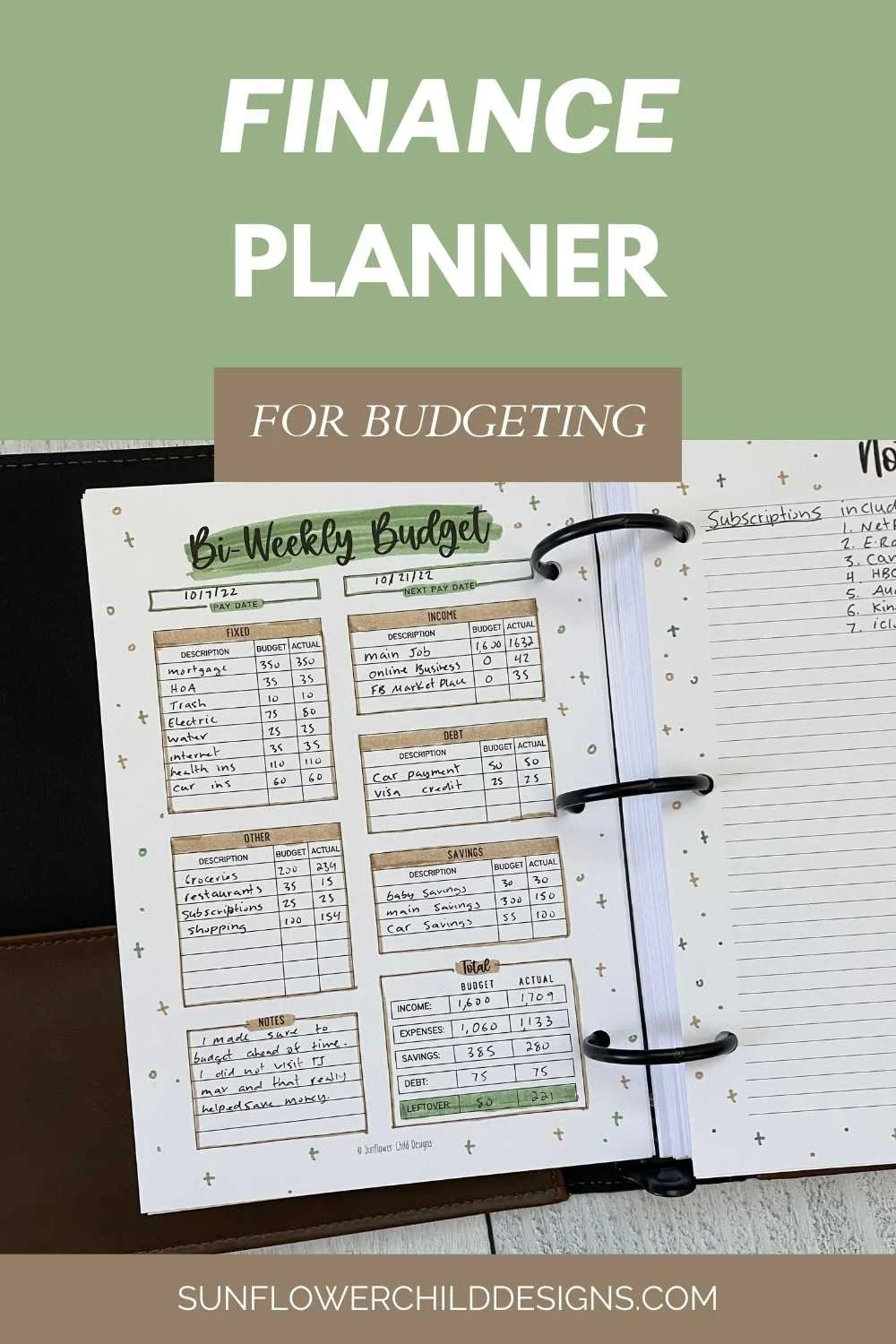

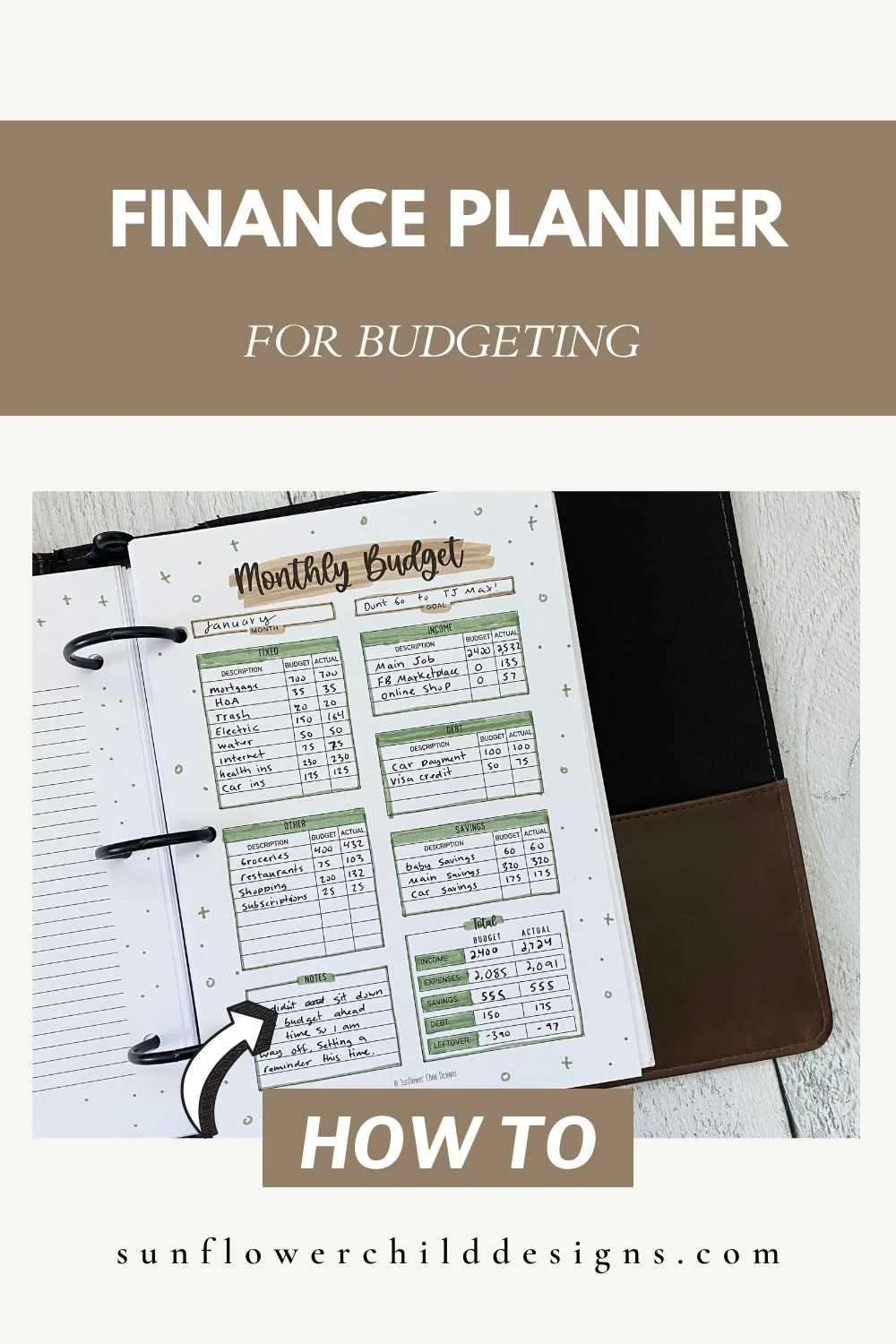

It depends. If you get paid bi-weekly most choose bi-weekly and budget for half of their living expenses every two weeks instead of once a month. If you prefer to make a monthly budget it is easier if you have funds in your savings to back you up if you max out one of your budgets within the first week since you do not have all of your funds for the month yet.

