101 Ways to Save Money: Simple Ways to Save and Grow your Money

It’s Time to Save and Grow your Money

There is no better time than NOW to start cracking down on your financial goals. With online shopping being so accessible with the click of a button, no wonder most people struggle to save a $1,000 emergency fund. Extra savings no matter how small can contribute greatly to your financial goals such as retirement, buying a home, a car, a boat, etc. If you are willing to make a few changes and take action it will be much easier to reach your savings goals. I encourage you print this list and check them off as you complete them. The following is a list of 101 ways to save money.

Ways To Save Money in General

Make a Budget

Creating your budget isn’t the hardest part, it is fairly easy actually. The hard part is STICKING to your budget. It is the most essential part in success.

Determine your Net Income

Track your Expenses

Create Financial Goals

Make a Plan

Regularly Review your Budget

You can go into more detail here How to Make a Budget it 5 Easy Steps.

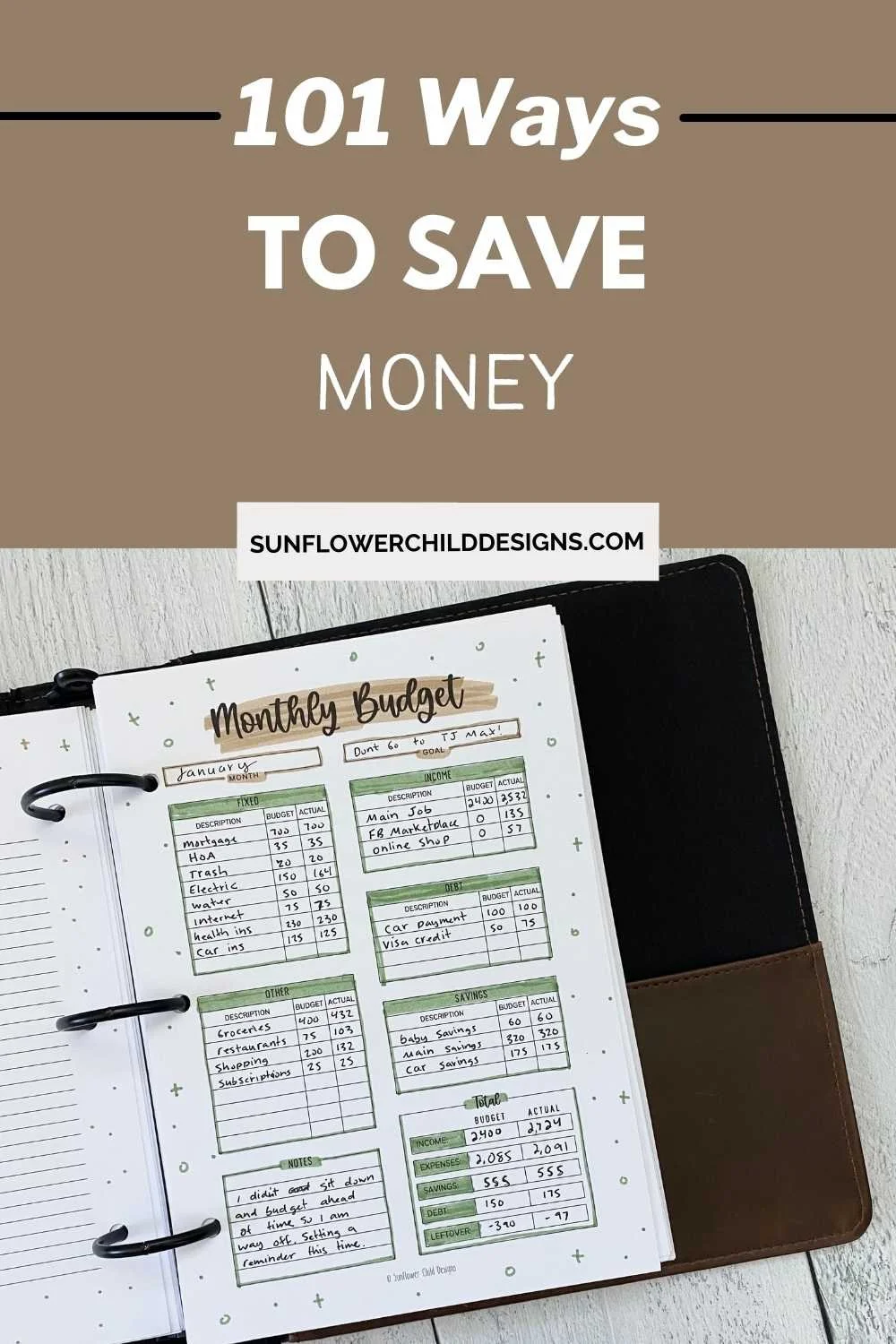

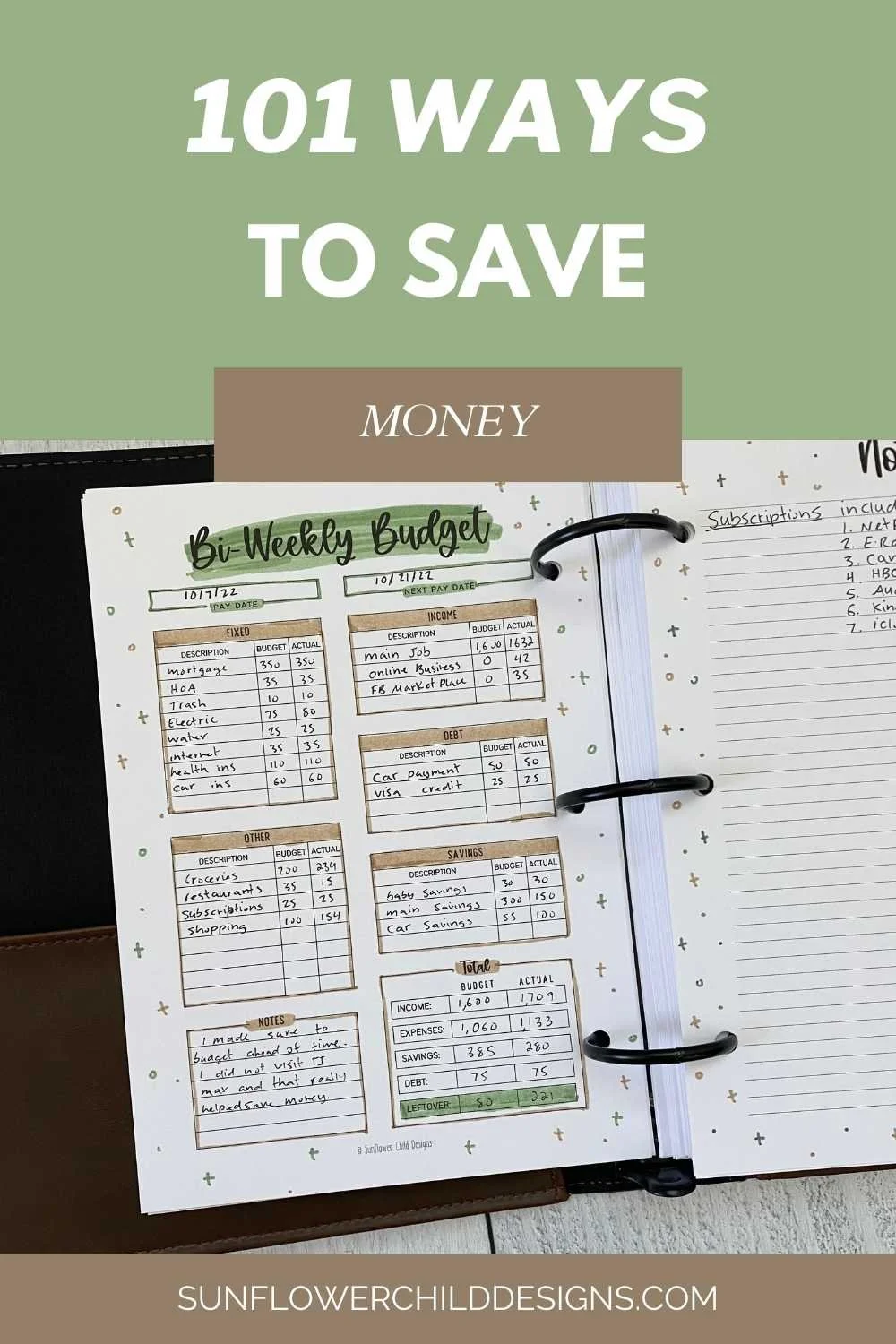

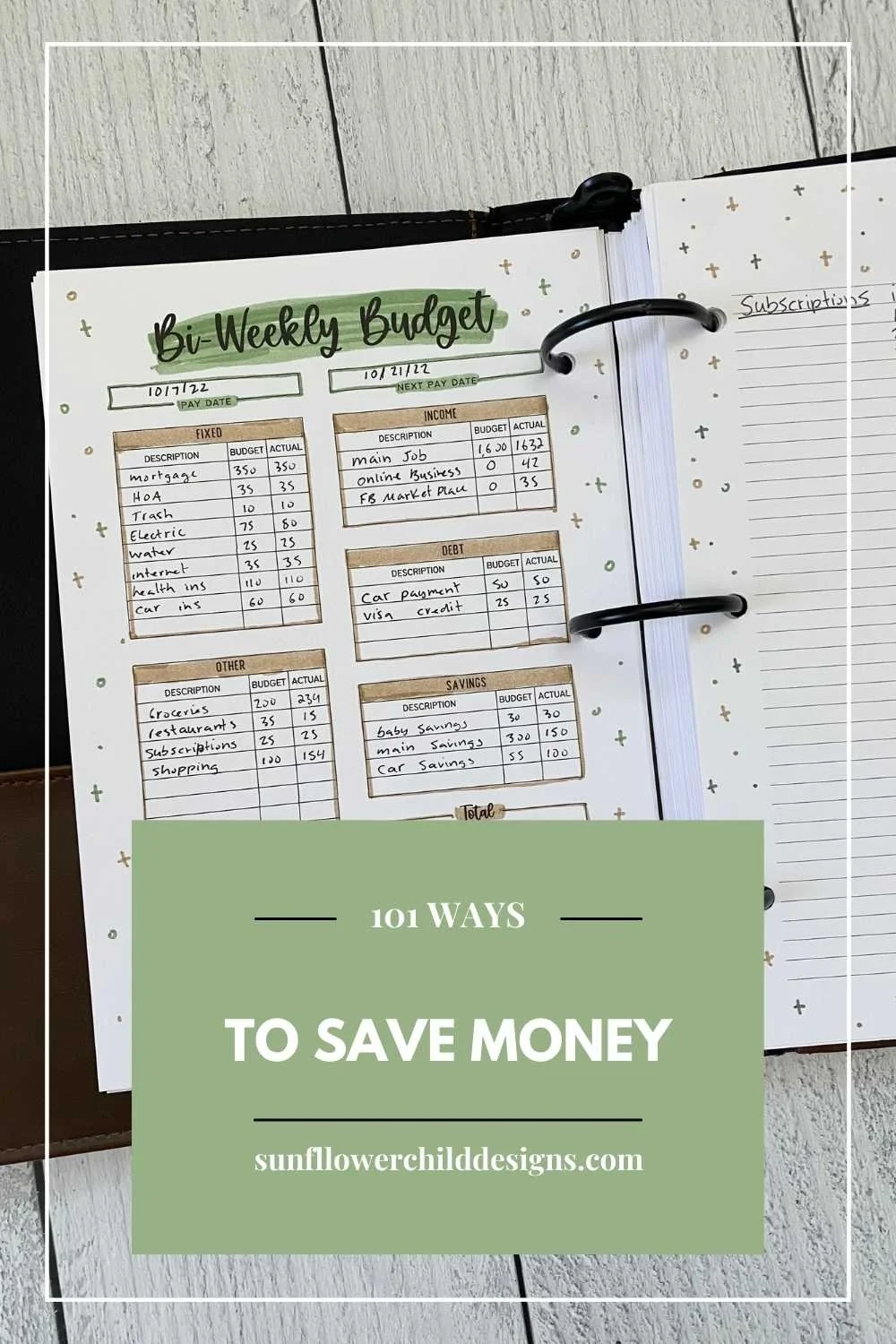

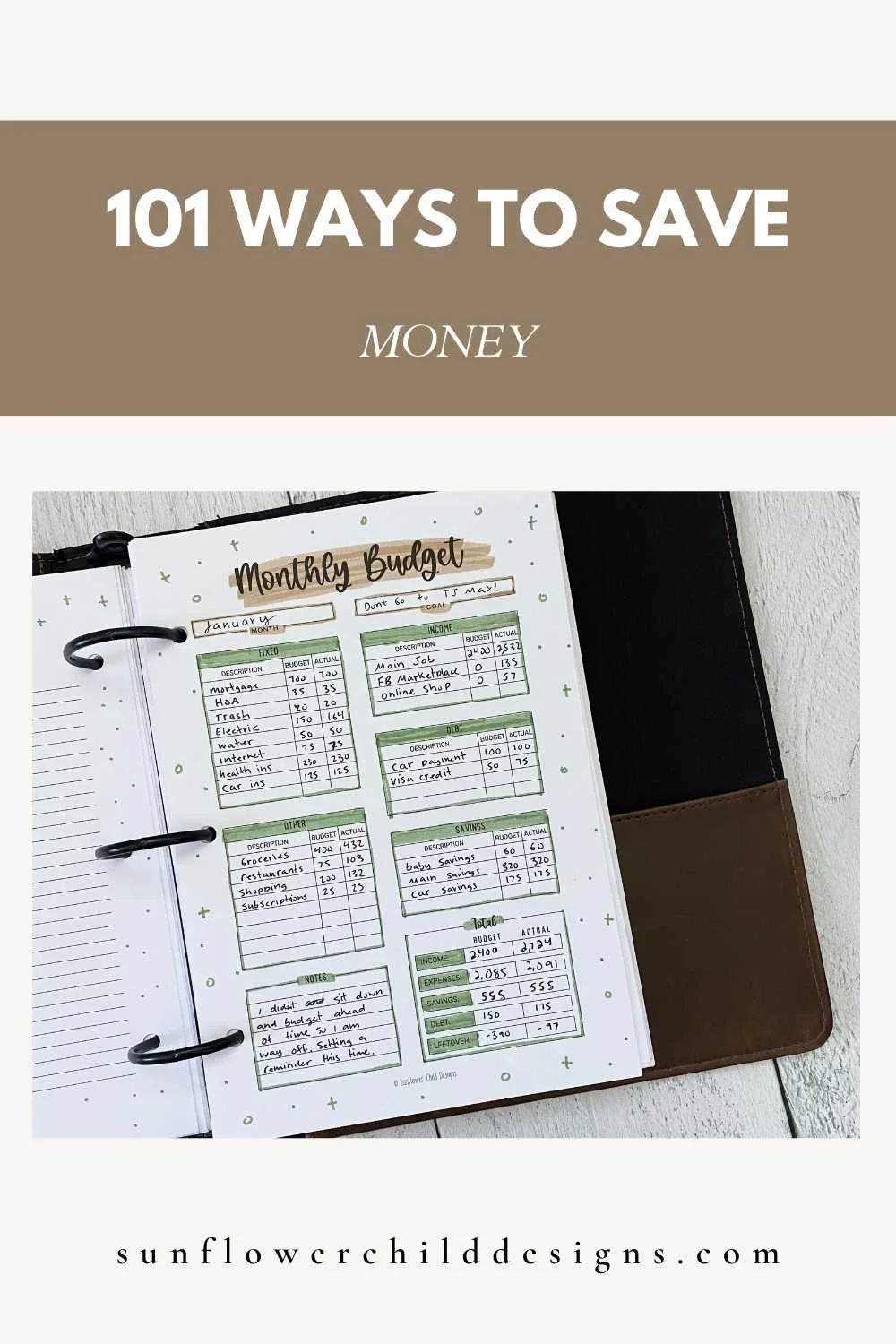

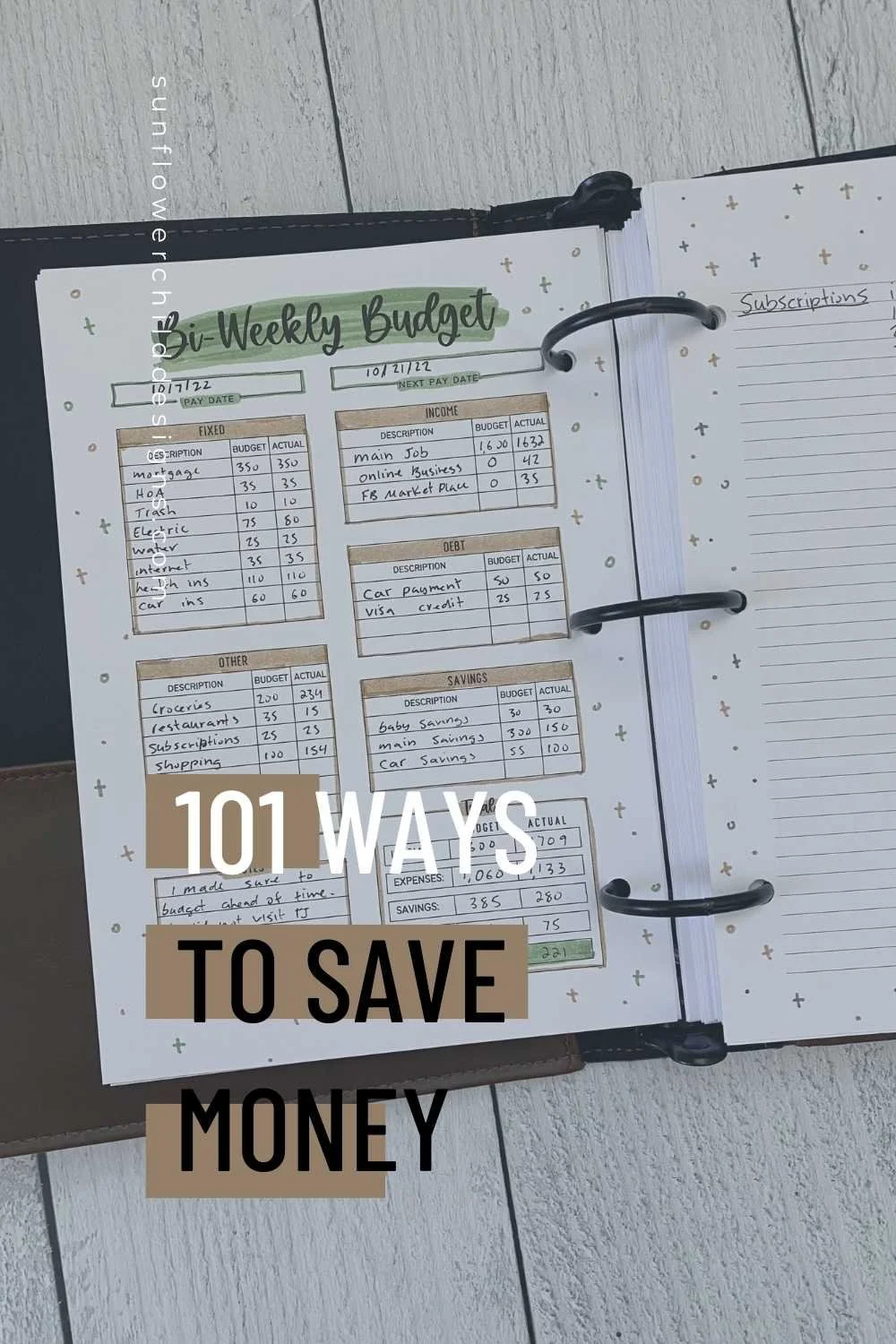

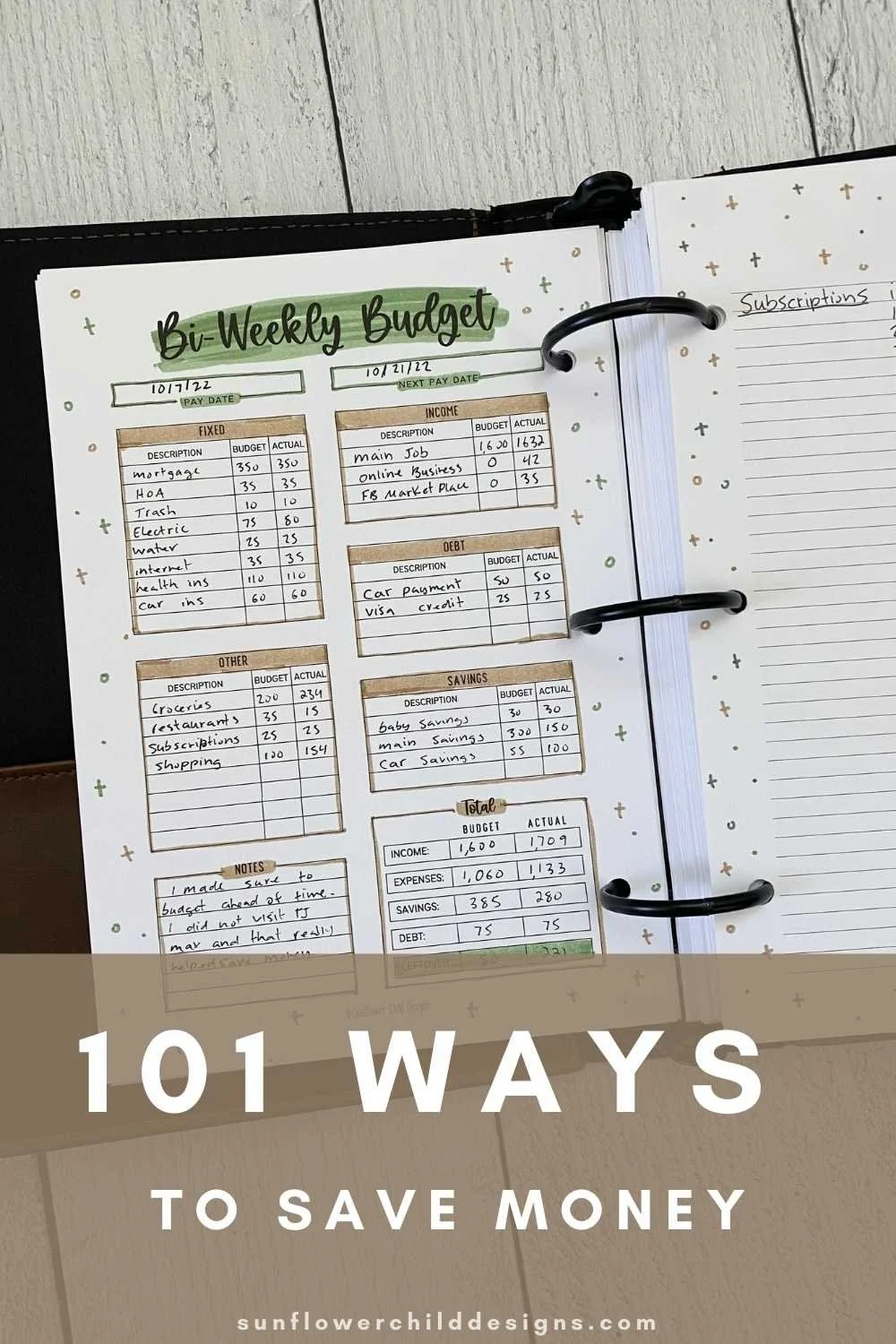

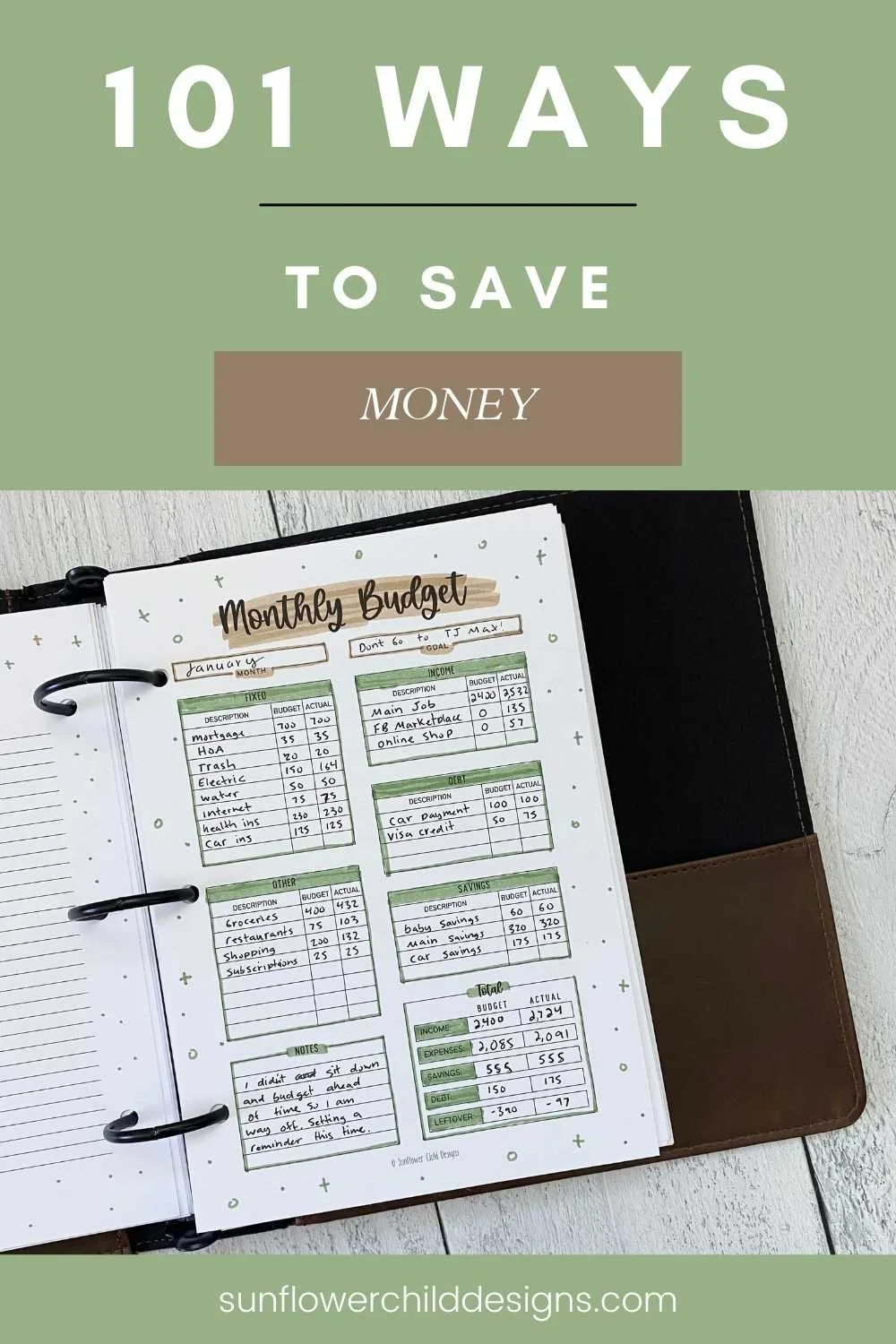

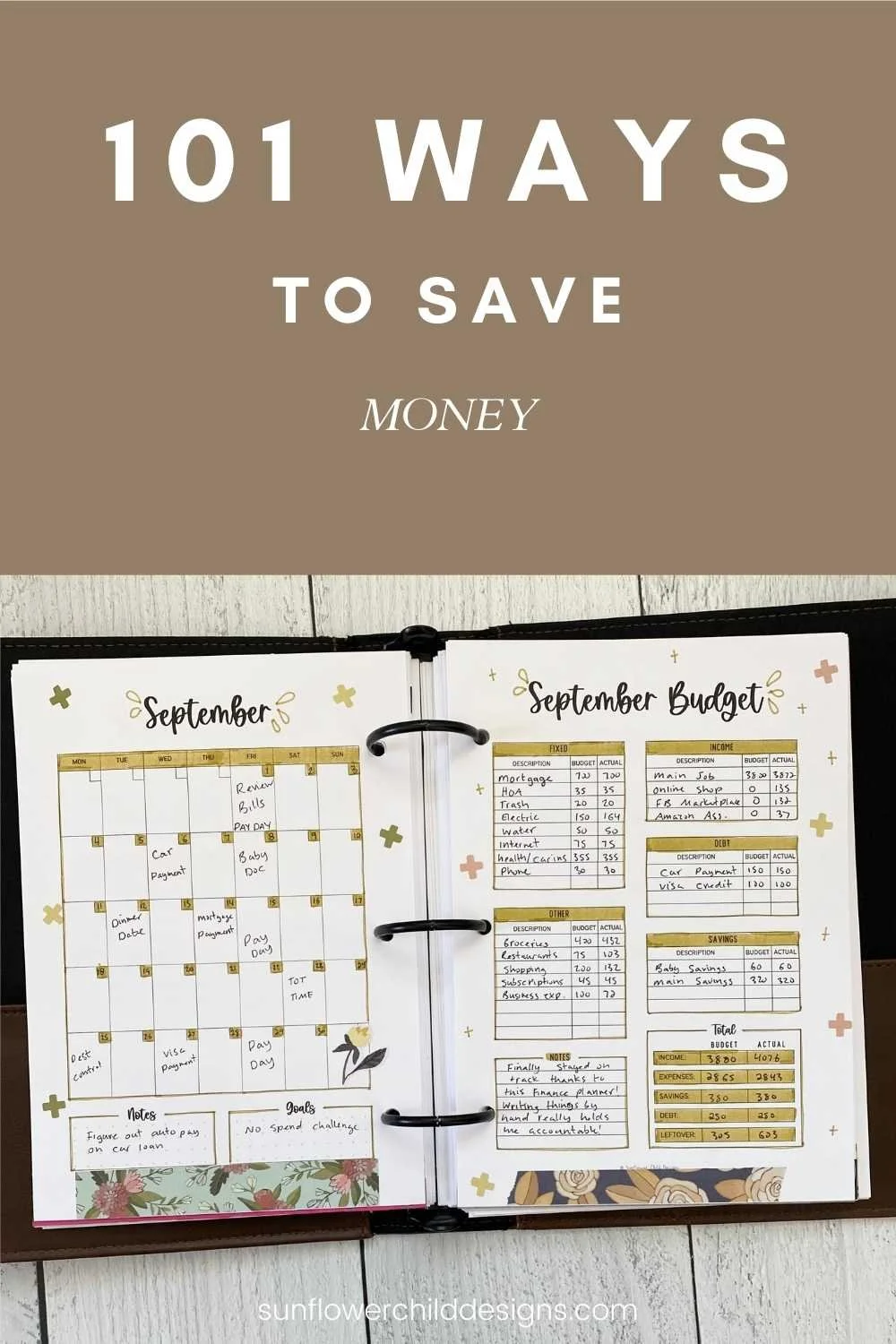

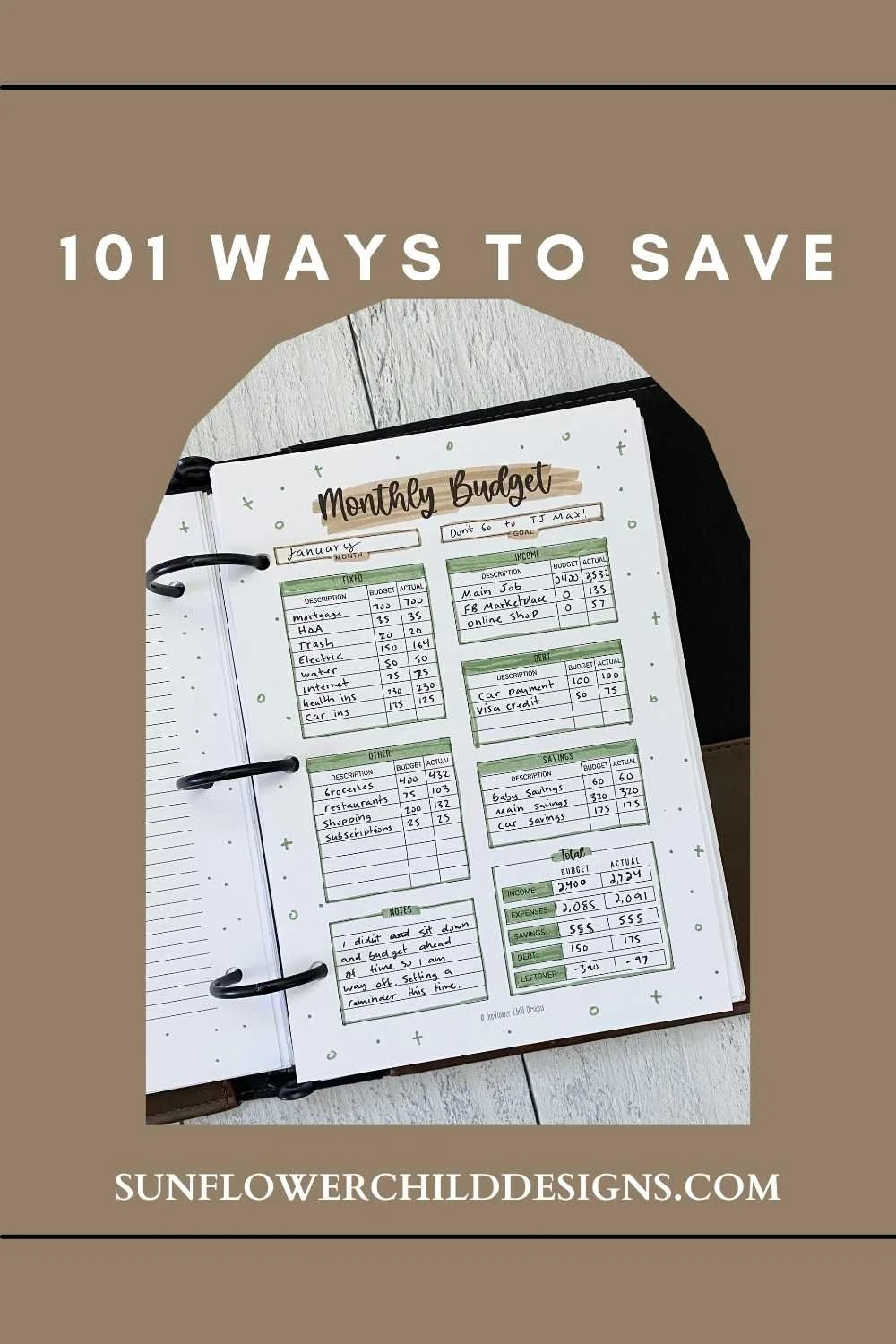

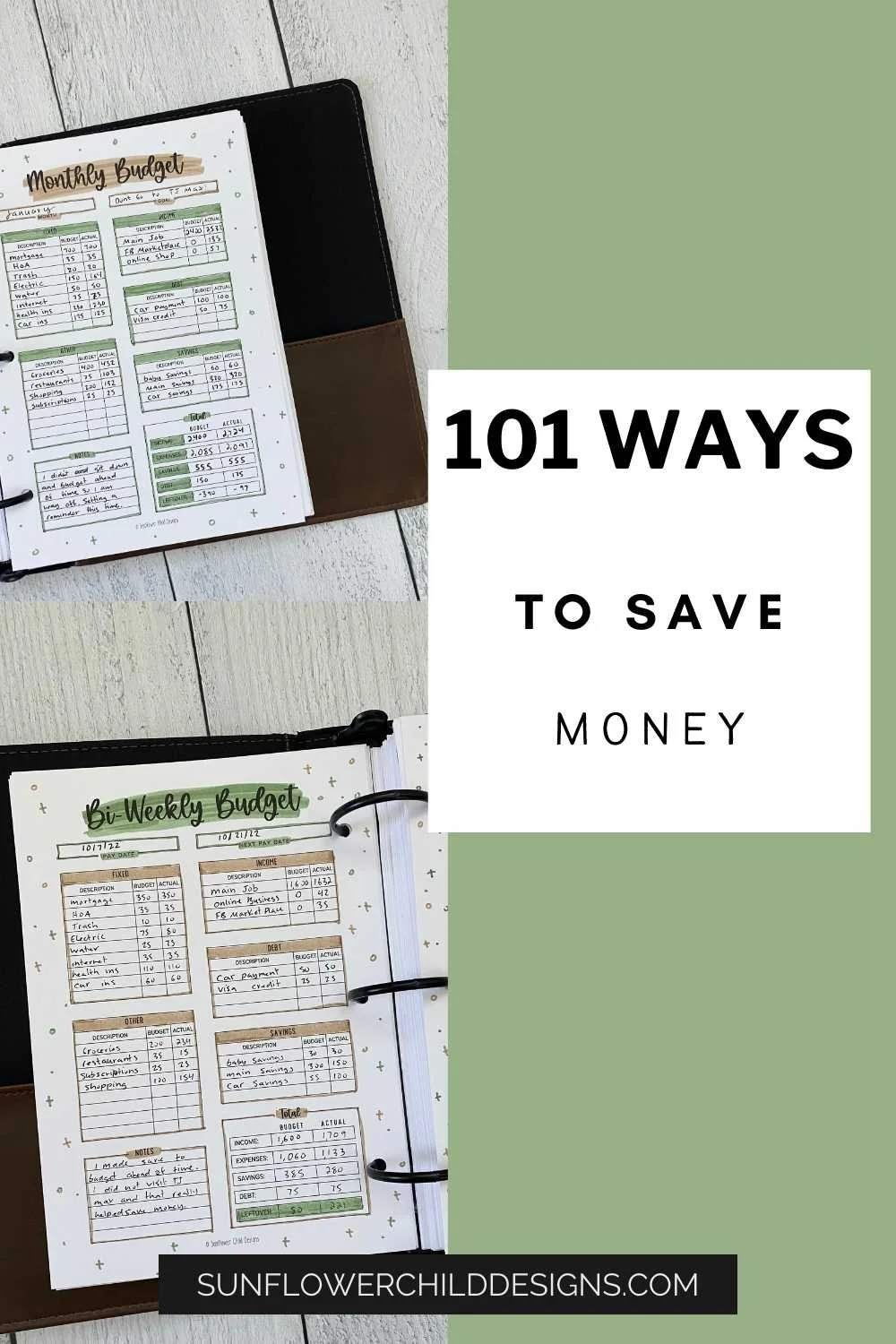

Use a Finance Planner

Using a physical copy finance planner or budgeting sheets will put your plan into action. You are 70% more successful when you write things down. This Finance Planner has everything you need and more including monthly or bi-weekly budget sheets and 50 pages to choose from. You will be motivated all year long by various savings challenges, debt trackers, savings trackers, income trackers, bill trackers, expense trackers, debt snowball tracker, 100 envelope savings challenges, no spend challenges and more. When you print the pages yourself you can print the pages that suit you. Generic planners often get bought but never used, its best to print the pages you need yourself and add it to a binder!

Use a Budgeting App

Here are the top budgeting apps to choose from. You may be thinking well why would I need a physical planner if I can use an app? It is best to use both. An awesome feature that the apps have is having every single transaction from all your credit and debit cards in one place making it easier to go over your budget.

Viewing this app often and physically writing your budget into your planner will ensure success. Some cons to apps are that if you are over or under budget overall it does not reflect your overall spending for the current month in one lump sum. You will have to add up each category yourself each month which makes the finance planner very handy. The annual finances page in the planner gives you a glance of your spending and savings for the entire year! Apps do not have this feature. It’s also much easier to make notes on a physical planner versus the app. Many of the apps charge money, when you buy a PDF planner you will have it for life and can use it every year, save your money!

Open a High-Yield Savings Account