-

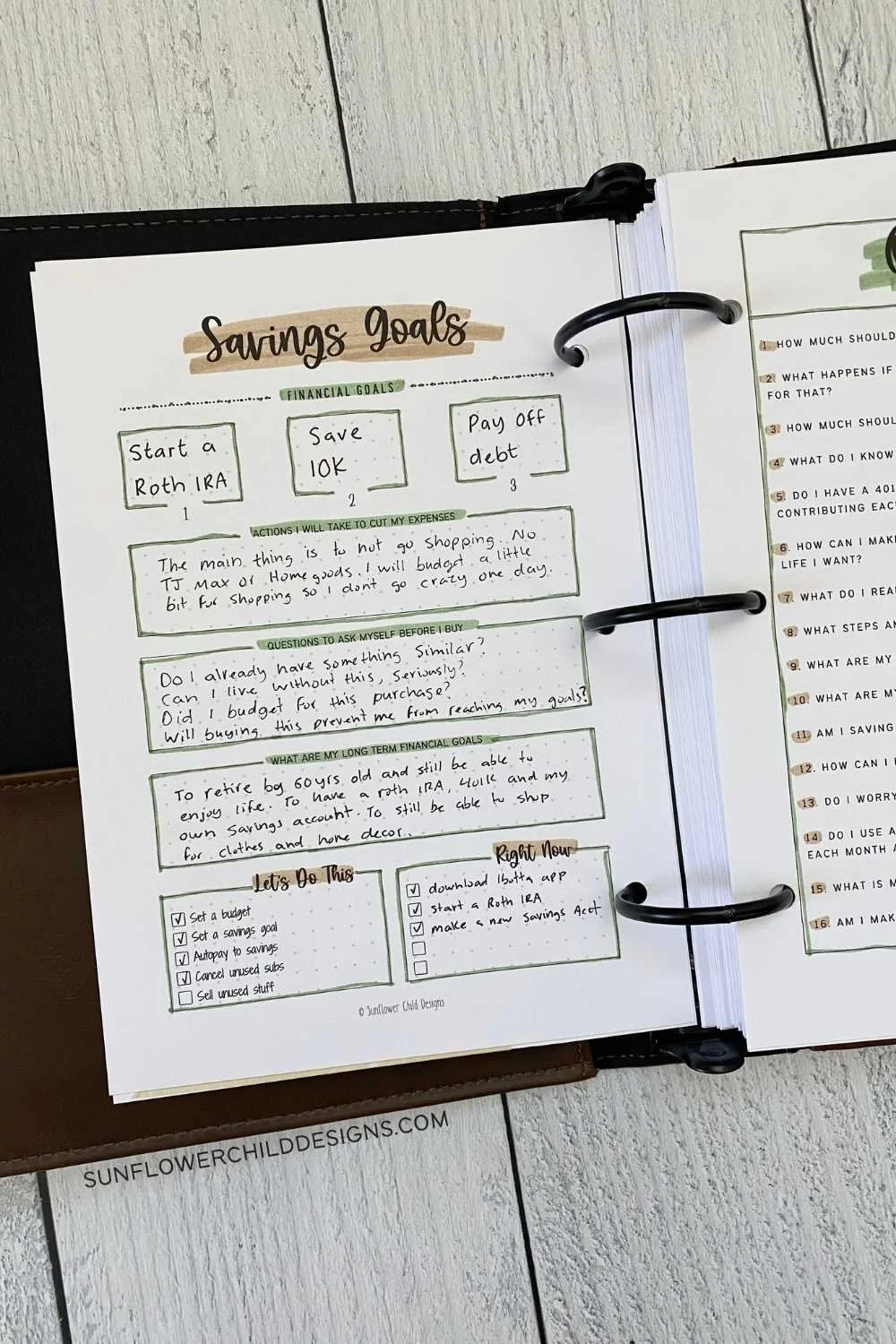

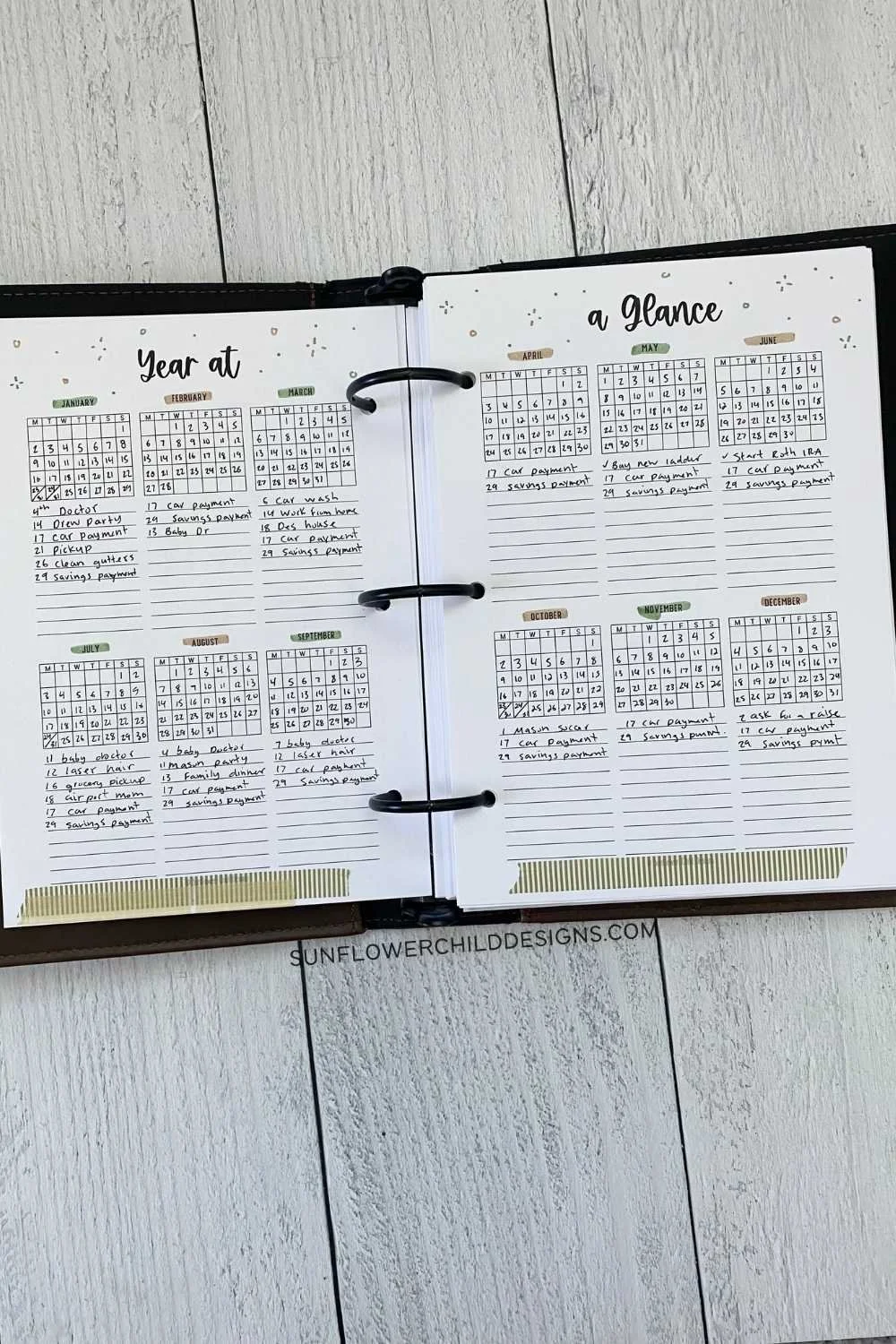

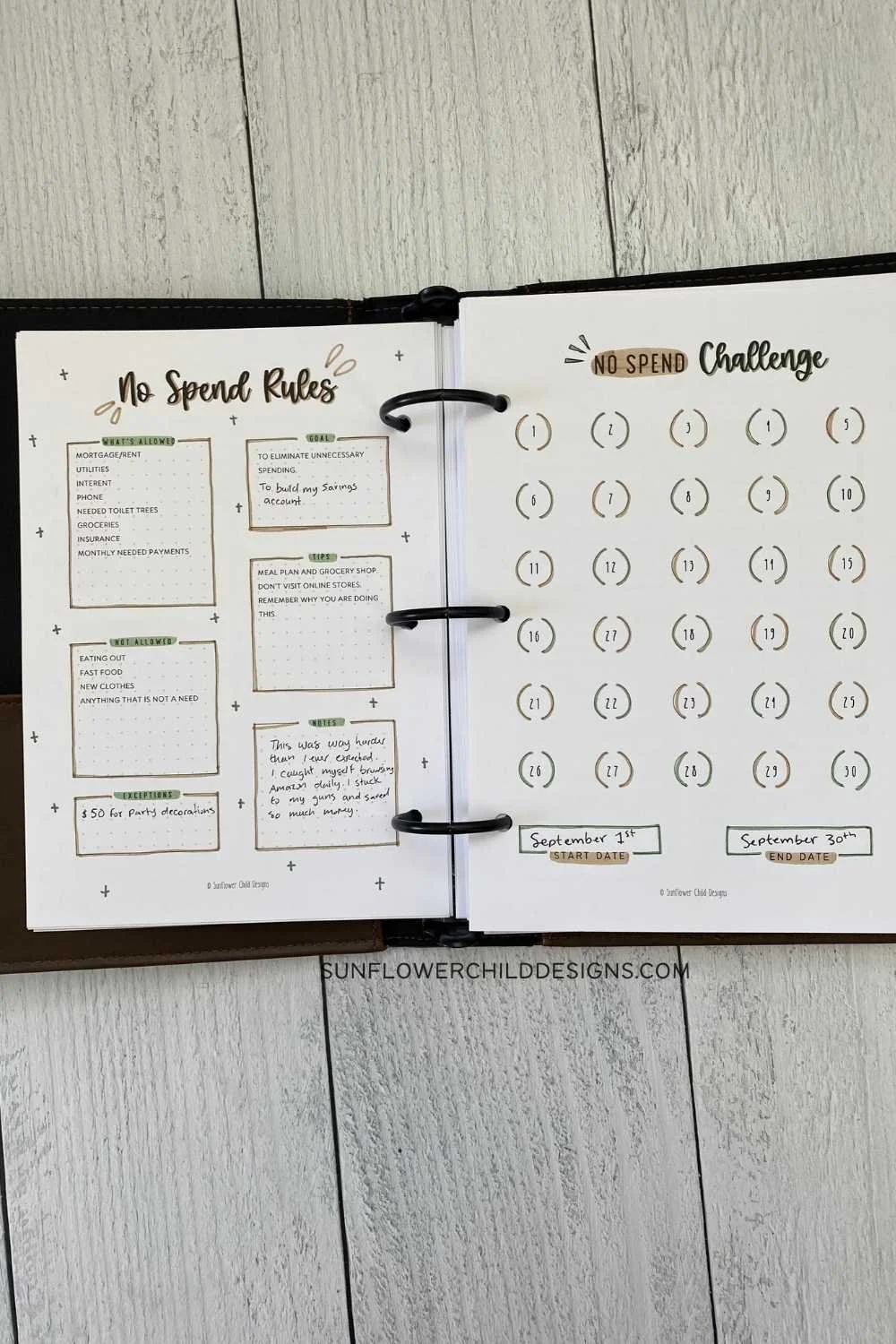

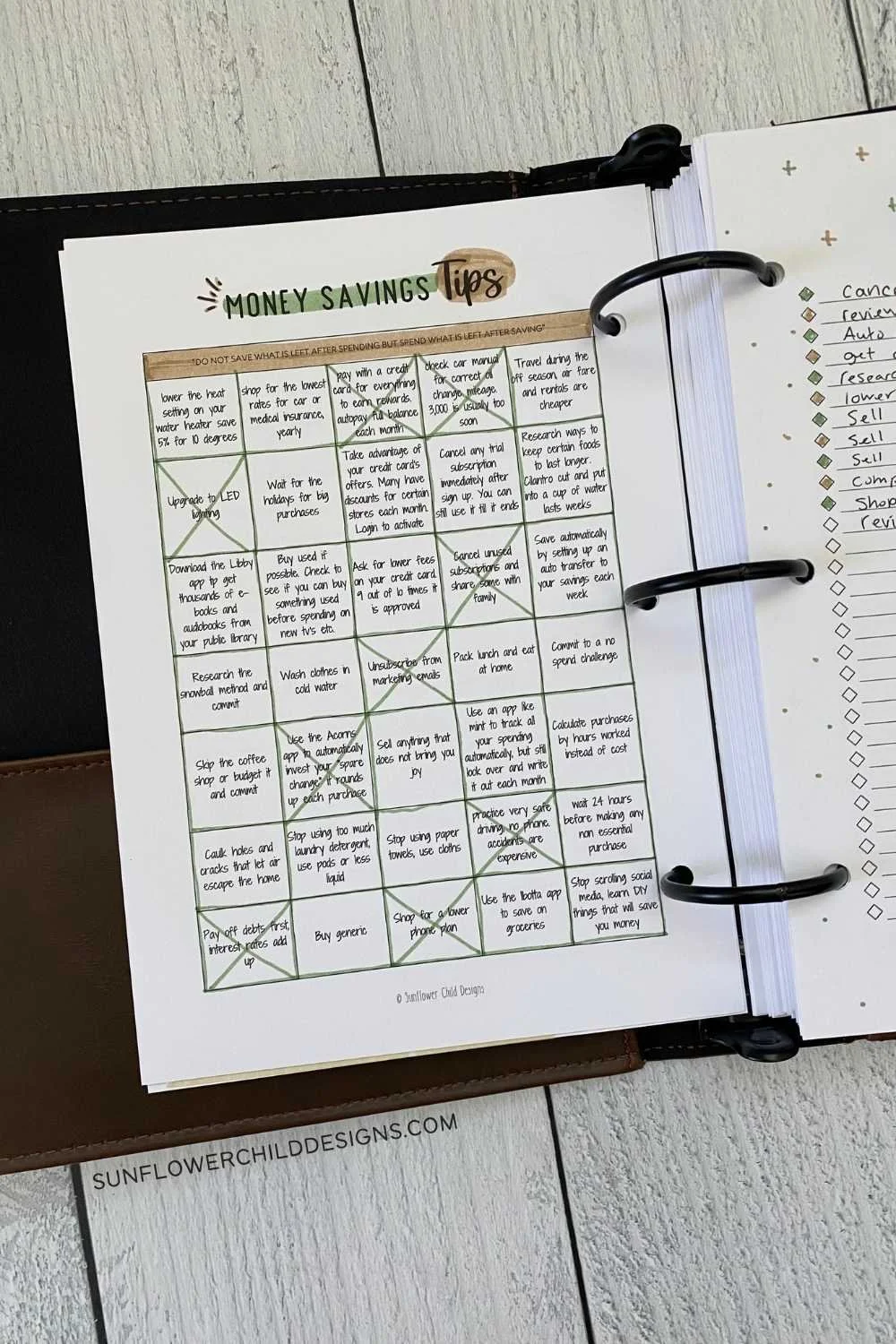

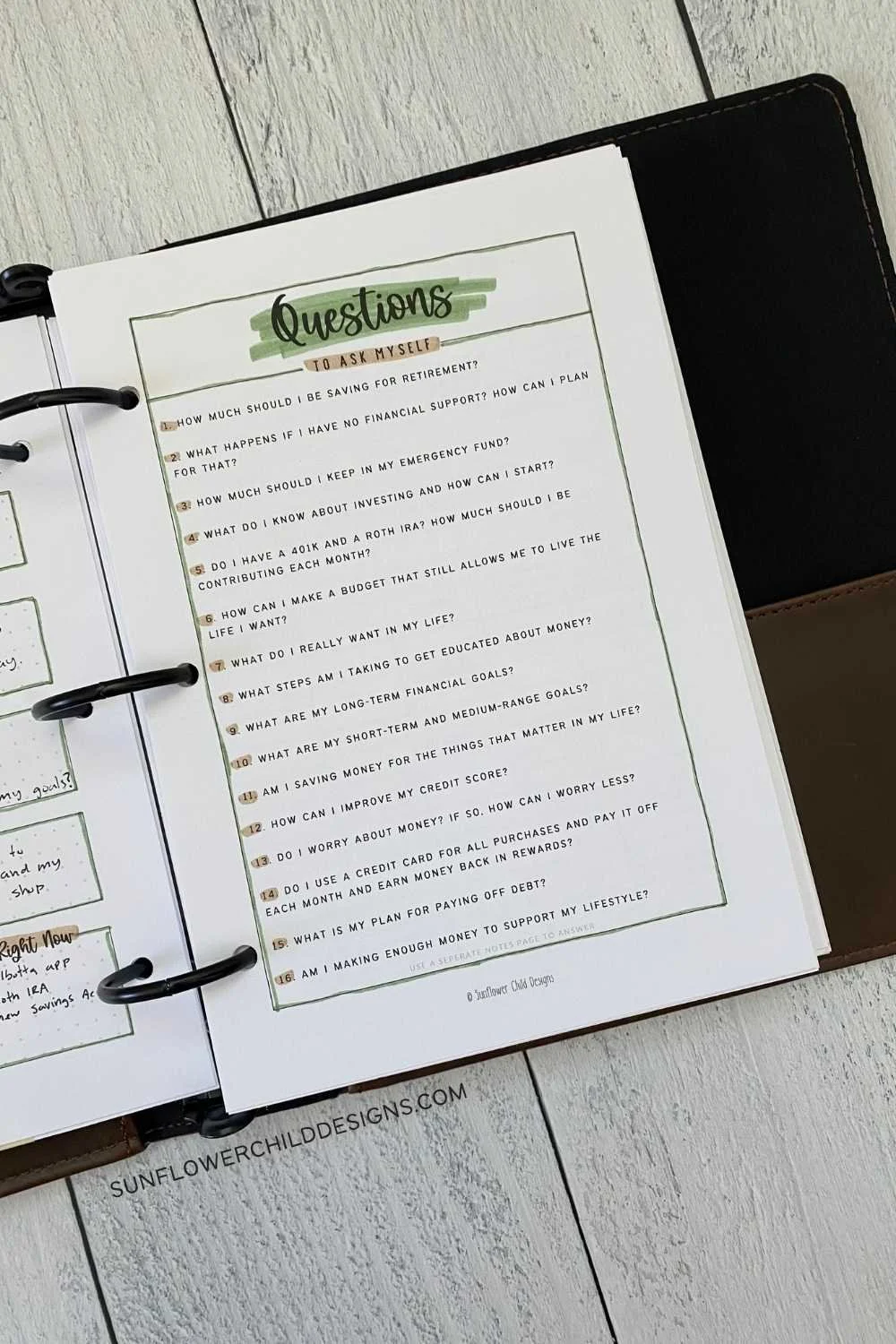

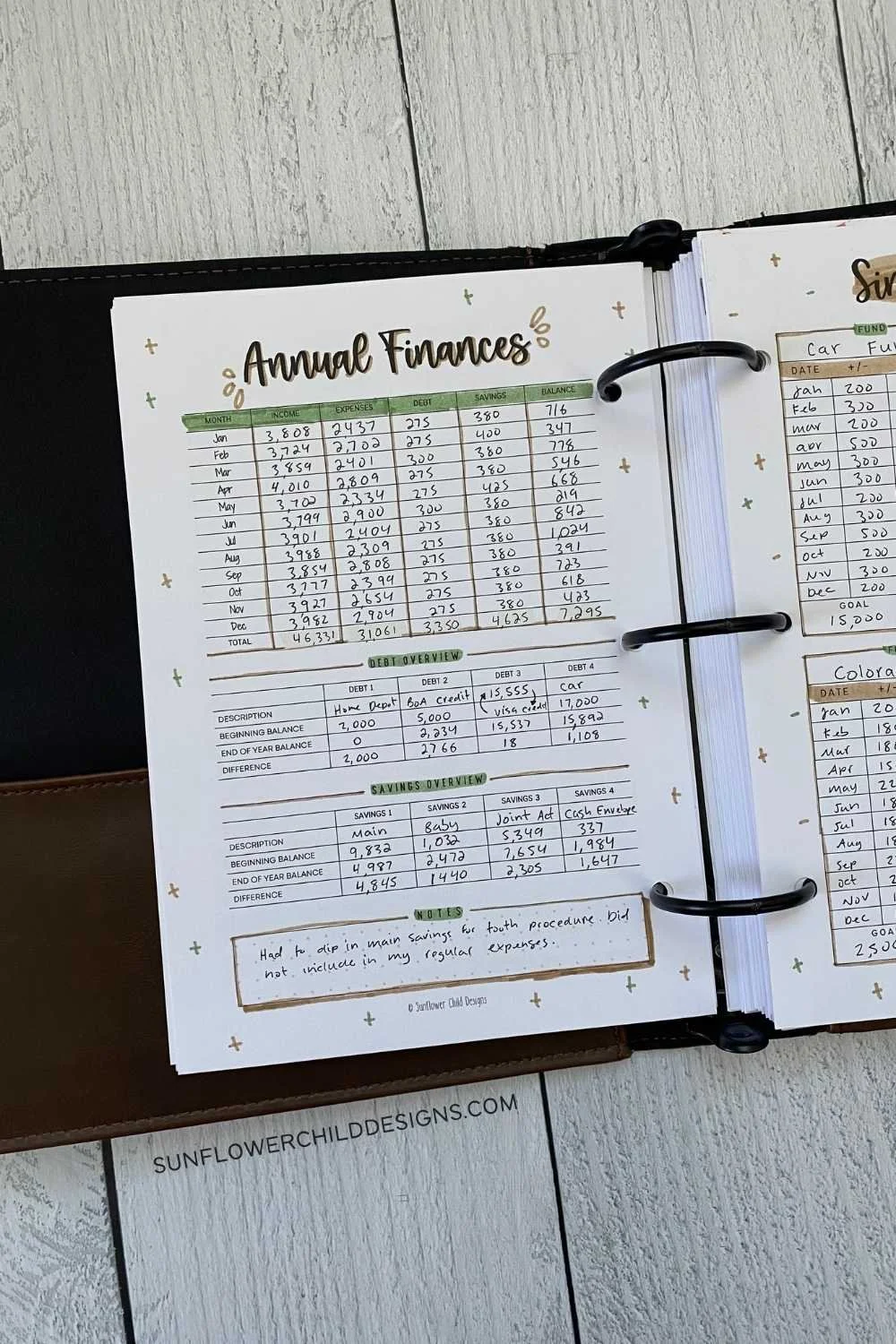

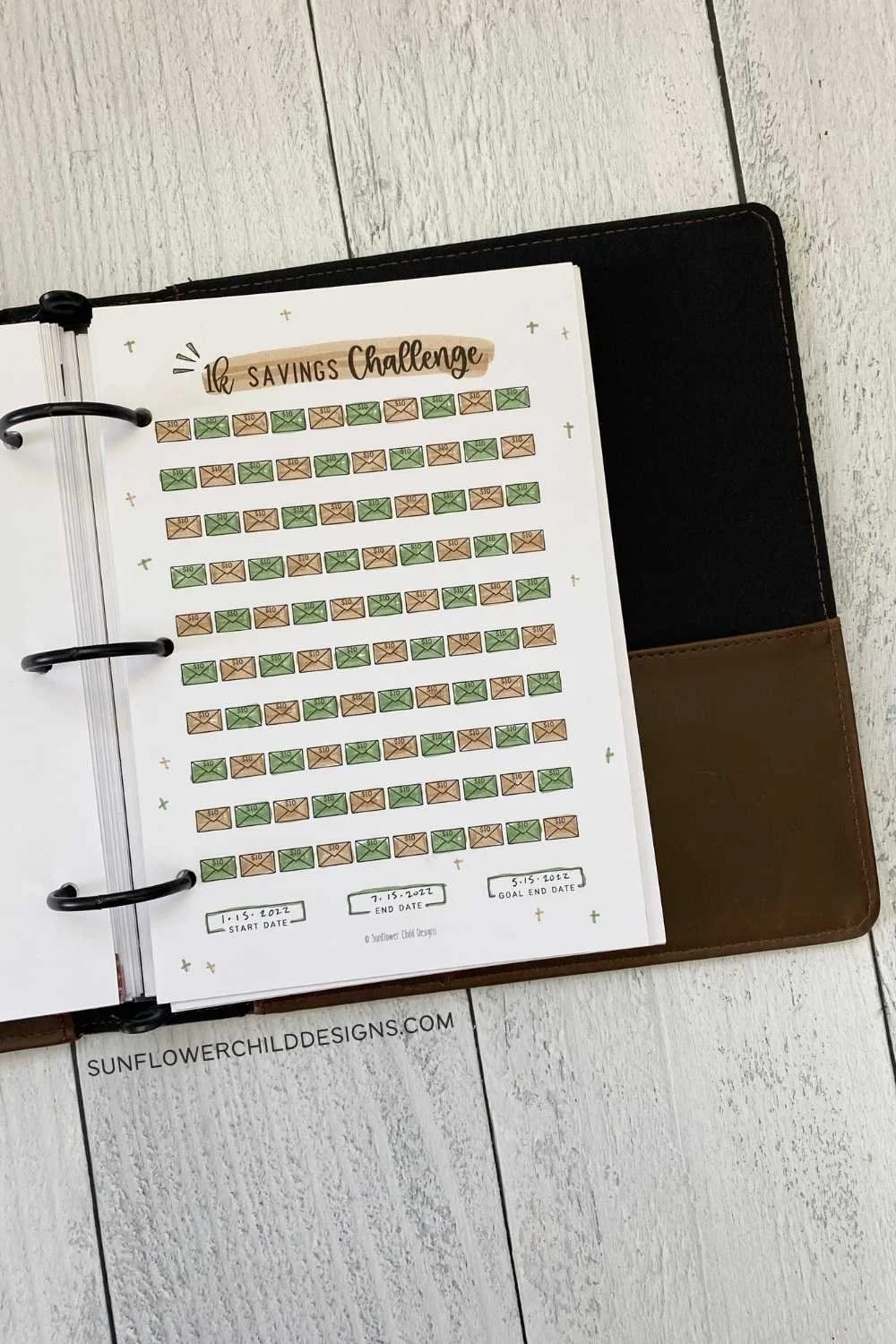

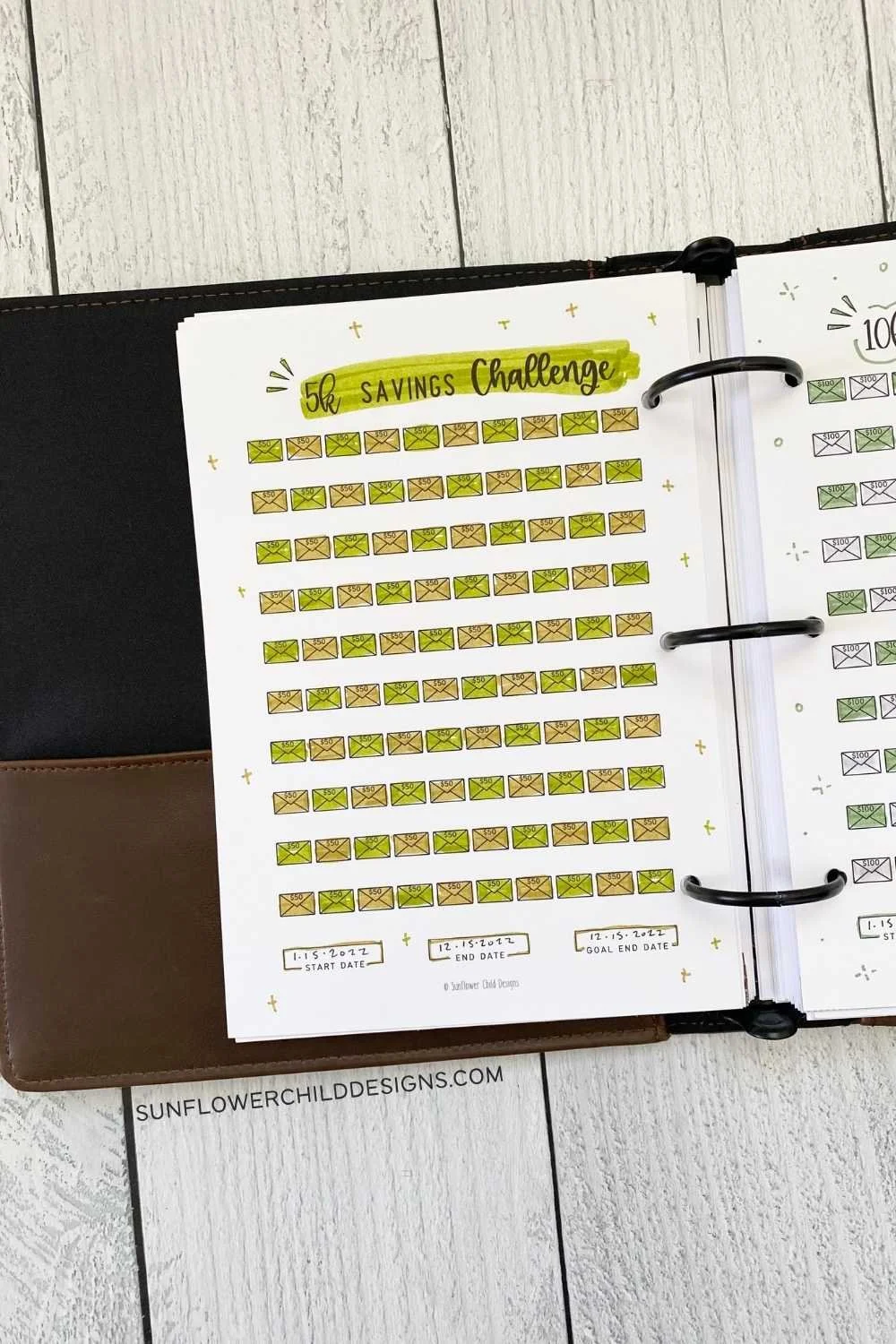

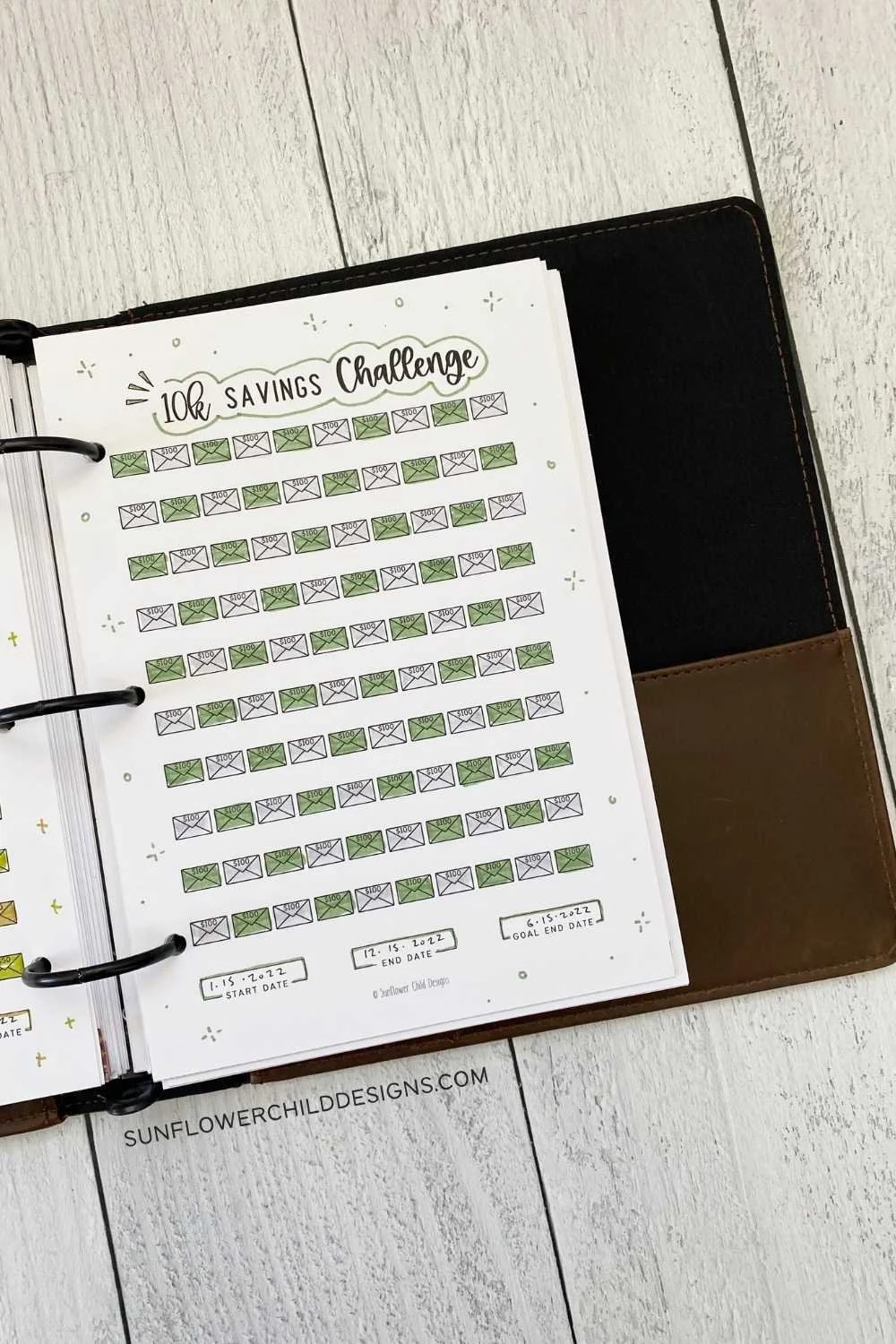

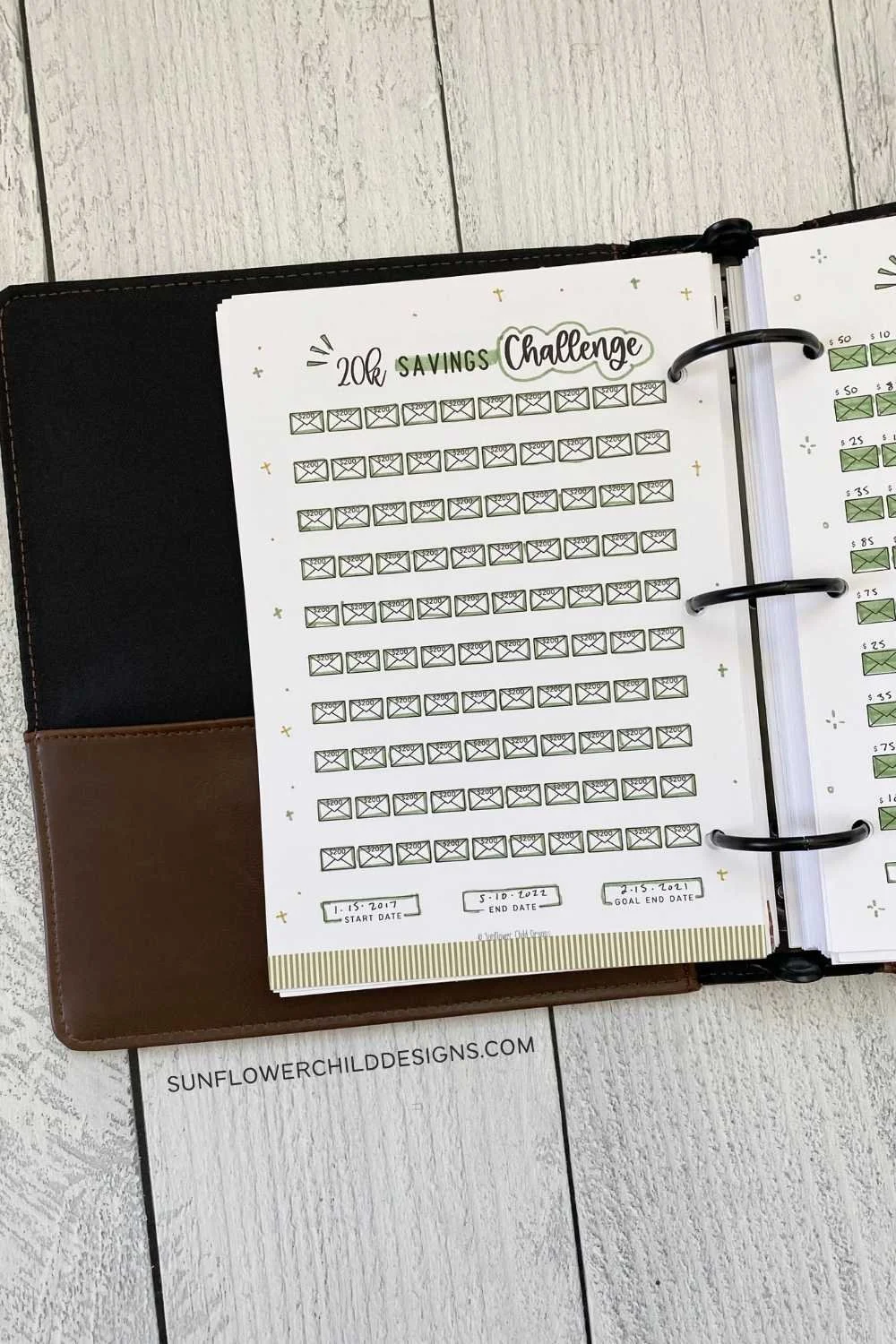

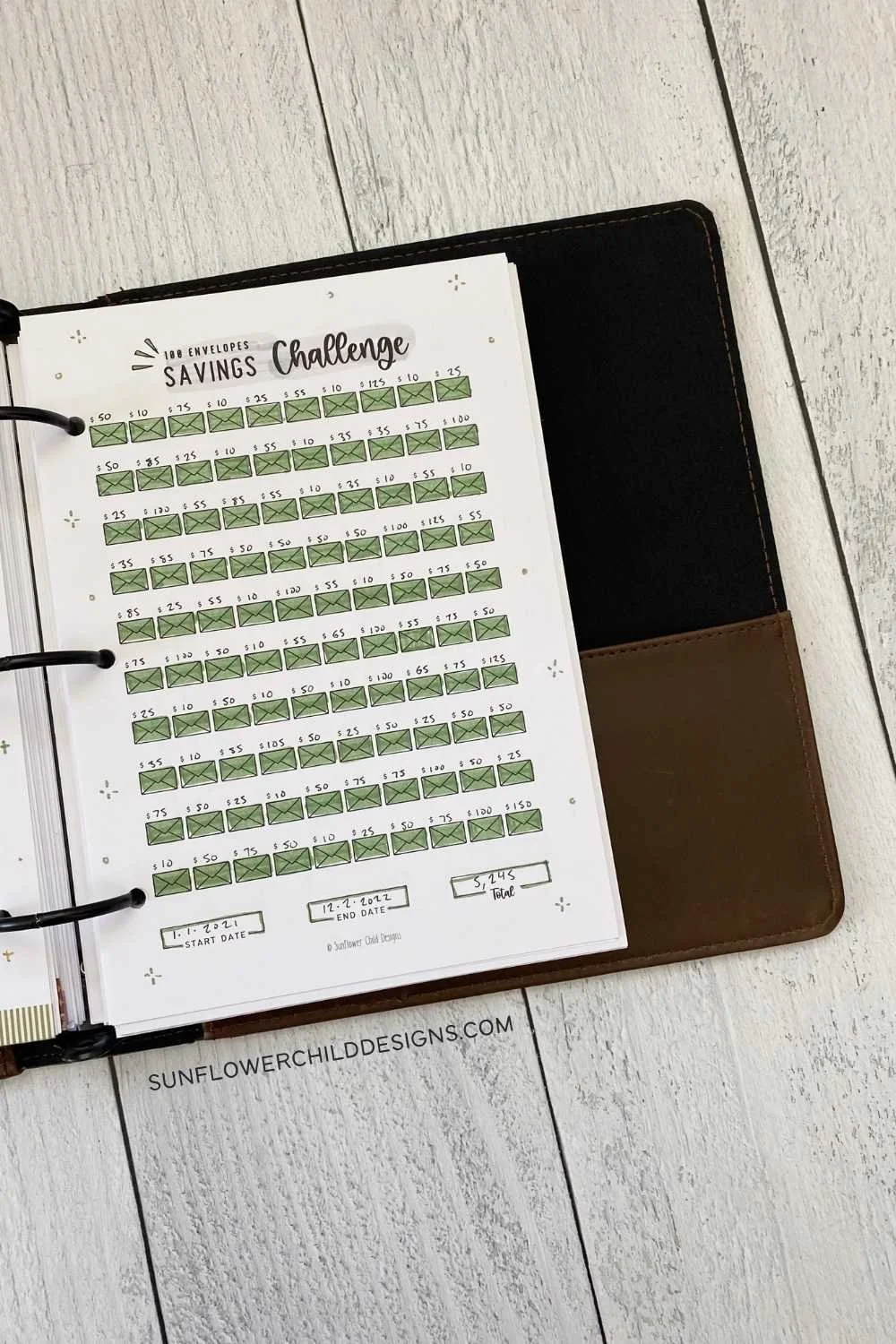

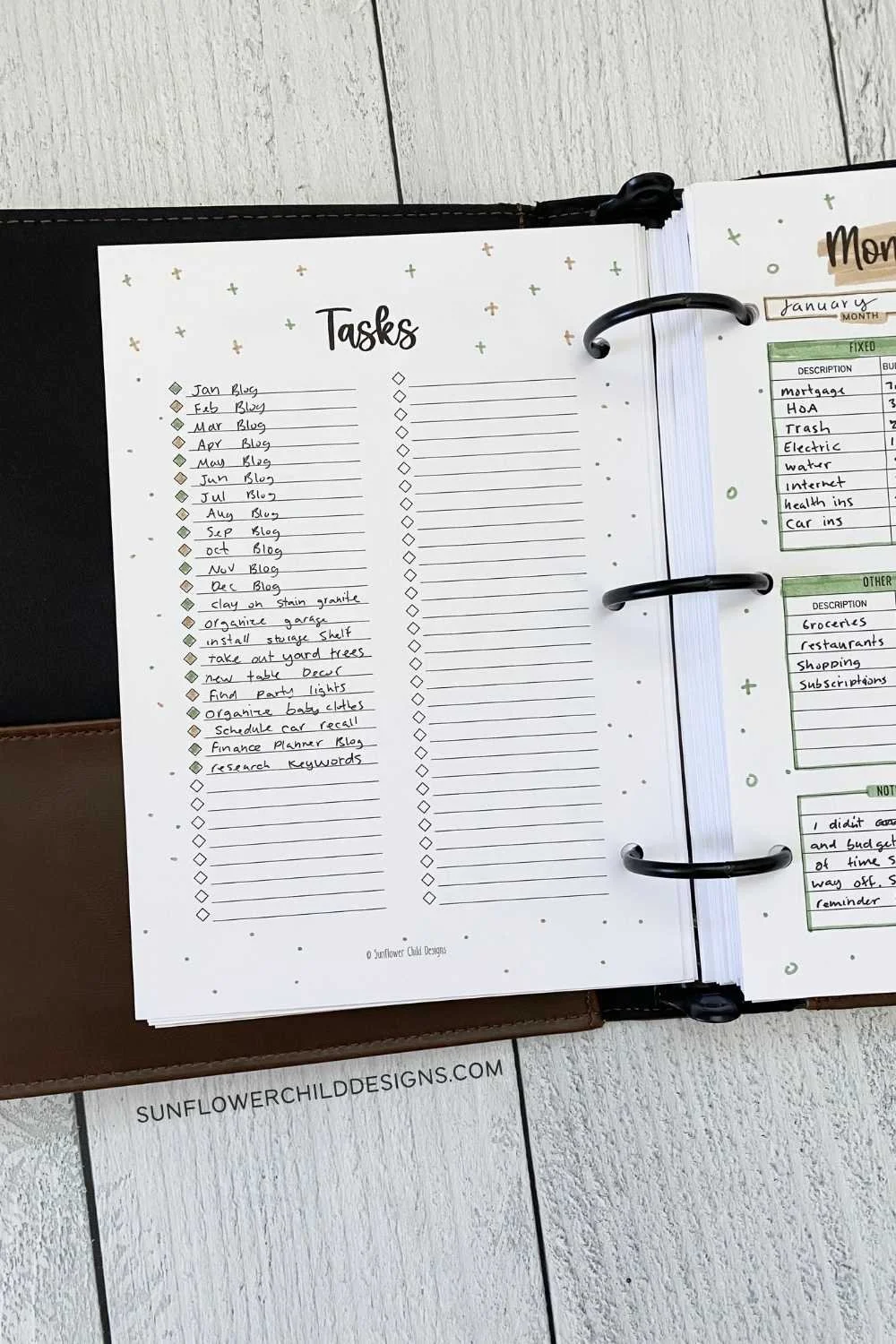

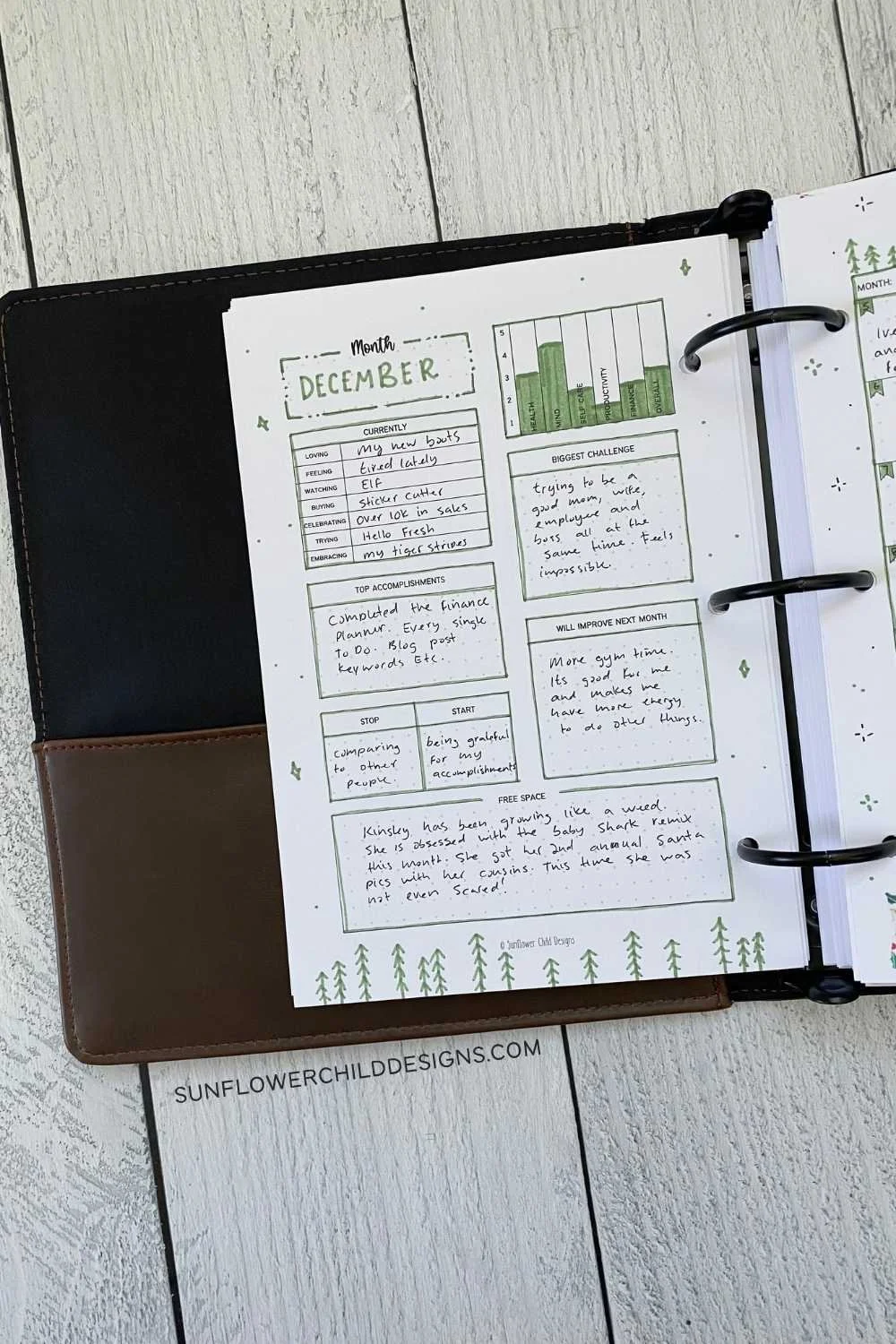

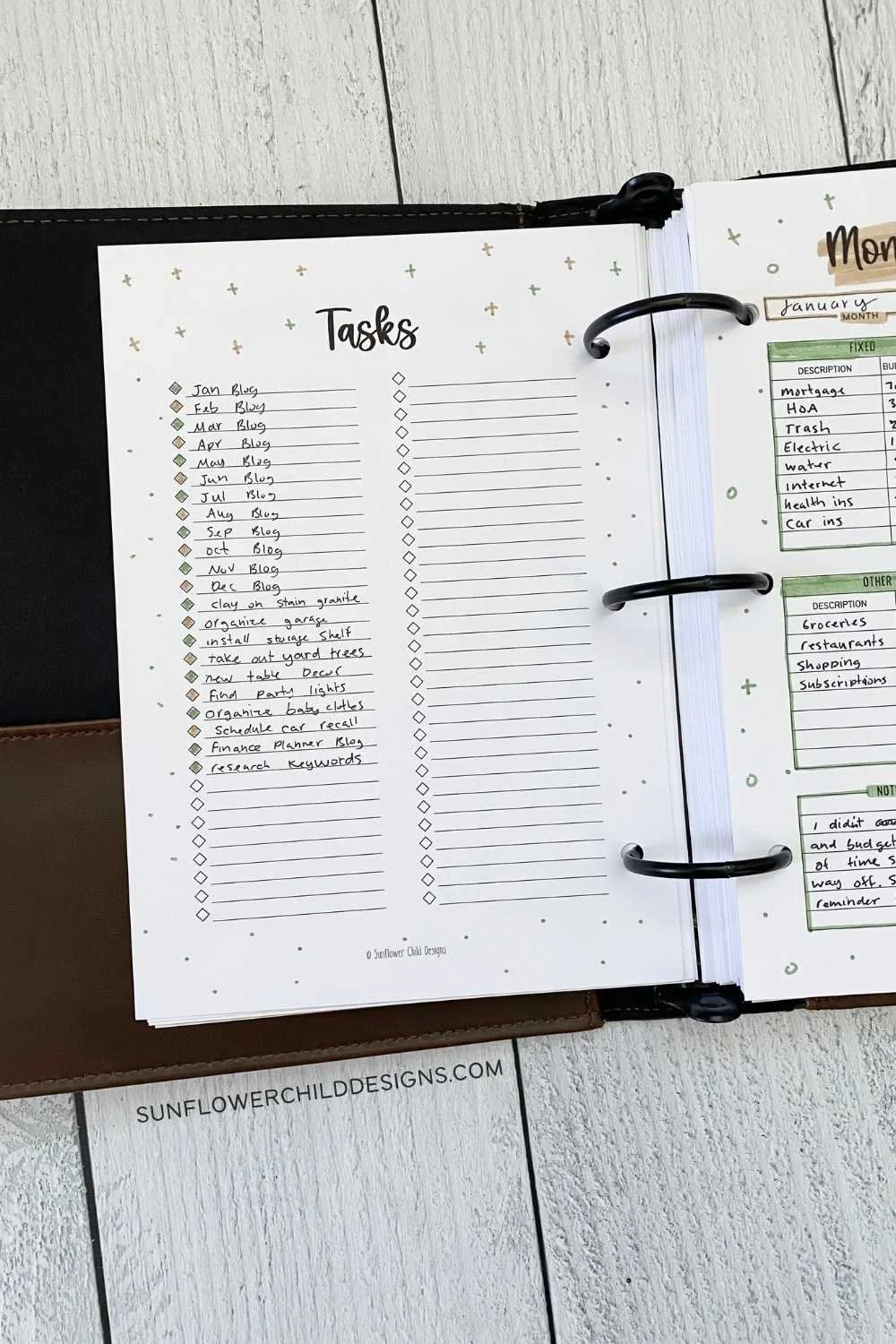

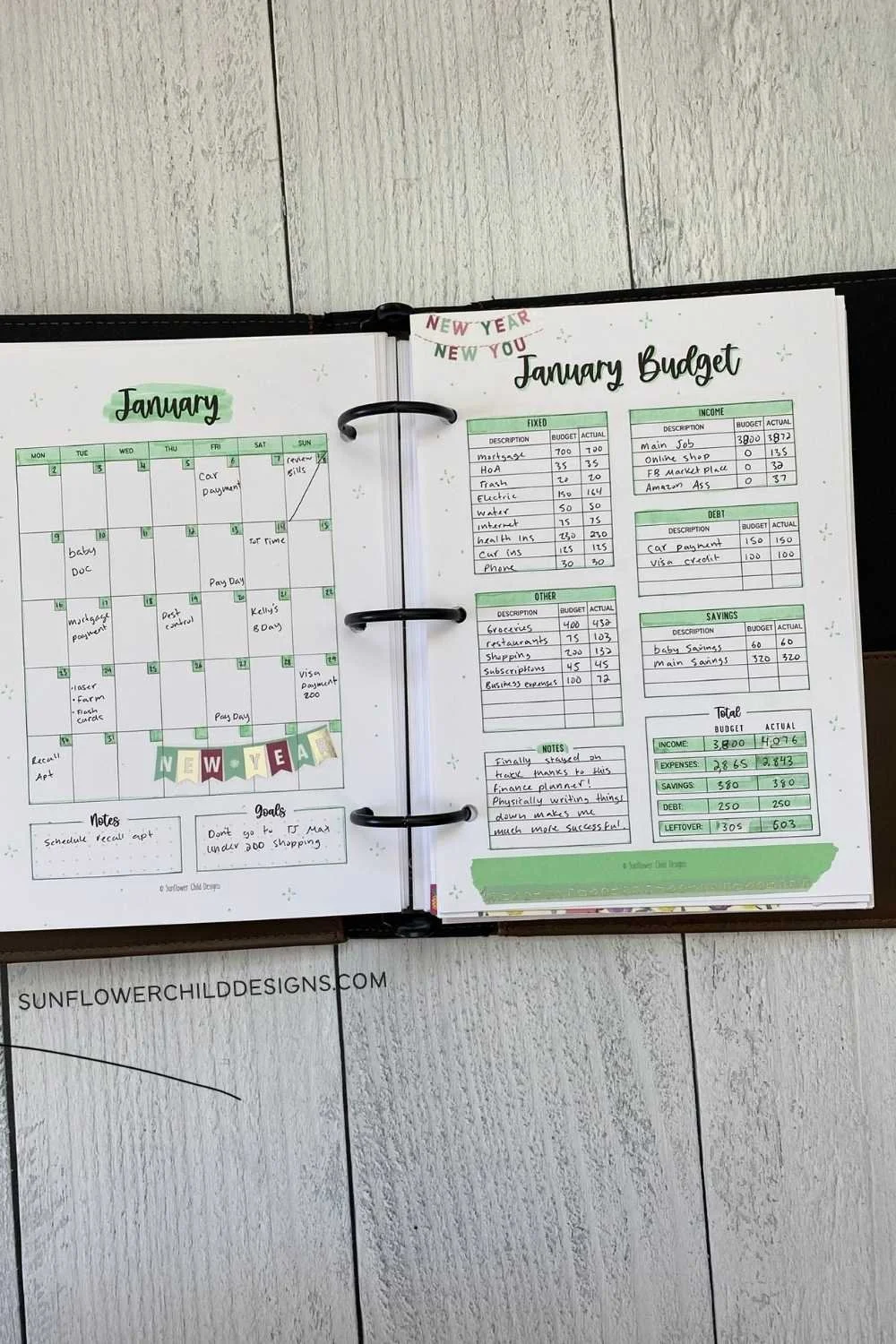