Did you know that most high-yield Savings Accounts are well over 3%! Keep your savings completely separate from your checking account. You will earn money without even trying. Make sure the bank is FDIC insured. If you have $5,000 in a high-yield savings account you will earn $152.27 in interest that year! Most of these account are compounded daily.

Automatically Save Money to you Savings Account

Treat your savings as an expense, add it to your budget. Pay your savings account like it is a weekly, bi-weekly or monthly bill. You can auto transfer from your checking account to your high-yield savings account. You can start smaller if you’d like to build the habit and increase the amount after 3-6 months.

Negotiate your Bills

Rates are always changing and better offers come up. If you see a better deal with another provider call up your current one and try to get the same deal. If your provider will not lower your bill then consider switching services. My husband and I (before we were married we had different last names) would take turns using the 1 year of service for $69.99 deal from Spectrum. He would cancel after a year and then I would order the service in my name.

Cancel Subscriptions

There are so many subscriptions in this day and age. Apps used to charge a one time fee but most are charging a monthly fee now. For apps you can cancel them or at least find one that has a one time fee. Do you REALLY need amazon prime? Most people have this now, the price keeps going up. If you do not use all of the benefits such as prime video and Amazon photos, consider canceling. You sill get free shipping if it costs over $35 so you most likely won’t miss that feature. Pro tip#1: if you cancel you may get a better deal once you hit cancel. Audible dropped from $15 to $7 for 3 months after I hit cancel. I have seen many other services give you a last chance offer as well. Pro tip#2: Cancel any trial subscription immediately after sign up. You can still use it till it ends.

Increase your Savings Amount

Of course one way to save money is by increasing your savings amount. If you were saving 20$ a week up it to 40$. Treat it like a necessity, a bill.

Shop for the Lowest Rates for Car or Medical Insurance, Yearly

Rates are ever changing, make sure to check that you have the best rate, yearly.

Wait for the Holidays for Big Purchases

Sometimes companies raise the prices so it seems like a great deal so it is easy to be duped but if you pay attention there really are great deals during holidays. Different holidays are better for certain things to go on sale, for example mattresses go on sale for presidents day and labor day. If you want to go more in depth here is a great resource for common holidays to shop along with which items will go on sale.

Buy used if Possible

There are so many online thrift shops and in person thrift stores. Many people use Facebook Marketplace to buy kids toys, furniture, electronics, clothes and almost anything you can think of. You will get the best deal if you buy from a private seller that is local. Make sure to meet in a public place.

Subscribe to Marketing Emails

If you are looking for a good deal if you join the companies mailing list they usually offer 10% to 15% off your first purchase. You will also receive other offers and be notified of sales.

Unsubscribe from marketing emails

This contradicts the tip above but they are both accurate. Once you have bought what you needed on sale it is time to unsubscribe so you no longer get tempted from emails.

Commit to a No Spend Challenge

A no spend challenge will keep you motived, you are still allowed to pay your bills. This is about setting a budget for food and bills and challenging you to not spend any money on unnecessary things like clothes, Starbucks and more. There are many challenges in the Finance Planner.

Automatically Invest your Money

Use the Acorns app to automatically invest your "spare change" it rounds up each purchase to the nearest dollar and invests it.

Sell Your Unused Items

Not only can you buy great second hand items on Facebook Marketplace but you can easily sell your own stuff. Sell it locally and you will not have to ship it to anyone. Make sure to always meet up with someone in a public place.

Calculate Purchases by Hours Worked Instead of Cost

You will start to realize how many purchases are just not worth it. Do you really want to work an entire hour or two to buy that really cool cup that you know you already have one just like it?

Wait 24 hours before Making any Non Essential Purchase

When you become excited about something it is so easy to buy it immediately because your endorphins are going. If you wait 24 hours before buying you most likely won’t want it anymore and will even forget about it.

Pay off Debts First, Interest Rates Add up

If you pay an extra mortgage payment a year you will pay off your mortgage years earlier and will save so much money in interest! The same goes for credit cards, those are often at 20% interest which is STEEP! Pay it off and stop paying interest.

Shop for a Lower Phone Plan

It’s easy for years to go by and you don’t even think about what you are paying because you are so used to it. See what deals are out there and try to lower your bill or switch providers. Make sure to use your cell phone for as long as possible, avoid buying a new one as long as you can.