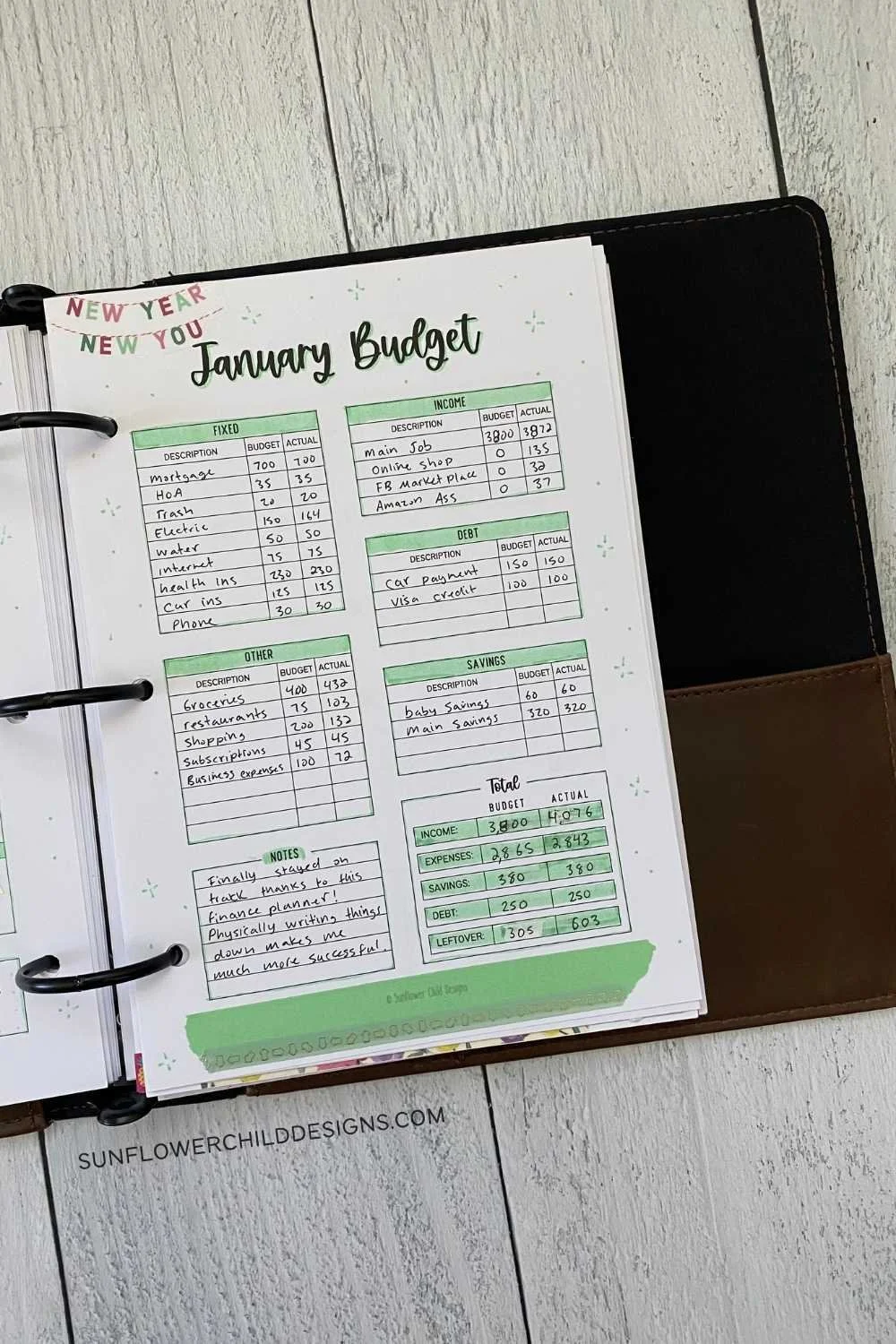

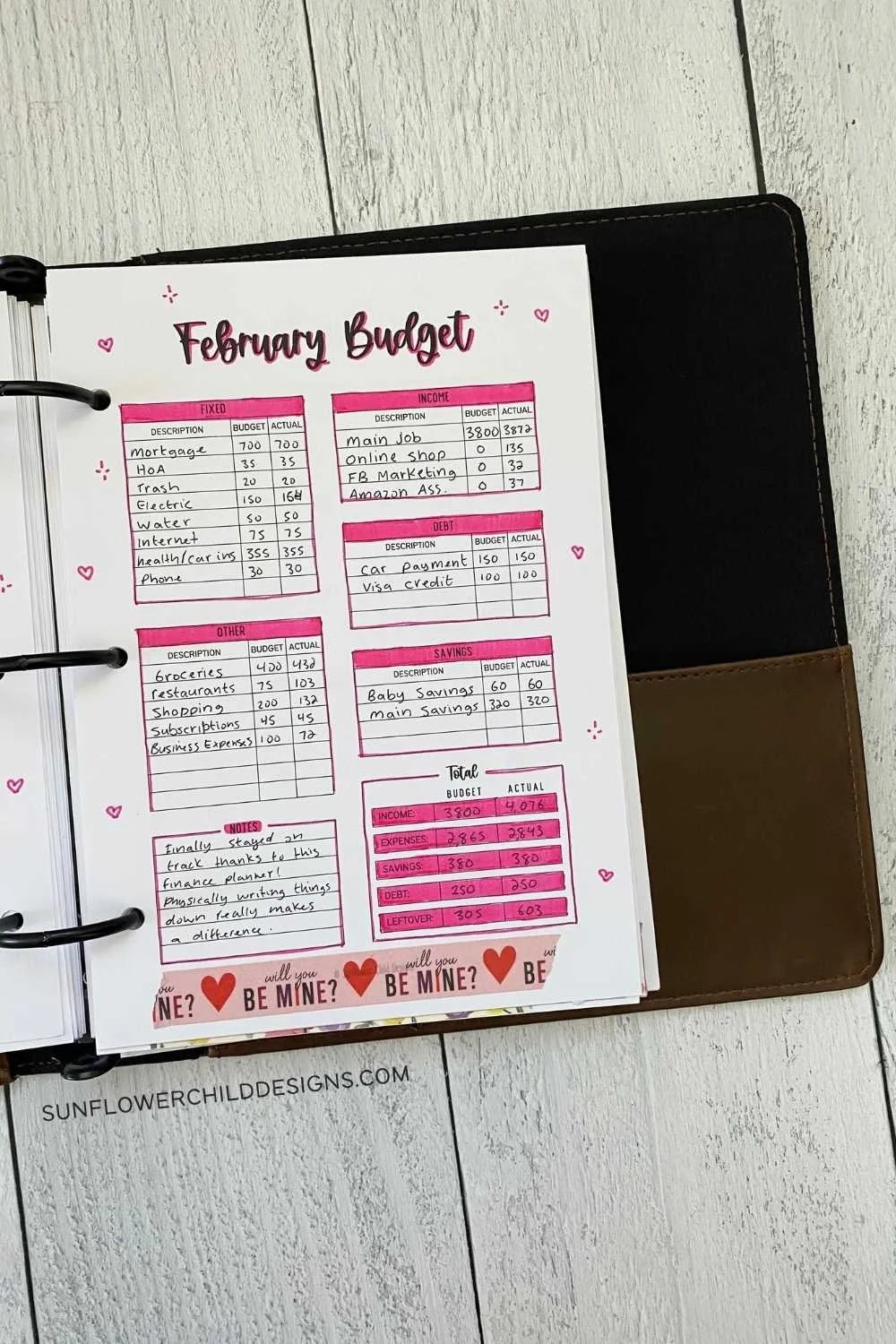

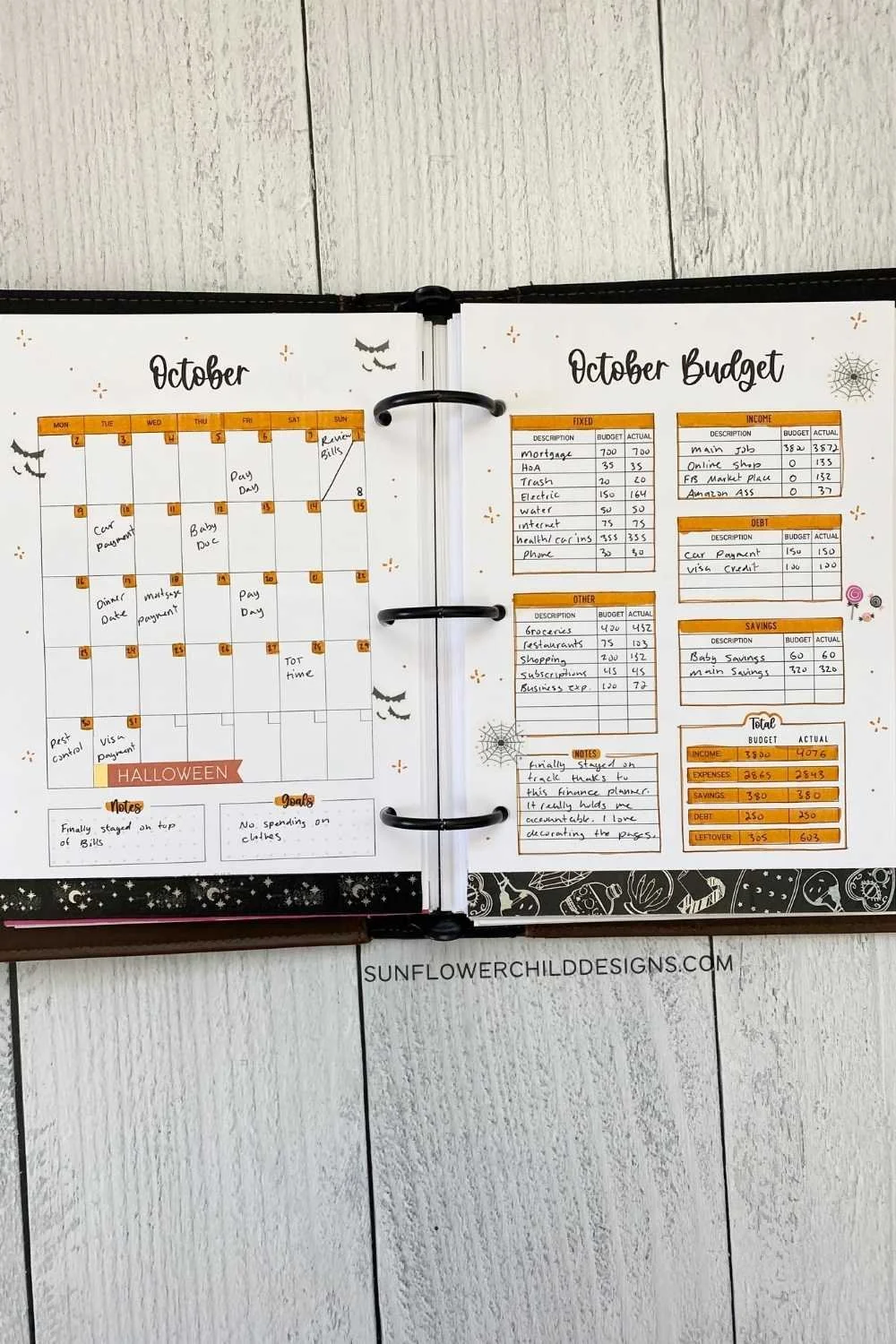

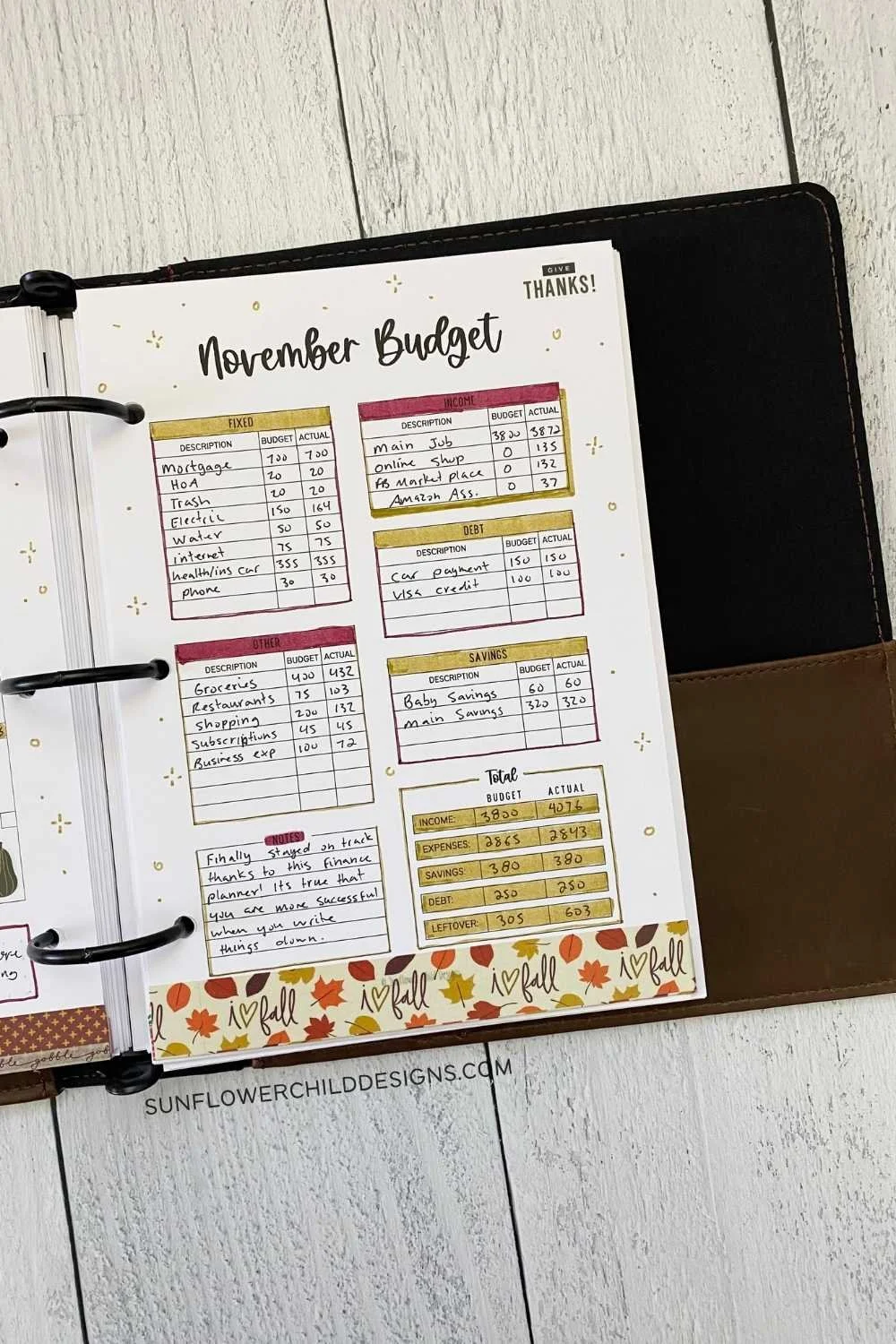

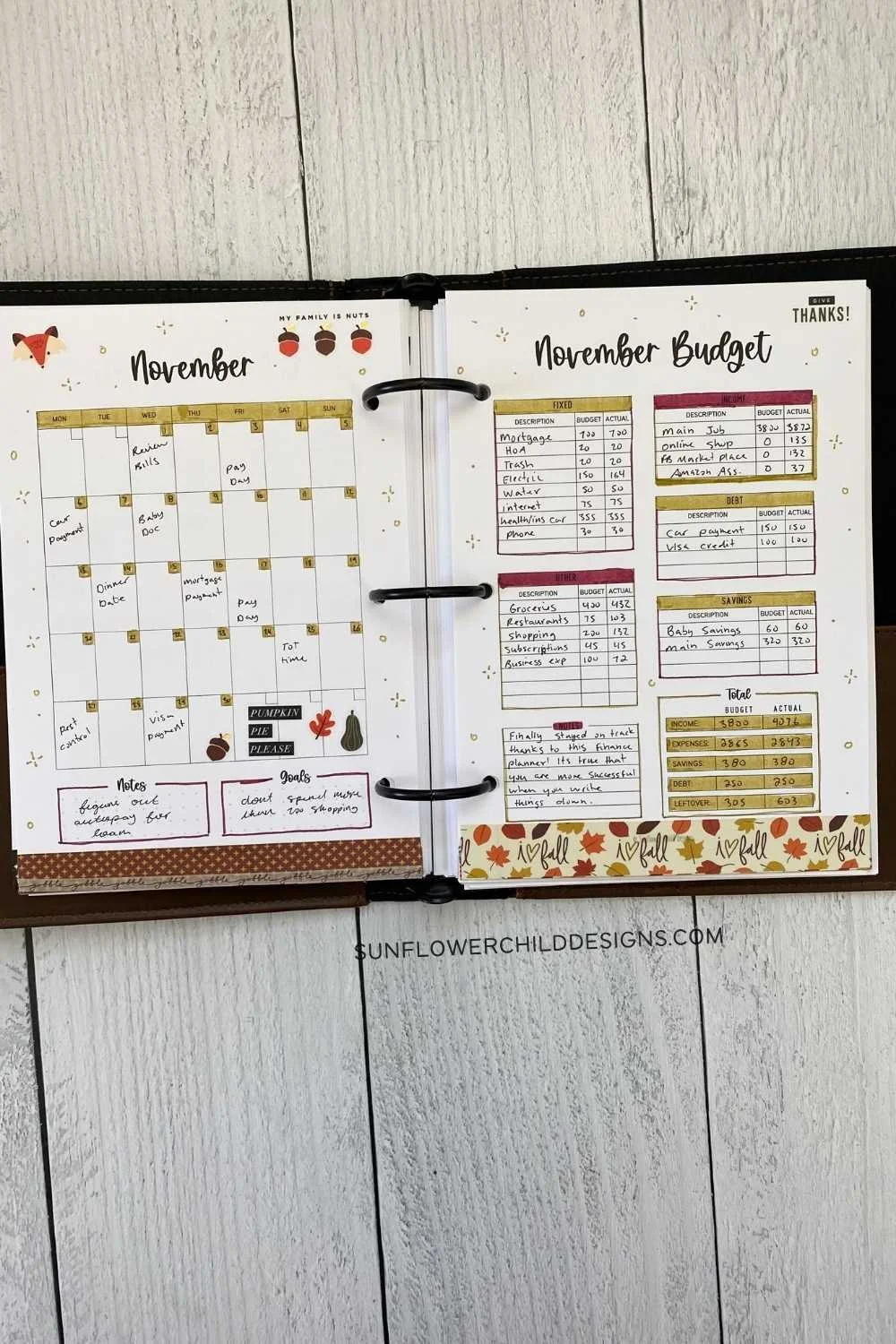

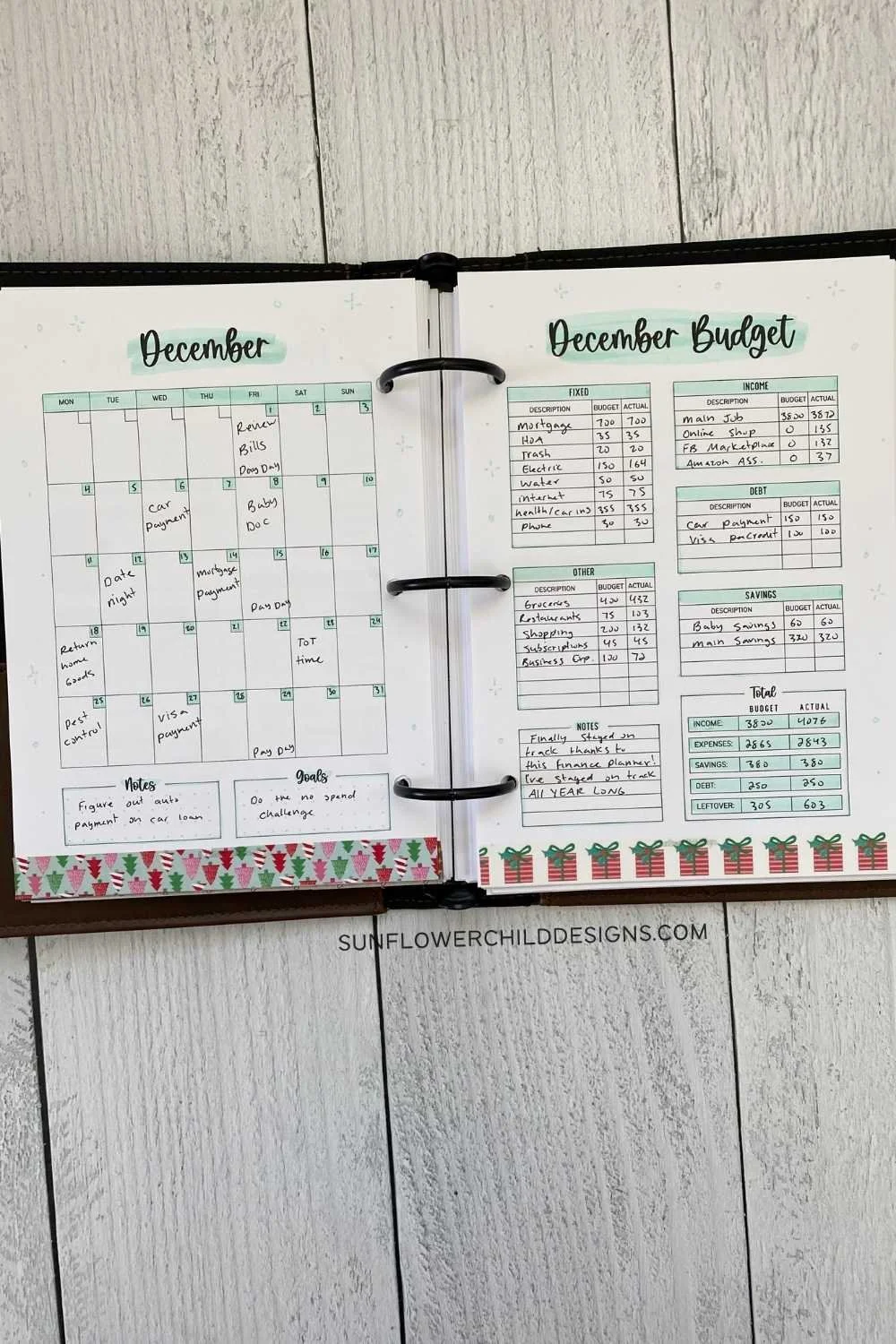

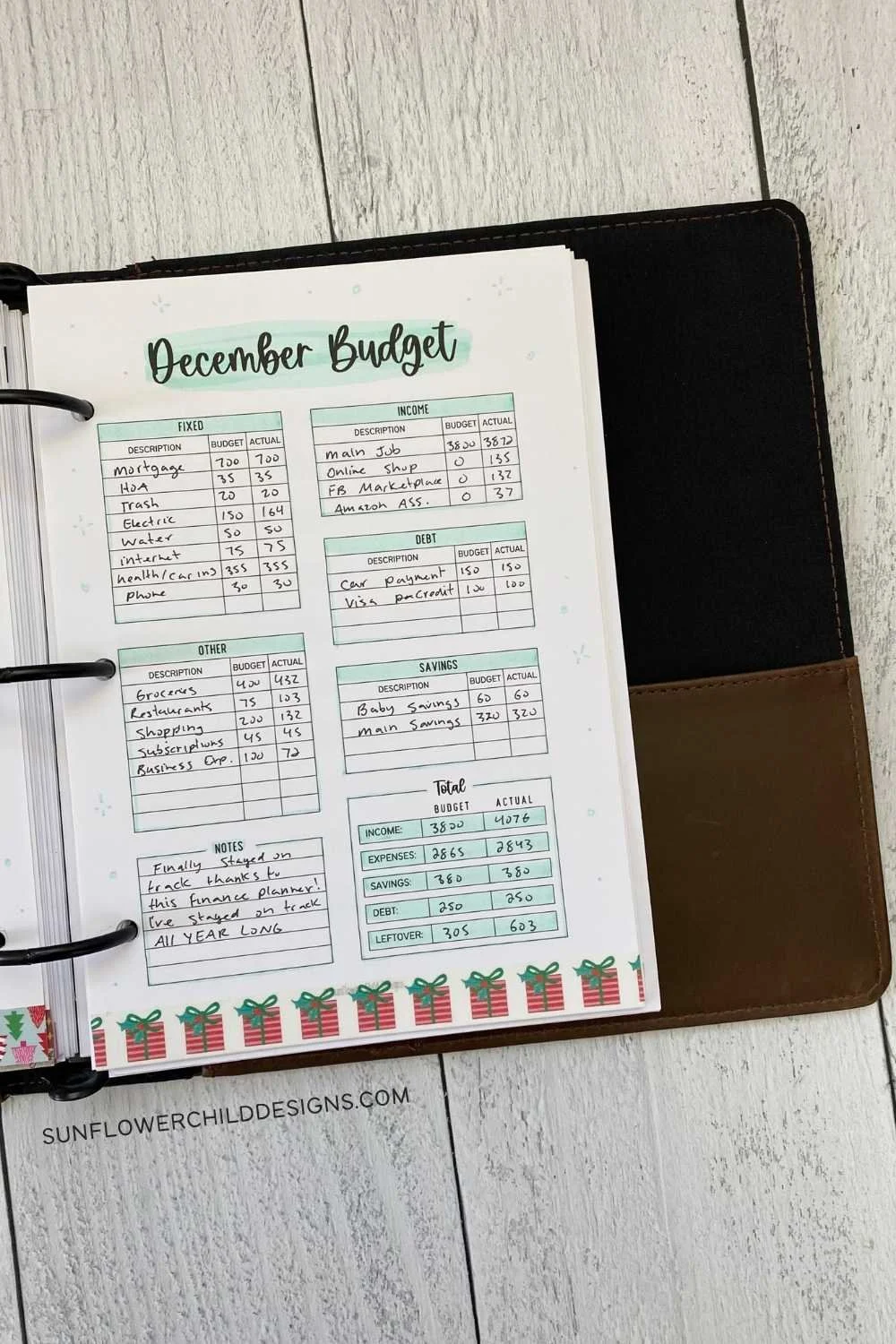