Stop Scrolling Social Media

There are so many temptations on social media. The phrase “Tiktok made me buy this” exists for a reason. Not to mention all the targeted ads, and they are so good!

Learn DIY Things That will Save you Money

Instead of scrolling social media, research how to do common things that can save you money. Do you hire someone to install a new fan or can you learn that yourself? Do you hire someone for home improvement or are there some things you can DIY?

Delete your Amazon App or Other Shopping Apps that you are Addicted to

Make it harder for your to spend money. Delete the apps off your phone. If you are not willing to do that you can at least move them to a difference screen. You can even set a time limit for certain apps in your phone.

Turn off Notifications that want you to Spend Money

Remove yourself from marketing texts and emails. Turn off all notifications that are trying to sell you something.

Compare Other Banking Options

Rates and offers change, make sure you are getting something that aligns with what you need.

Expand your Financial Literacy to Understand Investment Options

Do some research, read books to educate yourself about money and investments. Some well known books are:

Take Advantage of Employer-Matching 401(k) contributions

Always match whatever your employer will match. Many companies will match 50%-100% up to 3% to 6% of what you make.

Open an IRA

Many people choose to open an IRA account if they do not have access to a 401k and even if you already do it is known to be a great retirement fund. Check out traditional IRA vs a Roth IRA.

Start with a Short Term Goal

It is easier to save $30 a week for 5 months instead of $400 a month for a year. Once you reach the short term goal you will be proud of your accomplishment and be encouraged to keep going and even aim for a higher amount.

Start Saving for your Retirement as Early as Possible

Have you thought about retirement? Pensions are hard to come by these days. It is important to set yourself up for success for retirement. It is impossible to save for your retirement on wages alone. A retirement account will accumulate interest and will grow over time especially if you start young. The sooner the better.

Save your Bonuses and Tax Refunds

Put a large portion of your bonuses, tax refunds, and gambling winnings into your savings account.

Treat Yourself “twice”

If you splurge on an unnecessary smoothie add the same amount to your savings account. It will start to grow quickly.

Set Alerts for Spending Over a Certain Amount

Most credit and debit cards have the option to send you a reminder when you have spent over a certain amount for a purchase. It is easy to forget about your budget and stop tracking, this feature will help keep you in check.

Participate in a Local Investment Development Account (or IDA) Program.

If you are willing to attend financial education sessions and your income is low you may be eligible for the IDA program. You will learn about banking, savings, credit history and writing checks. Also about Asset-specific training (like first-time homebuyer training, business planning, and first-time vehicle purchasing). The savings will be matched! So if you save 1$ they will also add 1$. Find an IDA program near you.

Budget with Cash and Envelopes

If you often overspend with credit and debit cards you may want to only spend cash. Many people use the envelope budgeting system, you put a specific amount of cash into each envelope for different things. Once you spend the cash it is gone, you will not overspend.

Save Money for Specific Things

If you think of the bigger picture you will be able to save more. Instead of just saving money, think of saving money for retirement, a house, a car, emergencies, etc.

Get free Debt Counseling

A very useful service is the free Consumer Credit Counseling Services (CCCS). You will receive a free sessions with a counselor on how to manage your debt and help you figure out your options. Get started here.

Pay your Bills on Auto-Pay

The one is fairly obvious considering the digital world we live in. Make sure all of your bills are on autopay. Make sure to treat your savings as a bill too which means auto pay to your savings as well.

Check your Credit Report

Having a great credit report is important. To buy a house car, etc., you will be required to have a certain credit score. You can save money by having a good credit score. People with a bad score often have to pay a bigger interest rate. Learn more about your credit score here.

Create a Family Spending Limit on Gifts

Create a budget for gifts and let your family know ahead of time in certain situations. For example if you and your sister get each other gifts for Christmas you can let her know not to spend more than $20 so you do not feel bad when you give her a $20 gift.

Do a Secret Santa with your Family

Everyone will only have to get 1 person a gift. Most people agree that they do not want to buy everyone a gift that they probably won’t ever use anyways. Put all the names in a jar and have each person in your family pick a name, don’t forget it is a secret.

Stop Buying so Many Clothes

It is easy to accumulate a large amount of clothes. Buy fewer pieces and better quality. A $5 shirt is great but how often does it shrink after one wash and become unusable.

Payoff Debt with the Snowball or Avalanche Method

Paying off your debt will save you a lot on interest. Snowball vs. Avalanche.

Ask a Friend to Borrow Tools etc., or for their old clothes

Many people clean out their closets and trash their old clothes. If you have a friend like this ask to go through their donations pile. If you need a specific tool for a project that you will never use again ask a neighbor to borrow it. Your neighborhood community Facebook group is a great place to ask if you live in an HOA or a tight nit community.

Take on a Side Hustle

This is of course easier said than done. You can only minimize your spending so much. There is no limit to how much you can make. You could start small and sell your old stuff on Facebook Marketplace. You could mow your neighbors lawn. Some people find hot wheels car collectables at Walmart and resell them for 10x the value. You could find something you are passionate about and create a way to make money from it.

Have a Goal in Mind

When you have a specific goal it is easier to achieve that goal. Want to buy a house or car? When you are about to make an impulse purchase remember your big why.

Get out of Debt

The more you do not pay off your debt the more you will owe. If your bill has gone to collections you can usually get a discount to pay it off.

Ways to Save for Food

Plan your Meals

When you plan your meals you cook what you buy and do not let food go bad sitting in the fridge too long. You won’t be out of food and tempted to buy fast food or spend all your money at a restaurant.

Use Grocery Pickup and Stick to your Shopping List

When you plan your meals and use grocery pick up you buy only what you need and do not get tempted by what you see. Even better you will save an hour of your time.

Buy Generic

Most generic foods taste the same as the more expensive brand names. The great value broccoli at Walmart is 1/3 of the price of the Birds Eye brand, this one really tastes the same too.

Pack Lunch and Eat at Home

Resist the urge to eat at fast food places and restaurants. Set a budget for the month and stick to it. If you tend to get hungry when you are out and about keep some healthy snacks in your car such as nuts to hold you over.

Skip the Coffee Shop or Budget it and Commit

Have you seen how long the lines are at Starbucks or Dunkin in the morning! Not only will you save money but you will save time. It is important to still enjoy life so if that is what you love make this a small part of your budget.

Use the Ibotta App to Save on Groceries and Alochol

Did you know you can get cash back on the food you buy?! Cash back ranges from 10 cents to $5. Just last week there was a bogo for the family size Dorito chips giving me around $4 cash back. There is always a great cashback offer for alcohol too.

Look Through your Pantry and Cook as much as you can Without Buying Anything Else

Try to use as much of your groceries without buying anything else. Then make recipes based on the last foods that you have and buy the few ingredients that you need.

Commit to Eating out only 1 Time a Month

The amount you will spend on a meal in a restaurant is usually the amount you can spend on many meals at home.

Only Drink Water at Restaurants

Especially if you are paying for a family if everyone drinks water you’ll save over $15!

Double the Recipe

How often do you only cook half of the ingredients in a recipe? Double the recipe and you will save time and money because the rest of the food will not go to waste. If you know you won’t eat it in time, freeze it.

Buy Groceries in Bulk at Sams Club or Costco

If you can get your monthly grocery expenses down that is a huge step. Food is a big expense each month. Compare prices and buy in bulk if it saves money. You can buy the bulk fresh ingredients like onions and cut them up and freeze them if you won’t use them before they go bad.

Make Groceries Last Longer.

Cutting your cilantro and putting the bottom in a few inches of water will make it last weeks. Double bag bread and toss in the freezer. Then take out a slice or two and put it in the toaster on the lightest setting to defrost. Here are some more tips on making your groceries last longer.

Sit Down and Compare Prices for Common Foods you Buy

At Walmart the great value broccoli is 6.9 cents an ounce and the Birds Eye Broccoli is 20.6 cents an ounce!

Health Savings Tips

Use Generic prescription

Most generic prescriptions perform the same as the non generic, but they are much cheaper.

Get your Needed Dental Work and Routine Cleanings

Keeping up with your dental work will prevent further damage. If you do not fill a cavity in time you may need a root canal. Root canals are very expensive, and after that you will need an expensive crown!

Shop for Health Insurance each Year

Make sure you are still getting the best deal and benefits you desire. Rates change often.

Ways to Save for Home

Get Help Paying for Improvements

The Low Income Home Energy Assistance Program provides funding to help people pay for energy related home repairs and weatherization. Find out if you qualify by visiting your state’s LIHEAP website or calling 866-674-6327 toll-free.

Caulk Holes and Cracks that let air Escape the Home

Letting air escape the home will cost much more than the materials you will need to fix the issue.

Stop using too much Laundry Detergent

Most people overuse laundry detergent. If you stick to pods you will spend less since you are not wasting any detergent. Traditional laundry detergent is mostly water. You can also use Earth Breeze laundry detergent it is natural and looks like a dryer sheet.