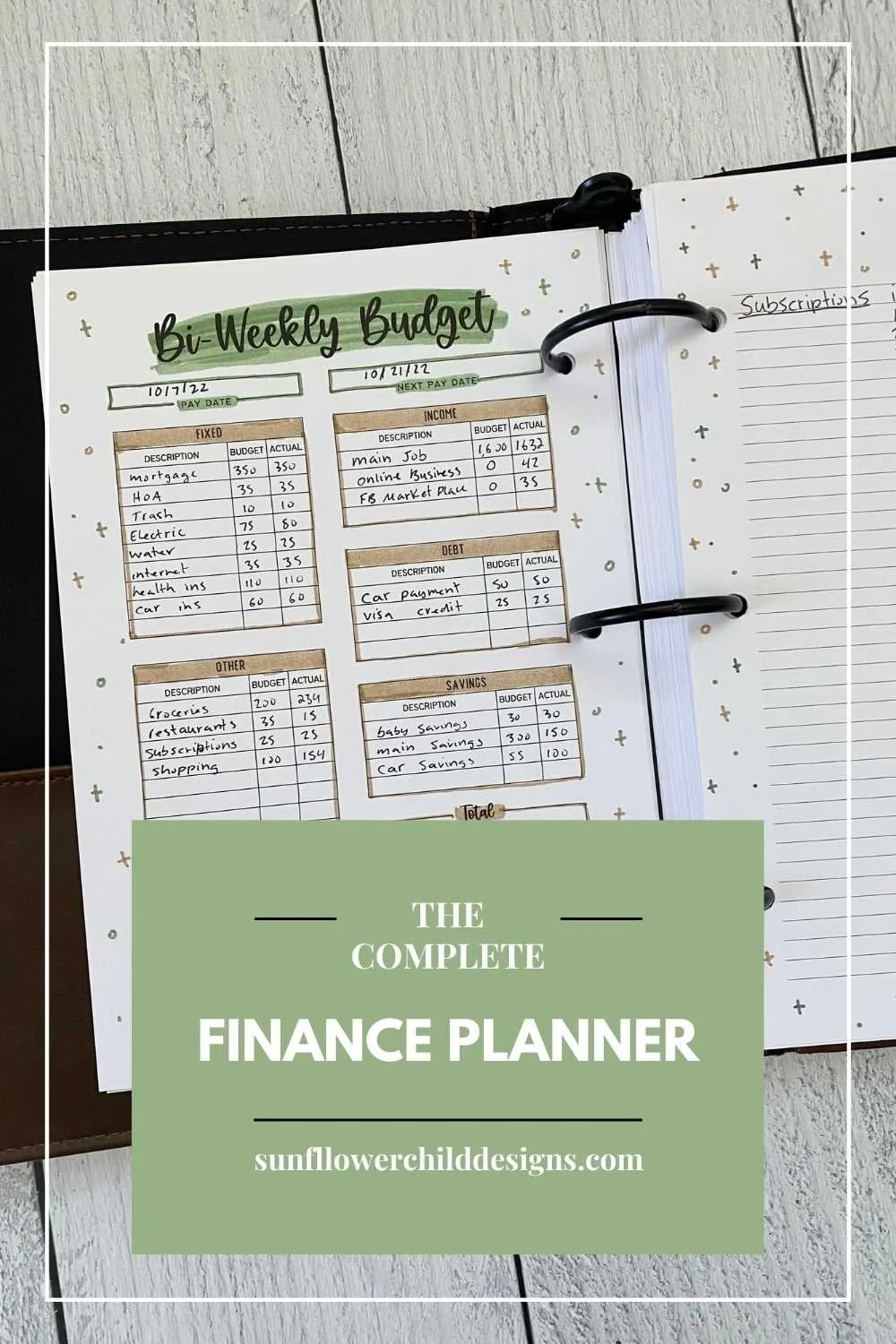

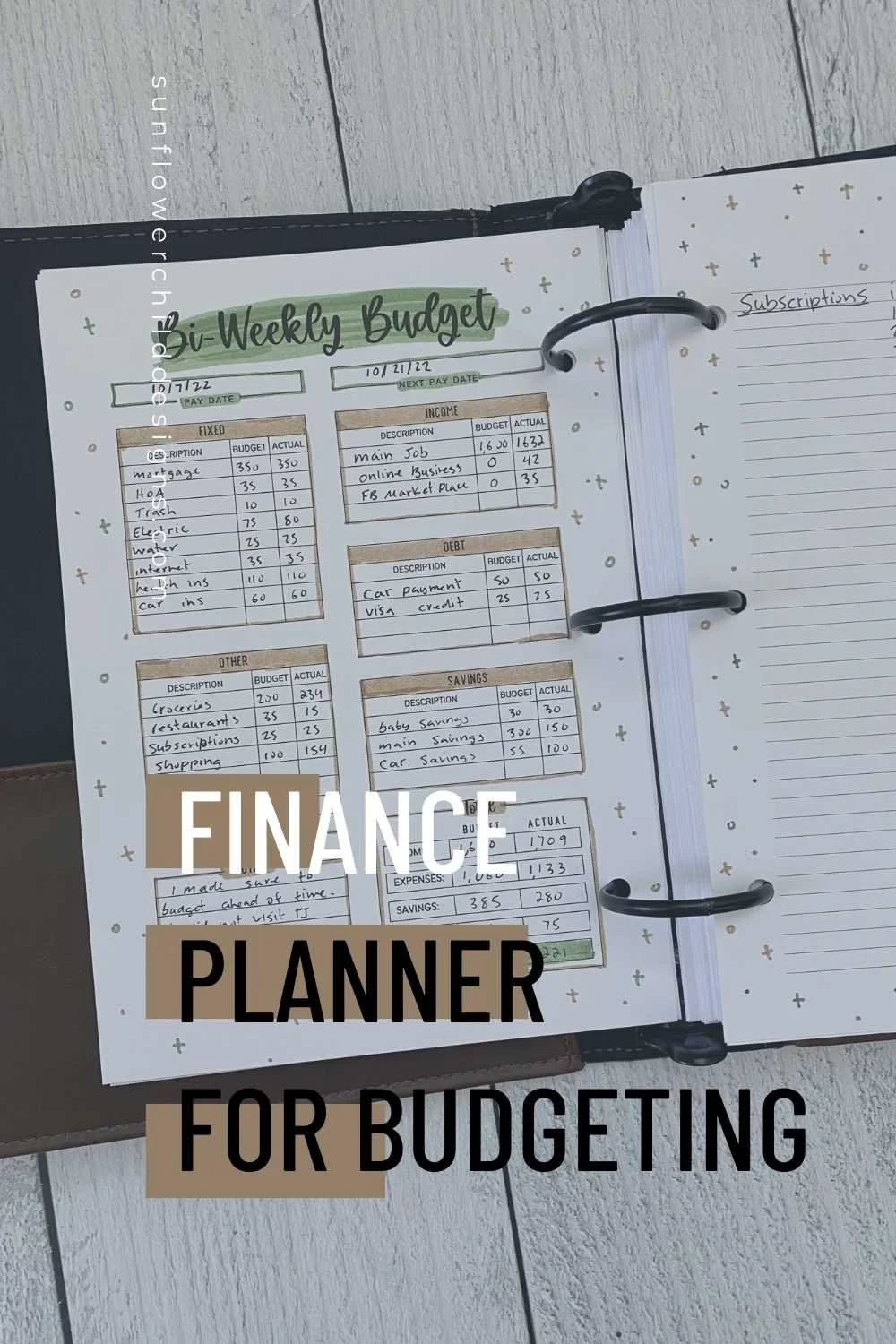

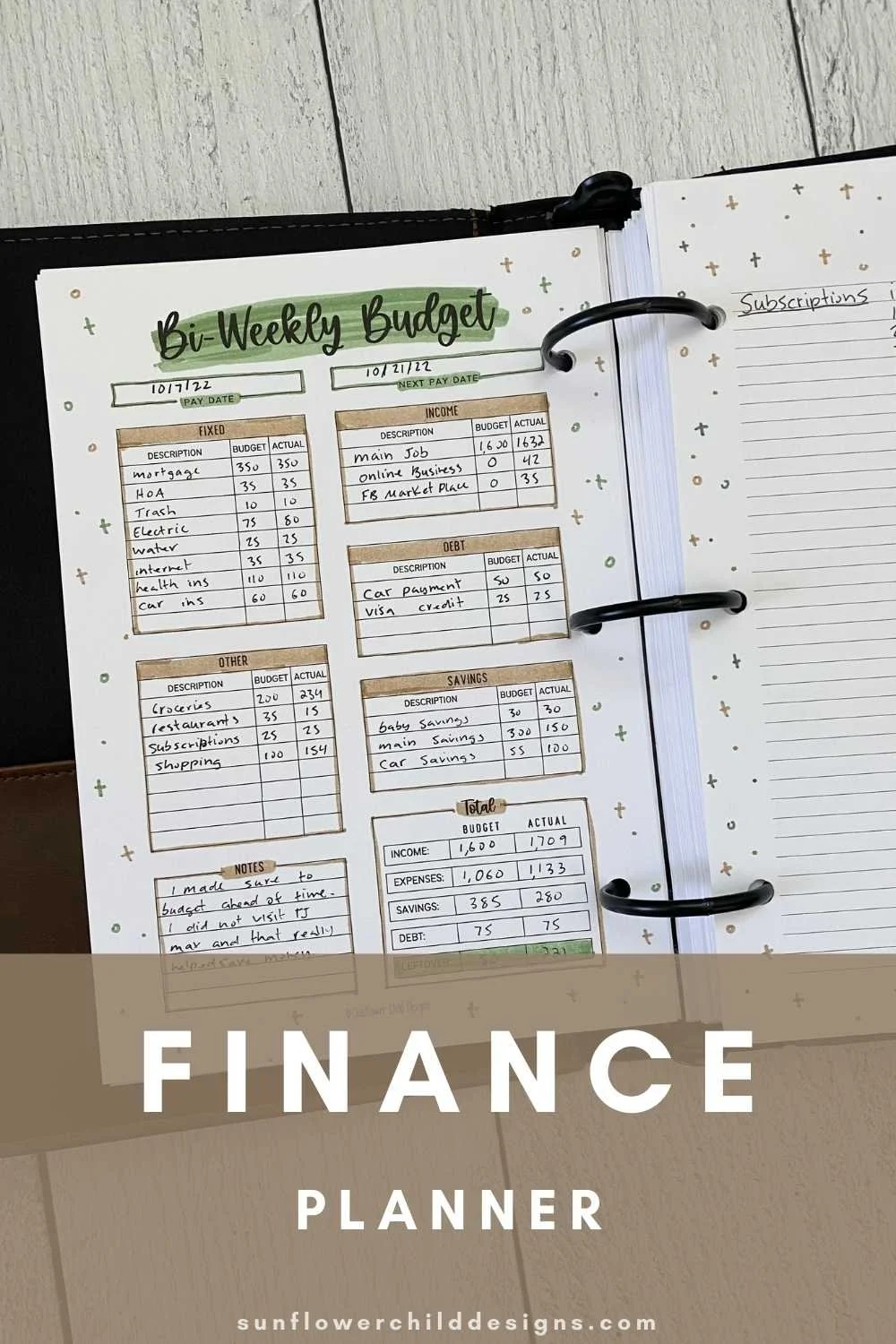

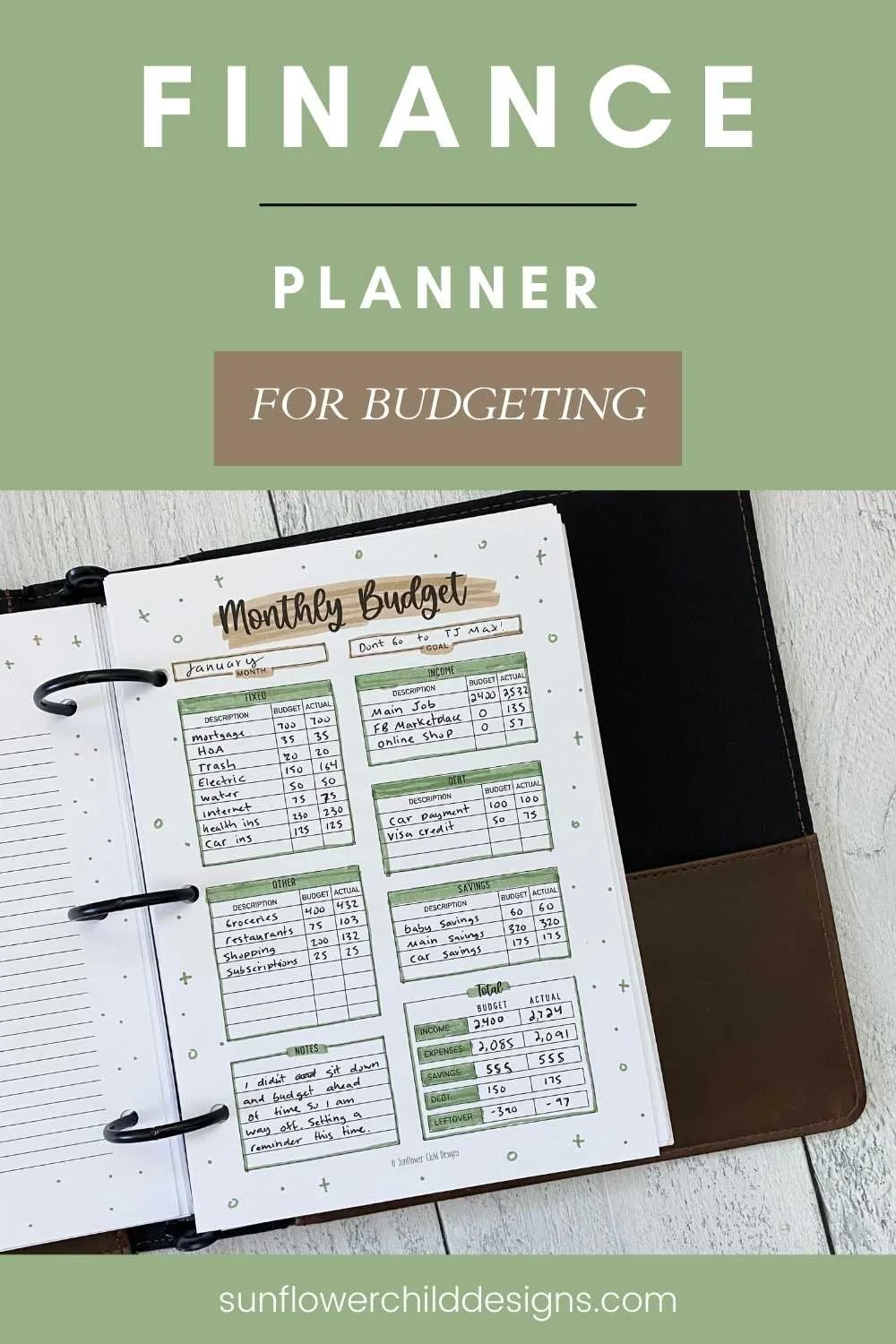

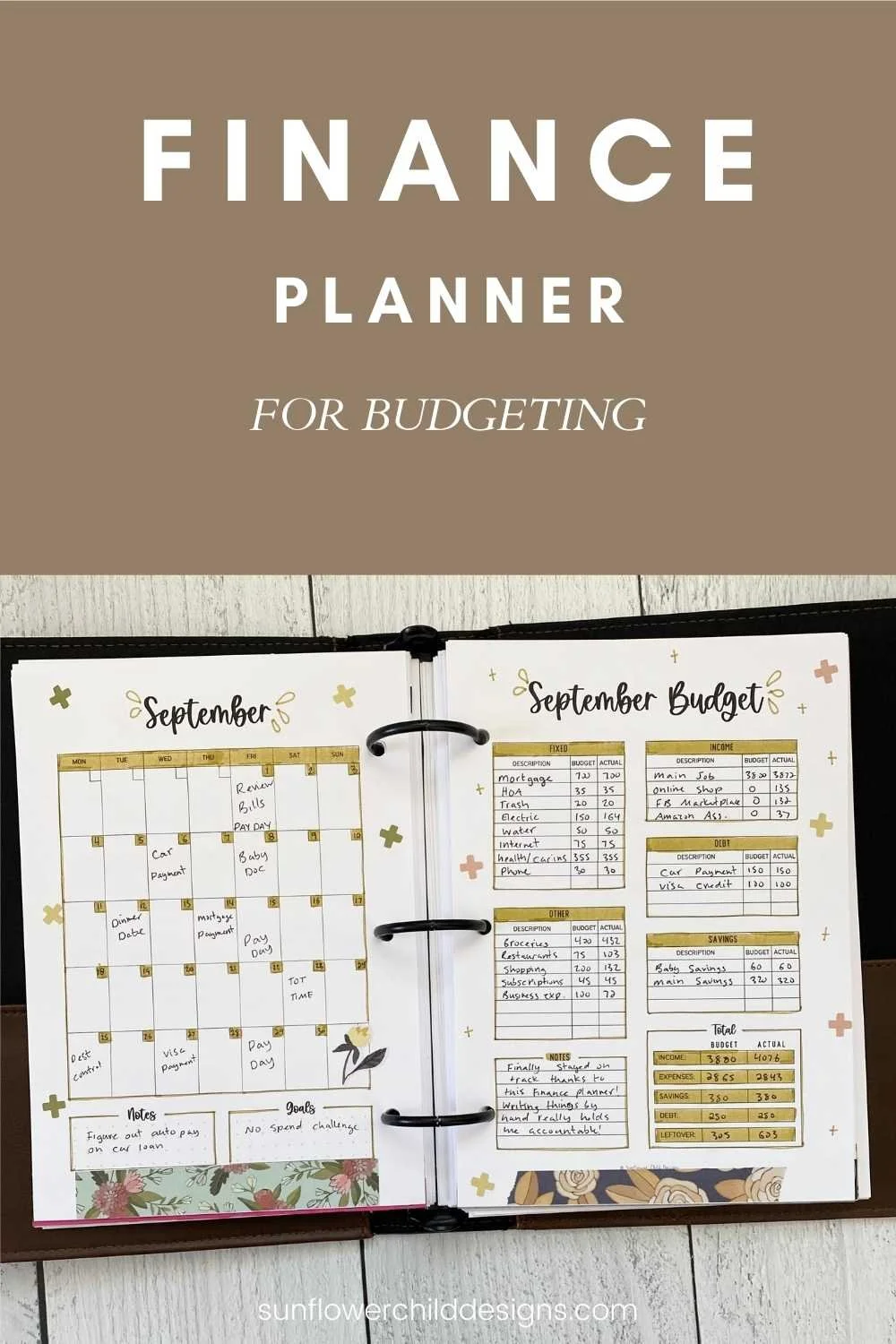

There are over 50 budgeting pages to help you achieve your financial goals! Bi-weekly budget, monthly budget for each month, savings goals, no spend challenge, money saving tips, questions to answer to help achieve your goals, savings tracker, debt tracker, debt snowball, debt avalanche, income tracker, donations tracker, tax deductions, expenses (2 columns), expense tracker (1 column), bill tracker, annual finances, weekly planner page, monthly review, monthly calendar Sun or Mon start, sinking funds tracker, 1k, 5k, 10k, 20k envelope savings challenge, blank envelope savings challenge, savings jar 2 styles, my (fill in the blank) funds - savings tracker, 2 cover pages, notes, tasks, and year at a glance with future log.