Stop using Paper Towels

Paper towels cost an average $1 per roll! That is money you are throwing away. Use hand towels as napkins and only use paper towels when guests come over. Keep them hidden so you are not tempted to keep using them.

Upgrade to LED Lighting

LED lighting will save you money on your electric bill.

Lower the Heat Setting on your Water Heater

You can save 5% of your bill if you lower your water heater 10 degrees.

Refinance your Mortgage

If you have the option to refinance you have the opportunity to save money. If you lower the interest just by half a percent you could be savings thousands of dollars a year. This will also help with the unexpected home repairs.

Cut Back on Rent or your Mortgage

If you are strapped for cash you may want to get a roommate to help pay rent. If you own your home you could rent out a room.

Use Less Water

You can use less water by taking shorter showers, only doing large laundry loads, using the dishwasher instead of washing by hand, and watering your grass less often. Install low-flow shower-heads and faucet aerators to reduce your water usage and water costs.

Use Less Electric

Unplug things when you are not home. An energy sucker is the TV. Buy a power strip and plug the TV and consoles into it and use the power off button when not in use.

Comparison Shop for Homeowners Insurance

Before renewing your existing homeowners insurance policy each year, check out the rates of competing companies.

Prevent Heat from Entering

During the summer keep your blinds closed. Blocking the sunlight will help keep your house cooler, thus saving you on AC costs.

Ways to Save for Transportation

Practice Very Safe Driving

Accidents are expensive. This one is obvious but very true. Pay attention and be aware of your surroundings. I have spotted so many drunk drivers and ones who are on their phones and swerving, stay away from them. If you are going out drinking have a plan to not drive.

Check Your Car Manual for Correct oil Change Mileage

Most places will try to get you to come back after 3,000 miles. If you read your car manual it will most likely be 5,000 miles. Over time you will save money by not needing oil changes so soon.

Sell Your Car Privately

A private sale will in most cases make you more money than selling it to a dealership. Here’s more information on how to sell your car privately. If you are buying a new car negotiate the price without the trade in. That way you’ll know what the dealer is actually offering.

Use the App Gas Buddy to Find the Cheapest Gas Near You

There is often a 30 cent difference for gas stations within .3 miles!

Use the App Upside to get Cashback on Gas

You can get cash back while using this app. You add the cards you use to the app and let the app know you are getting gas at a certain gas station and you receive cash back.

Save 11 Cents a Gallon by Paying with the 7-Eleven App

You can save 3 cents to 11 cents a gallon when you use the 7-Eleven app. You can pay for fuel with the app so you do not even have to swipe your card!

Comparison Shop for Auto Insurance

Each year make sure you are getting the best deal for the coverage you need.

Use and Send Referral Links for Uber and Lyft

You can usually send and receive a link to a friend to retrieve money off your ride. Have the friend you are riding with send you the link through the app.

Ways to Save for Credit Cards

Use a Credit Card for all Purchases and Automatically Pay it off Every Month

Most people are scared of interest on credit cards, and you should be. If you set it up to where you are automatically paying off the full balance each month then you will actually EARN money. most credit cards have at least 1% cash back for all purchases.

Ask for Lower Fees on your Credit Card

If you are in debt on your credit cards 9 out of 10 times the company will approve to lower your interest rate.

Earn a Welcome Bonus for Signing up with Certain Credit Cards

Many cards have a $100-$300 bonus for signing up with their credit card.

Take Advantage of your Credit Card's Offers

Many credit cards have discounts for certain stores each month. Login to view and activate.

Use a few Different Credit Cards

Certain credit cards have a bigger cash back for different things. Some offer 3% back for groceries and some 3% back for gas. Websites like CardRates and NerdWallet let you compare your card with others.

Ways to Save Money for Entertainment

Use your Library

Many people forget to use the library. Most let you use the book for a month and allow you to recheck it 2 times. This is a huge saver if you read a lot of books. It will also save you space.

Volunteer at Festivals

Most festivals offer free admission to volunteers.

Take Advantage of Free Local Attractions

Facebook Events lists all your local free events. There is usually something each weekend.

Download the Libby App

There are thousands of free e-books and audiobooks.

Ways to save money for Traveling

Don’t Pay Resort Fees

Most resorts charge fees for amenities which average about $25 per night. You can look for lodging without the extra charge at ResortFeeChecker.com. Booking with loyalty points will also avoid these fees. The World of Hyatt and HiltonHonors are known to waive resort fees.

Travel During the off Season

Air fare and rentals are cheaper during the off season. Learn more here. To save it is known to book one to three months before your departure for domestic airline tickets and two to eight months prior for international flights. Tuesdays and Wednesdays are usually the cheapest to depart for your flight.

Check Multiple Sites for Low Airfares

Get the best air fare by checking a few websites. Make sure you calculate how much you’ll need to spend on your checked luggage. Southwest includes two checked bags which makes it cheaper overall compared to other airlines.

Ways to Save by Making it Yourself

Window Cleaner

Use 2 cups of water and half a cup of vinegar. You can add 10 drops of essential oil, grapefruit and lemon are common. Use a spray bottle, shake before using. You can even just use a few drops of water and a microfiber cloth. Then use a second cloth to wipe away the water.

Oven Cleaner

Use 2 cups of baking soda and some dawn dish soap to make a spreadable paste. Let it sit for an hour and scrub off.

Body Scrub

2 cups of salt (dollar tree sells this) and 3 tablespoons of coconut oil if you have that on hand. You can add several drops of essential oil. This comes outs to under $2!

Makeup Remover

Did you know you can use oil as makeup remover? Grab a cotton pad and a lightweight oil such as Almond oil, or sunflower oil.

Cleaner

Simple soap and water does wonders. There are so many unnecessary cleaners that people use. Why use harsh chemicals when soap and water work just as good?

Shower/Tub Cleaner

Grab an old spray bottle. Add water to fill up the bottle 1/3 of the way. Add vinegar to make it 2/3rds and pour it out and heat it up for 2.5 minutes. Add it back to the spray bottle and fill the rest of it with dawn dish soap. Shake and pour all over the tub or shower (don’t use the spray nozzel) wipe the area with a sponge and let it sit for an hour then wash off.

Bath Bombs, Lotions, Chapstick and More

A great resource is Humblebee and Me. Check out these simple products that you can make at home simple list of great products. They make great gifts too!

In Conclusion

It’s easy to read 101 Ways to Save Money, but what actually helps is putting things in action! Here’s a 3 simple step plan to help you.

STEP 1: Print this page so you can check off what you have done. You can also pin it to your Pinterest board, just click the image at the top.

STEP 2: Buy the Finance Planner and print it. Add a reoccurring reminder on your phone if you need to get in the habit of using a planner. Make it at a convenient time and day. Add the printed 101 Ways to Save Money Blog Post to your planner.

STEP 3: Download a budgeting app and create your budgets.

The budgeting apps and the Finance Planner work great together. It is important to regularly review your budget and make adjustments. Having the planner will hold you accountable and keep you motivated. Set a reminder to use the planner to build the habit.

TAKE $5 OFF THE FINANCE PLANNER

Use code FINANCE for $5 off the Finance Planner. It is undated so you can use it every year for a lifetime, saving you tons of money!

Finance Planner Flip Through

This post may contain affiliate links. I would never recommend a product that I do not truly love. The price does not increase for you. Thanks for supporting Sunflower Child Designs. See my disclosure for more info.

DISCLAIMER

The information provided on Sunflower Child Designs is for educational and informational purposes only and is not intended as financial advice. I am not a licensed financial professional. Please consult with a qualified financial advisor or other licensed professional regarding your specific financial situation before making decisions.

Leave me a “tip”, go ahead and pin one!