-

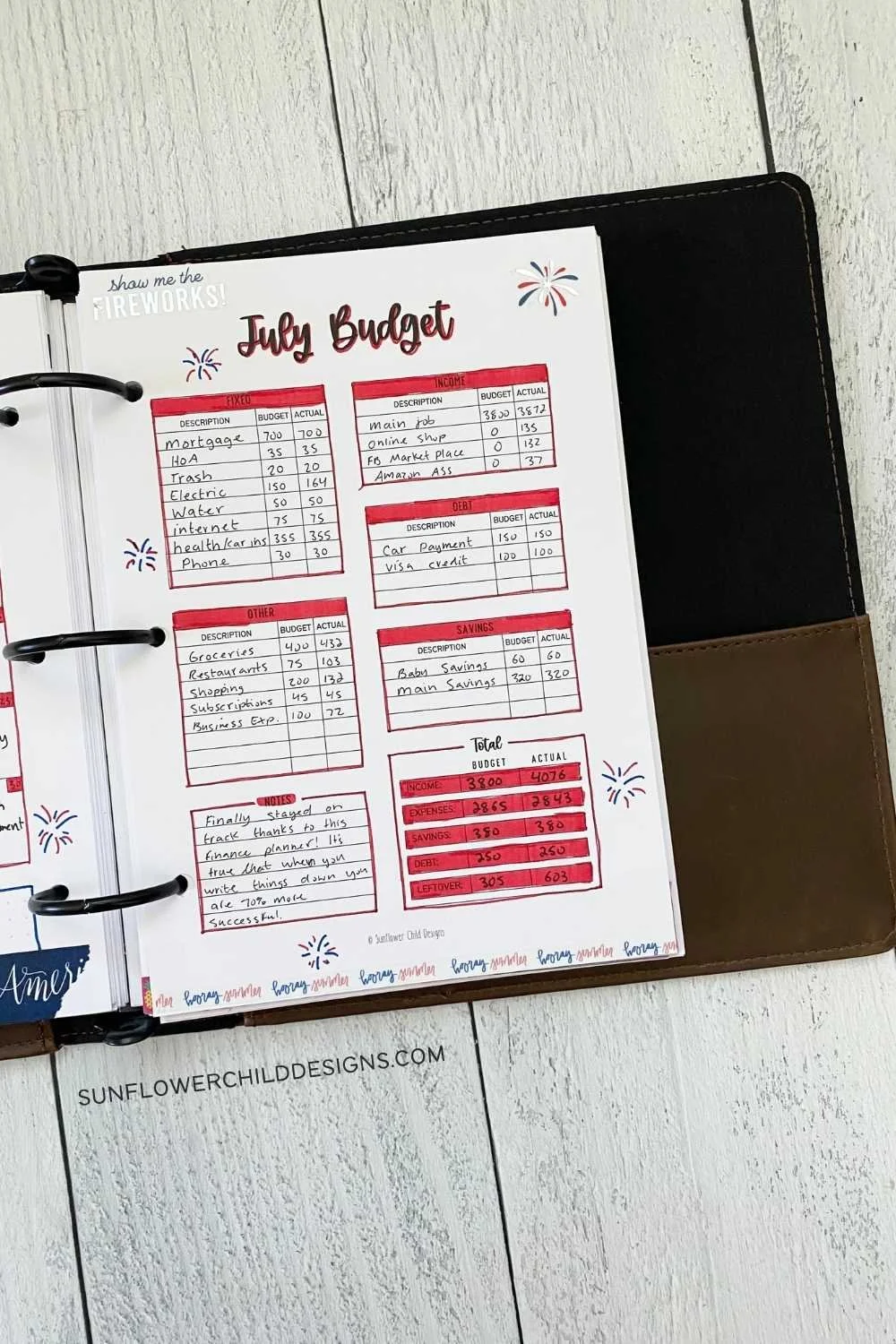

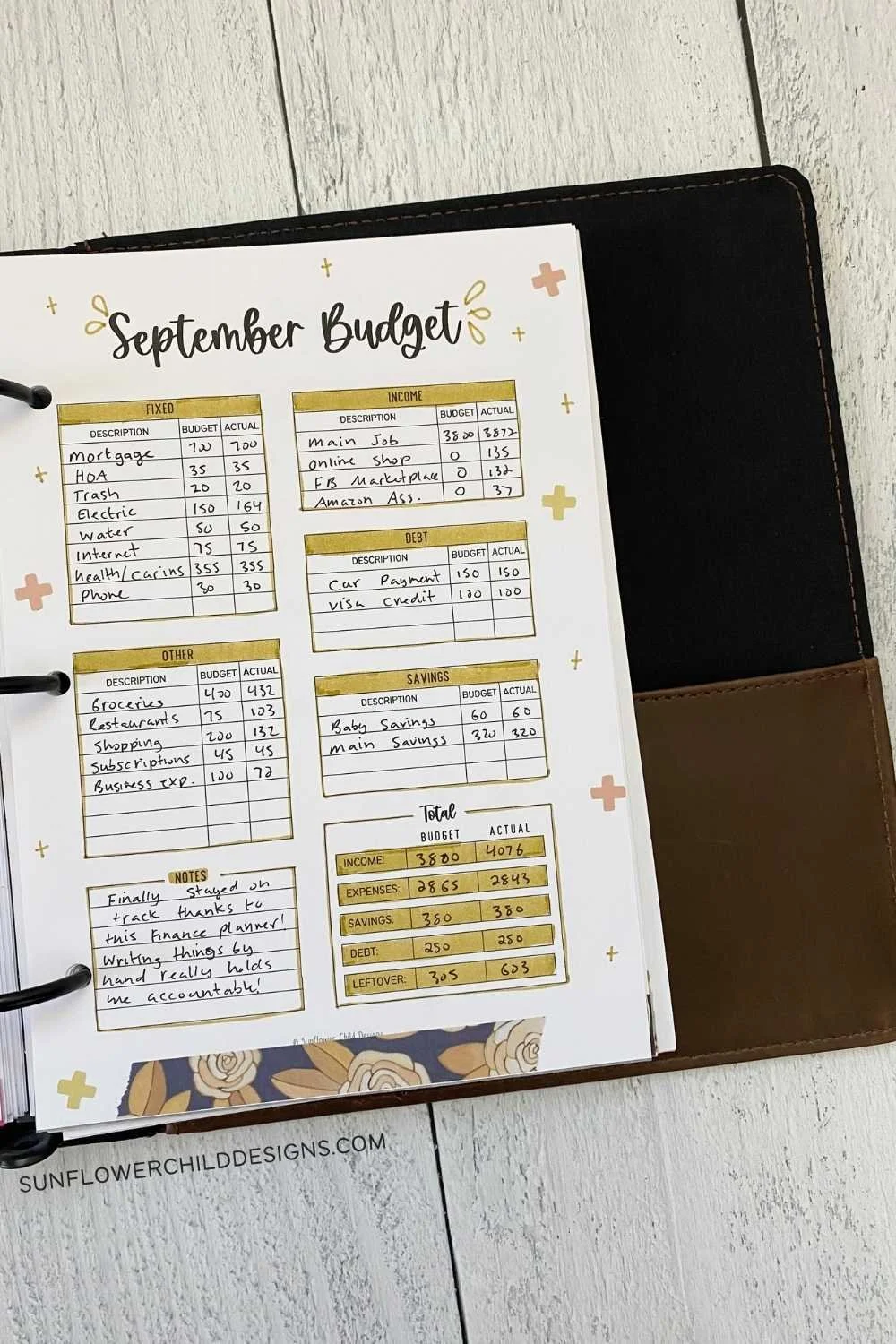

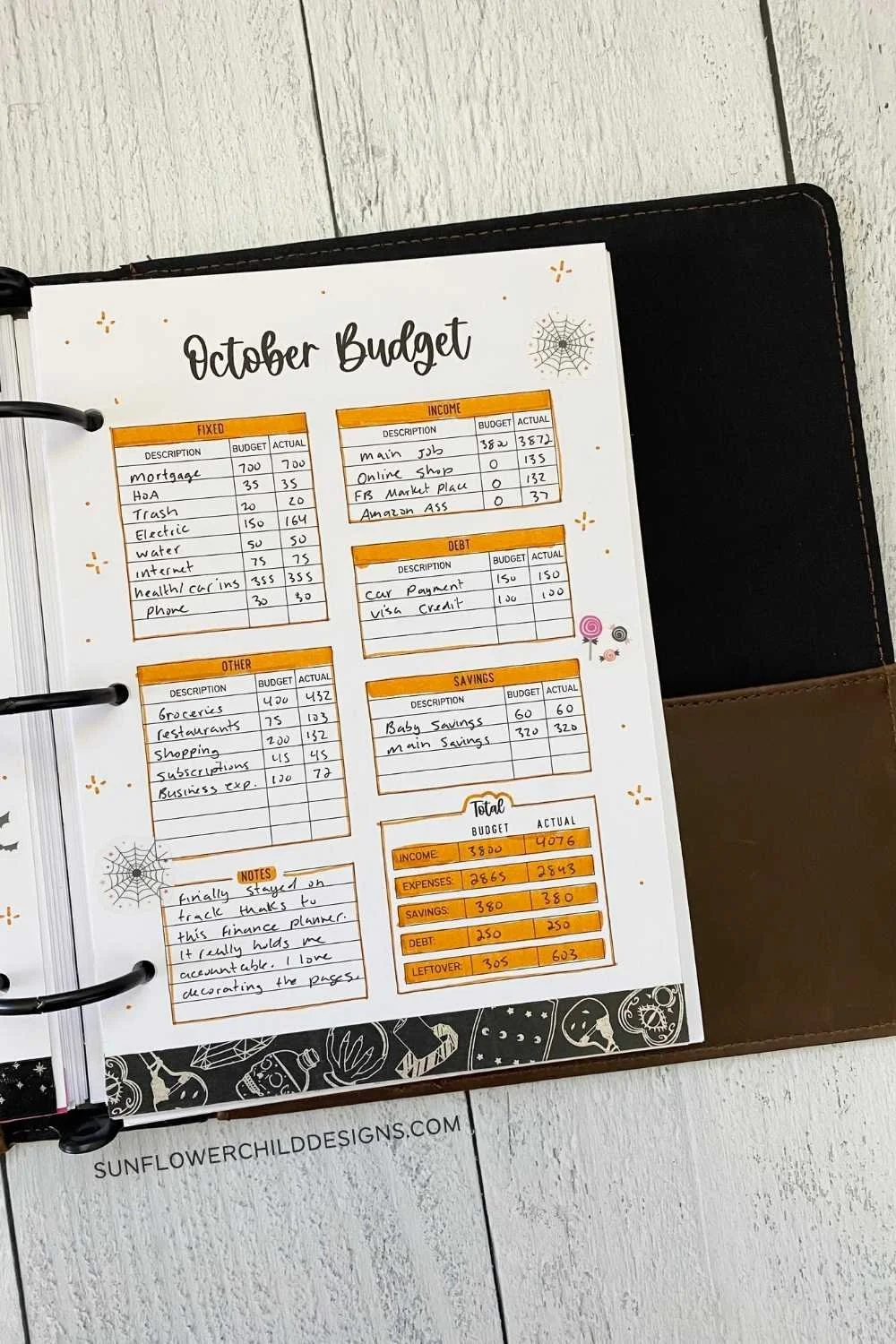

Did you know that you are 70% more successful when you write things down? I like to use an app like mint to automatically keep track of my budget but use the printed planner to review and keep track of everything. It is the perfect duo.

-

Yes, there are many pages dedicated towards saving money including various envelope saving challenges, savings tracker and so much more.

-

Yes. This planner has many pages dedicated towards paying off debt including pages for the debt snowball method and debt avalanche method with instructions on how to use them.

-

Determine your Net Income

Track your Expenses

Create Financial Goals

Make a Plan

Regularly Review your Budget

Finance Planner Demo

TAKE $5 OFF THE FINANCE PLANNER

Use code FINANCE for $5 off the Finance Planner. It is undated so you can use it every year for a lifetime, saving you tons of money!

Finance Planner Flip Through

This post may contain affiliate links. I would never recommend a product that I do not truly love. The price does not increase for you. Thanks for supporting Sunflower Child Designs. See my disclosure for more info.

DISCLAIMER

Sunflower Child Designs is not a financial expert. Please see a financial expert for professional advice.

Leave me a “tip”, go ahead and pin one!

Archive Blog Posts

- A - Guides

- April bullet journal ideas

- Bullet Journal

- December Bullet Journal Ideas

- Productivity systems

- Todoist tips

- august bullet journal ideas

- best pens for journaling

- brush pen calligraphy

- budgeting

- bullet journal setup FULL YEAR

- elf kit

- february bullet journal ideas

- fitness

- fluff prompts

- free printables

- habit tracking

- hard cover planners

- how to bullet journal for beginners

- january bullet journal ideas

- july bullet journal ideas

- june bullet journal ideas

- manifestation journaling

- march bullet journal ideas

- may bullet journal ideas

- modern calligraphy alphabet

- november bullet journal ideas

- october bullet journal ideas

- planner binder

- pregnancy

- printable holiday planner

- printable planner pages

- printable stickers

- september bullet journal ideas

- setup from scratch

- setup using printables

- setup using stickers

- stranger things

- tarot

- witchy

- witchy bullet journal ideas